READ MORE

Our Brands

- Announcements

- Debt Investors

- Supporting our clients

Investor Relations

- Announcements

Our Brands

What do we do at TP ICAP?

Find out how we make a difference to peoples' lives.

Careers

Work With Us. We'd love to hear from you.

Joining the TP ICAP Group puts you at

the heart of markets that matter.

You’ll have the freedom to innovate and act on your initiative. We’ll train you and build your abilities in your specialist area, so that you can become an expert in your field. And all within a connected network that’s set up to give you the dynamic career you deserve.

Social

09 Mar 2026

Yesterday, we joined millions around the world in celebrating International Women’s Day. Gender equity means creating an environment where everyone feels they belong and can perform at their best. This is something we care deeply about at TP ICAP.

06 Mar 2026

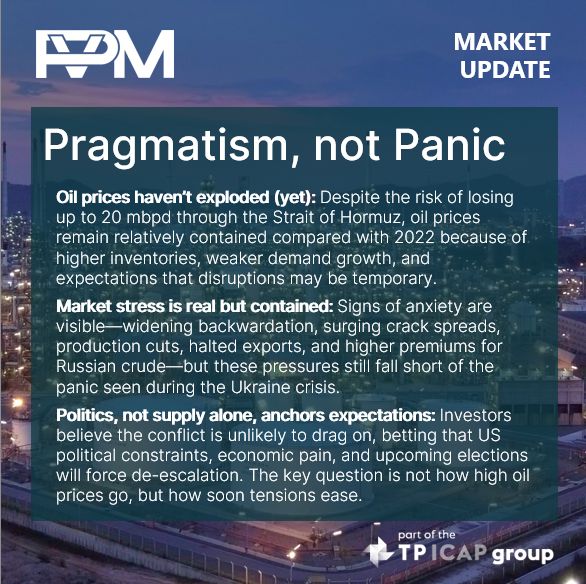

In a week like few others in global oil markets, our experts at PVM Oil Associates are providing the insight and clarity clients need to navigate volatility with confidence. Their daily insights are the go-to analysis in fast-moving markets.

06 Mar 2026

En marge de la Journée internationale des droits des femmes (IWD), nous vous proposons une mini‑série dédiée à celles qui font bouger les lignes dans nos métiers.

Copyright © 2026 TP ICAP