What Lies Ahead for the Market Data Industry in 2022

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

What Lies Ahead for the Market Data Industry in 2022

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

What Lies Ahead for the Market Data Industry in 2022

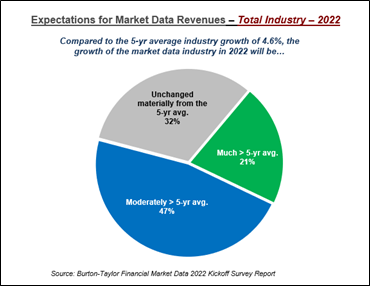

As we get further from the onset of the pandemic, growth expectations for the market data industry are becoming ever more optimistic. According to results from Burton-Taylor’s recent Financial Market Data 2022 Kickoff Survey, industry professionals believe the need for high quality data and analytics have led data budgets at firms to be increasingly non-discretionary.

Despite challenges presented by the pandemic, the industry expects growth in 2022 to outpace recent trends. In fact, two in three survey respondents to Burton-Taylor’s annual market data survey estimate industry growth in 2022 to be greater than the 5-year average , with the remaining third of respondents predicting growth will be in line with recent years. In fact, no respondents in this year’s survey predict that growth for 2022 will be less than the 5-year average, compared to 9% of respondents in last year’s survey who predicted that growth would slow in 2021.

growth would slow in 2021.

The expected increase in data demand and usage in the next 24 months will be driven by several factors. When asked to rank growth drivers by order of impact, survey respondents listed the growing acceptance of cloud technologies to manage data as the most impactful. The increased adoption of cloud technology in the market data industry opens doors for new and current data customers, allowing easier access to datasets as well as the increased ability to tailor data consumption to their liking. Respondents then ranked the ability, and increasing use of, advanced technologies like AI and ML to extract meaningful intelligence from data as the second most impactful growth driver for the industry.

Surges in ESG investing across asset classes last year resulted unsurprisingly resulted in sharp increases in demand for high quality ESG data/analytics. Nearly all survey respondents (95%) believe demand for ESG data increased last year, and 84% predicted that firms will further increase their consumption in 2022, despite some concerns over data quality and consistency.

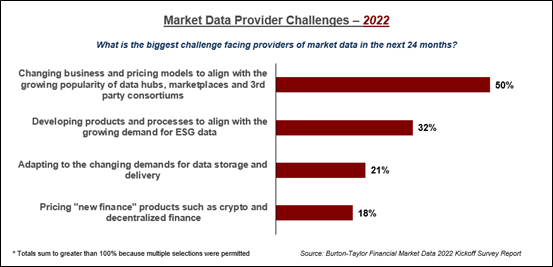

Although industry demand is expected to reach new heights this year, many expect traditional market data providers to face greater threats. One half of all respondents consider the biggest challenge facing market data providers in the next two years will be having to change their business and pricing models to align with the growing popularity of data hubs, marketplaces, and third-party consortiums. These new ventures afford customers more alternatives when consuming and purchasing data while at the same time allow them to maintain fewer direct vendor relationships, which respondents believe will pressure vendors to adapt. However, clients also continue to give their providers high marks, with 62% of respondents expressing satisfaction with how their data providers reacted to unprecedented market conditions last year, demonstrating value for providers as they face these challenges.

The industry should be optimistic for the year ahead. Burton-Taylor’s Market Data 2022 Kickoff Survey confirms that advances in technology and a seemingly unquenchable thirst for information continue to fuel rising demand for, and spending on, market data. Financial institutions recognize the migration of their crucial activities to data-driven models, especially as the new data sets and faster delivery mechanisms create greater opportunity to deploy data as a competitive advantage.

Adler Smith is an analyst with Burton-Taylor International Consulting. Visit the research section of our newly redesigned website at https://tpicap.com/burtontaylor/ to see Burton-Taylor’s latest research.