READ MORE

Our Brands

- Announcements

- Debt Investors

- Supporting our clients

Investor Relations

- Announcements

Our Brands

TP ICAP Acquires Neptune Networks

and Partners with Nine Global

Investment Banks to Create

New Dealer-to-Client Credit Business

Financial Markets

Liquidity Landscape: Europe back in vogue?

Energy & Commodities

The 2025 Commodities Outlook: What's Fueling the Future

What do we do at TP ICAP?

Find out how we make a difference to peoples' lives.

TP ICAP Q1 Trading Update 2025

Annual Report & Accounts 2024

Careers

Work With Us. We'd love to hear from you.

Joining the TP ICAP Group puts you at

the heart of markets that matter.

You’ll have the freedom to innovate and act on your initiative. We’ll train you and build your abilities in your specialist area, so that you can become an expert in your field. And all within a connected network that’s set up to give you the dynamic career you deserve.

Social

15 July 2025

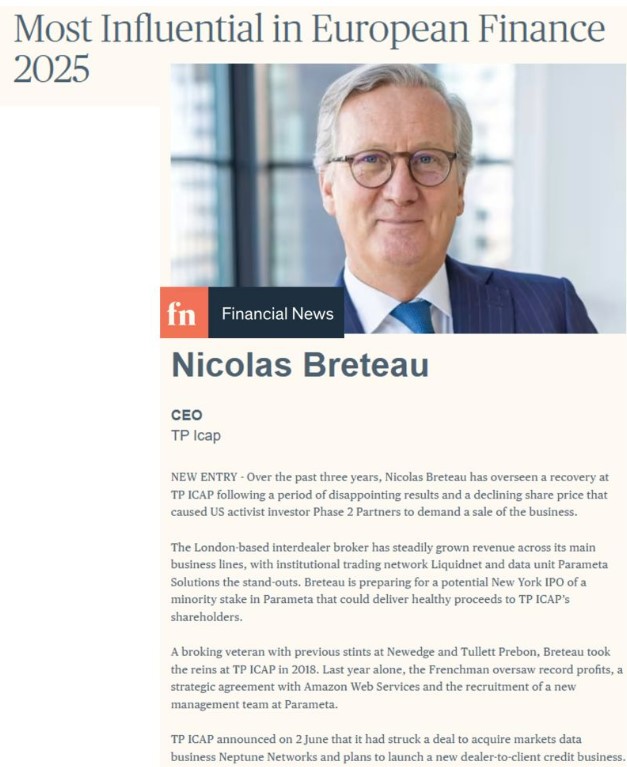

We are proud to share that our Group CEO, Nicolas Breteau, has been named one of the Most Influential in European Finance 2025 by Financial News. Under Nicolas’ leadership, TP ICAP continues to evolve and lead in an ever-changing financial landscape.

14 July 2025

It was a big night for our commodities team at the recent SGX Group Commodities Awards in Singapore, picking up four awards including being named the top Iron Ore Options IDB!

10 July 2025

"Generative AI is more than a buzzword—it's already transforming our Cloud Team's day-to-day, bringing agility and efficiency to the forefront. At our recent Women in Cloud event with Amazon Web Services (AWS) ...."

Copyright © 2025 TP ICAP