Google Invests $1B in CME: The Industry's Reaction

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Google Invests $1B in CME: The Industry's Reaction

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Google Invests $1B in CME: The Industry's Reaction

While many reacted with surprise, Big Tech’s influence on our markets has long been expected.

Google’s $1B investment in CME raised the eyebrows of our entire industry, leaving us to wonder what it means and, more importantly, what comes next. This is a signature of the current times when data is king—one that will result in more of these deals.

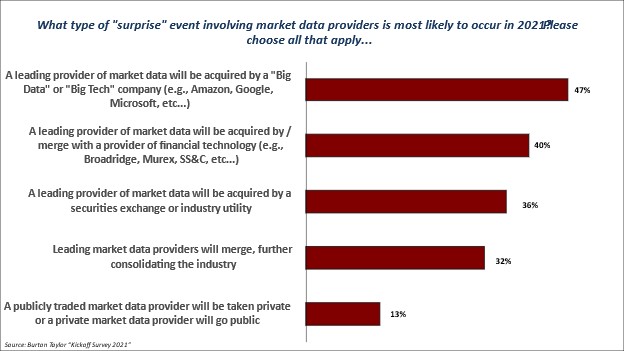

While the value of data is a surprise to no one, the roots of this deal were noted presciently in Burton Taylor’s 2021 Kickoff Survey, taken in January of this year. In that survey, 47% of respondents indicated that they expect a provider of market data to be acquired by a Big Tech company (see chart below).

This was representative of the growing belief, initiated in recent years, that Amazon, Google, and other Big Tech firms are exerting greater influence over our core institutions just as they have in other industries, and that influence will drive notable change in the future of the exchange business. It is also an indication of the value of data on our markets.

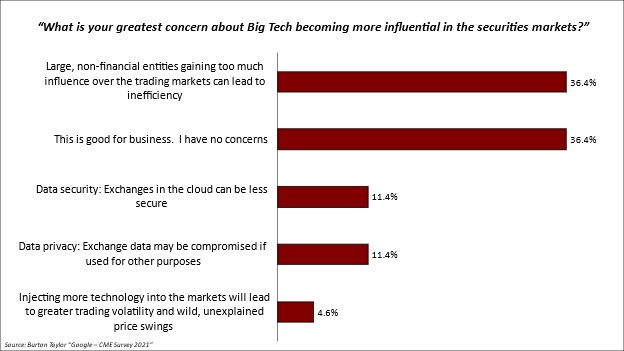

However, large deals like this don’t come without concern about unintended consequences. In Burton Taylor’s recent Flash survey of industry professionals (request the full survey results at no cost at info@burton-taylor.com), nearly 23% voice concern over data security and privacy brought about by Big Tech’s involvement, no doubt recalling well-publicized breaches that have occurred in Big Tech’s data (see chart below). Other worries range from centering on how our markets will operate under the influence of “non-financial companies,” to those concerned more specifically about the viability of a technology infrastructure that relies on the cloud to store and manage its data.

When Big Tech gains more financial influence, some grouse over the “impurity” of our markets while others see only the positive impact that technology will import. Focusing on the negative reaction may be simply a matter of viewing the glass as half-empty. In fact, just more than 1/3rd of respondents believe that Big Tech’s investment is good for business, bringing valuable capital and even more valuable analytics experience to our markets that are becoming more tech-reliant every day. Further, inserting fresh insight brought about by an (very successful) outsiders’ view may give the CME an advantage in strategy, and one that helps to form the model for exchanges in the near future.

Robert Iati is the Managing Director of Burton-Taylor International Consulting. Bob is a recognized capital markets industry expert with more than 30 years of wide-ranging experience in operations, data management and technology in global markets. Burton-Taylor offers unique insight into the Global Market Data Industry. Subscribers to Burton-Taylor’s Market Data research service get access to our library of content including our annual Market Data Benchmark as well as reports covering industry M&A activity and special reports focusing on specific segments within the industry.