The Expanding Opportunity of AI for Market Data Providers in the Capital Markets

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

The Expanding Opportunity of AI for Market Data Providers in the Capital Markets

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

The Expanding Opportunity of AI for Market Data Providers in the Capital Markets

Artificial Intelligence (AI) unlocks new frontiers for market data providers in the capital markets, enabling providers to deliver faster, smarter data solutions that will drive value for internal and external stakeholders. AI’s impact stretches from automating routine data processing tasks to offering clients deeper insights and predictive analytics, transforming the way market data consumption by humans and machines in coming years.

AI’s Potential to Revolutionize Market Data

For market data providers, AI has enhanced their internal effectiveness and is introducing innovative apps for clients to consume products. The shift with AI will allow providers to cater to clients’ increasingly complex needs, creating new avenues for value creation, and bringing strategic advantages to market participants. AI-driven data products, such as predictive models, tailored risk assessments and derived data, are enabling data providers to deliver high-value insights that will continue to expand. These products allow financial institutions from the buy and sell side to optimize portfolio construction, enhance trading strategies, and fine-tune risk management practices.

AI’s ability to process vast quantities of data from diverse sources enables market participants to gain better insight in everything from compliance to investment management to reporting. First generation machine learning (ML) and AI, in concert with the ever-dropping cost of compute, has allowed news, social media, and industry reports in real-time to reveal market sentiment trends that might otherwise go undetected as well as make rapid calculation across surveillance, margin, and trading. Today, Generative AI is allowing new levels of insight from textual data across the capital markets value chain and across functions.

Data Demand Continues to Grow

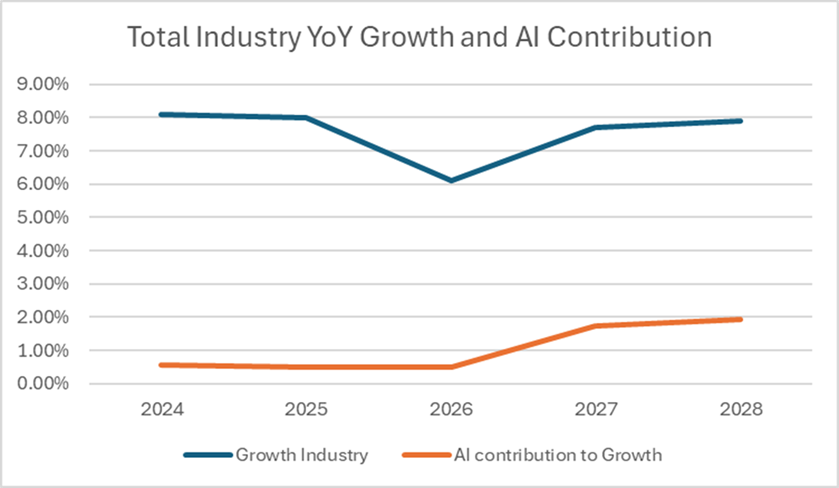

Demand for data is rising, driven by a growing interest in AI-ready, real-time, and alternative data sources that can power more sophisticated AI models and analytics. Market data providers are meeting this demand by developing scalable, cloud-based platforms that offer both raw data and AI-enhanced insights, making it easy for clients to integrate data directly into their investment, trading, and operational stacks. Burton Taylor predicts that by the end of 2028, AI will add approximately 2% to the year over year growth contribution of the market data industry. This will account for an additional $1.9 billion in industry revenues.

Source: Burton Taylor 2024 AI and its Implication on Market Data Providers: An Intelligent Data Future

As AI tools continue to advance, they will support an expanding array of applications in capital markets, including real-time portfolio monitoring, automated risk analysis, and trading strategies-super charging both quants and analysts. Providers who can offer seamless data integration and advanced analytics will capture a significant share of this growing demand.

The emergence of Generative AI has also created a surge in interest in customized research summaries and automated insights. Clients benefit from the ability to access concise, relevant insights without sifting through extensive reports, enhancing decision-making efficiency, and freeing up time for higher-level analysis. By embracing Generative AI, data providers can offer tailored, client-specific insights that add clear value, helping them deepen client relationships and strengthen loyalty.

Unstructured Data 3.0

The use of unstructured textual data, such as text from news articles, audio transcripts, and images, continues to be another frontier for market data providers. Generative AI enables providers to develop new ways to engage textual and unstructured data, allowing clients to explore data sets that offer alpha as well as operational efficiencies.

A Future of AI-Enhanced Market Data

As AI applications expand and mature, market data providers will develop even more innovative products to meet the evolving needs of capital markets. The ability to deliver not just data but intelligent, contextual insights positions market data providers as strategic partners for clients looking to navigate an increasingly complex data environment. The growth of AI-enhanced data solutions isn’t just a technological shift; it’s a powerful opportunity for providers to redefine their role in the capital markets ecosystem and strengthen their competitive advantage.

In sum, the shift toward AI in market data is a promising and transformative journey. Providers who focus on innovation, client-centricity, and quality will be able to leverage AI to create next-generation data solutions that are both relevant and valuable. As this technology evolves, market data providers are well positioned to lead the market to an intelligent data future, where the ability to deliver actionable insights will be more important than ever.

Brad BIley is a Research Director with Burton-Taylor International Consulting. Visit the research section of our newly redesigned website at https://tpicap.com/burtontaylor/ to see Burton-Taylor’s latest research.