Global Exchanges' Growth Continues to Exceed Recent Norms

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Global Exchanges' Growth Continues to Exceed Recent Norms

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Global Exchanges' Growth Continues to Exceed Recent Norms

Burton Taylor’s annual Exchange Benchmark shows the shifting nature of the global exchange landscape. The year 2023 was a significant one for global financial markets, marked by fluctuating trading volumes, varied security issuances, and evolving market dynamics influenced by geopolitical tensions, economic policies, and product and data advancements.

Burton Taylor’s annual Exchange Benchmark shows the shifting nature of the global exchange landscape. The year 2023 was a significant one for global financial markets, marked by fluctuating trading volumes, varied security issuances, and evolving market dynamics influenced by geopolitical tensions, economic policies, and product and data advancements. The equity IPO landscape, secondary market issuances, and the overarching impacts of international conflicts such as those in Israel-Gaza and Russia-Ukraine shaped market behaviors.

Trading Volumes

Trading volumes across major exchanges displayed a mixed pattern in 2023. Burton Taylor found that stock markets in the Americas saw a decrease in trading volumes compared to 2022 dropping approximately 10% YoY, in a year of reduced equity volatility. In a similar vein, European markets experienced subdued volumes, reflecting investor cautiousness considering ongoing economic challenges. In contrast, non-equity: fixed income, derivatives, energy, power, agricultural, and metals saw a jump in volumes. Innovations, like 0DTE (Zero Day to Expiration) options drove robust growth in index options.

Trading volumes across major exchanges displayed a mixed pattern in 2023. Burton Taylor found that stock markets in the Americas saw a decrease in trading volumes compared to 2022 dropping approximately 10% YoY, in a year of reduced equity volatility. In a similar vein, European markets experienced subdued volumes, reflecting investor cautiousness considering ongoing economic challenges. In contrast, non-equity: fixed income, derivatives, energy, power, agricultural, and metals saw a jump in volumes. Innovations, like 0DTE (Zero Day to Expiration) options drove robust growth in index options.

Capital Formation

Security issuance, encompassing IPOs, bonds, and other financial instruments, showed a varied landscape. The U.S. markets experienced a modest recovery in IPO activity from the lows of 2022, primarily in the technology and healthcare sectors. Europe remained slow, with political uncertainties and slower economic growth dampening new listings.

Exchanges Change

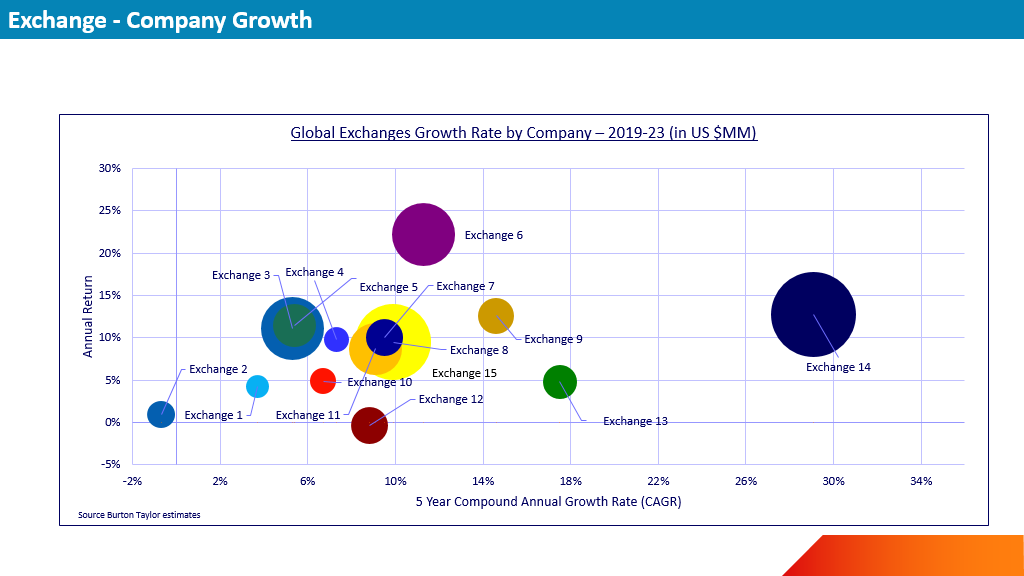

The largest exchanges continue to grow inorganically, adding large fintech technology and data platforms to their portfolios. For instance, Nasdaq added Adenza and Deutsche Boerse added Simcorp giving them new revenues from a broader set of direct customers on the buy side. Exchanges are changing and the differences in the core businesses of different competitors requires new ways of looking at the available data for analysis.

Technology and data offerings and services are the most rapid areas of growth for technologies. Innovation, in conjunction with large cloud providers, like Amazon AWS, Google GCP, and Microsoft Azure are assisting in the trend of the most rapid growth coming from non-transactional areas. In 2023 Burton Taylor’s analysis showed that the most rapid revenue growth was in Market Technology and Access, adding 14.8% YoY and Market Data and Analytics, adding 8.4% YoY.

Technology and data offerings and services are the most rapid areas of growth for technologies. Innovation, in conjunction with large cloud providers, like Amazon AWS, Google GCP, and Microsoft Azure are assisting in the trend of the most rapid growth coming from non-transactional areas. In 2023 Burton Taylor’s analysis showed that the most rapid revenue growth was in Market Technology and Access, adding 14.8% YoY and Market Data and Analytics, adding 8.4% YoY.

Market Forces

Several key forces shaped the global exchange landscape in 2023:

•Interest Rates and Inflation: Central banks' policies on interest rates significantly impacted market performance. The U.S. Federal Reserve's rate hikes in early 2023 led to initial market slowdowns, but adjustments later in the year aimed at curbing inflation without stalling growth influenced a market recovery. However, the market generally expected rate cuts before economic conditions prevailed to allow central banks to make those moves.

•Geopolitical Tensions: Ongoing tensions in Eastern Europe, Middle East, and to a lesser degree U.S.-China trade relationships intermittently affected market sentiments, causing fluctuations in commodity prices and cross-border investment flows.

Insights and Outlook

Burton Taylor is compiling data to better understand the growing complexity of what a modern exchange is today, and capturing the importance of data & analytics, AI, and technology in creating revenues this year.