Finding Liquidity at the Midpoint

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Finding Liquidity at the Midpoint

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Finding Liquidity at the Midpoint

As we step away from a year largely defined by unpredictable and extreme bouts of volatility and back into a quasi-state of normalcy, institutional investors will once again train their focus upon the larger, longer-brewing challenge of balancing performance against liquidity and opportunity cost in an ever-changing electronic landscape.

After all, the natural evolution of the markets, with US equities in particular, invariably leads to unchecked complexity. The innovative reflex to this trend has been an expanding toolset to help traders navigate the equities trading ecosystem. This has been largely defined by, over the past few years, variations on optimization algos such as VWAP, TWAP, or implementation shortfall strategies (which all aim to seek out liquidity while also minimizing market impact.) Naturally then, there has also been a significant technological burden upon modern day institutional investors to maintain the hardware, software, and (more recently) AI-tools necessary to stay competitive.

The middle ground of these trends (a growing technological burden, increased complexity, and cost of business) is efficiency. While vendors, buy-side, and sell-side quants continue to develop solutions for their customer base, they are only a piece of the comprehensive puzzle.

Exchanges, ATSs, and dark pool operators have also launched a wide-ranging suite of tools designed to increase execution options and therefore improve quality. While nuanced order types have been common-place for some time, the sophistication of additional products and services such as proprietary data-based analytics as a means of managing execution quality have grown precipitously. Most recently, exchanges and ATSs have made headlines after debuting innovative midpoint execution tools that access contra liquidity on an exchange while mitigating information leakage that can have an adverse market impact on execution quality.

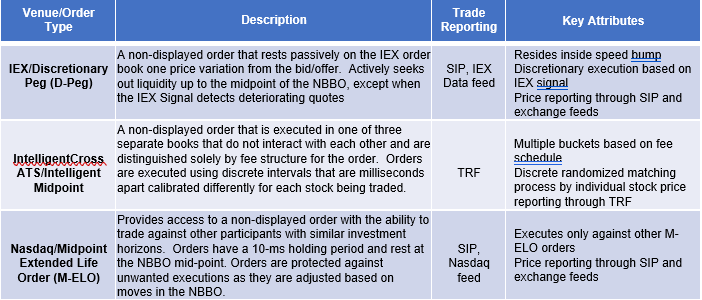

Three midpoint execution tools are currently available to market participants. Although the mechanics of the order types are similar, the capabilities and functionality of each provider’s solution is subtly different- not only in terms of how the order works but also with respect to the provider’s market position (Exhibit 1). Exchange offerings are accessible to a broader pool of participants, while an ATS may prove to be harder to access given their ability to segment or restrict access. Exchange solutions also benefit from the fact that participants can leverage existing exchange connectivity and data access while others prefer to trade in the dark and add an additional layer of anonymity over their strategies.

Exhibit 1: Order Type Attributes

While the key attraction of liquidity-seeking midpoint orders remains the same for all market participants (minimal market impact for larger trades), comparing the effectiveness across the solutions is not a straight-forward task. After all, there is never going to be a one-size-fits-all for any particular trade or strategy- especially as liquidity continues to fragment across the wide range of execution venues available to equity market participants today. Venue analysis data provided by Clearpool, however, paints a clearer picture of which solutions stand out and when.

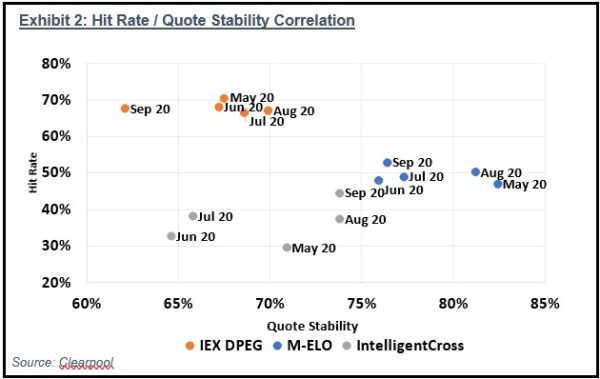

As mentioned earlier, there is a fundamental trade off that every market participant faces when weighing the probability of hit rate against market impact and fill rates- the rudimentary example of this being a hidden vs. displayed order. The displayed order will benefit from a higher fill rate, but it comes at the cost of increased chances of market impact. In this way, all trades, on a fundamental level, must find the appropriate place within this continuum. Nasdaq’s M-ELO, for instance, was designed with an execution quality bias. Looking to Clearpool’s venue analysis of trading between May and September 2020 using a VWAP strategy, we see clear trends in terms of which offerings fare better with respect to the quote stability/Hit rate trade off (Exhibit 2).

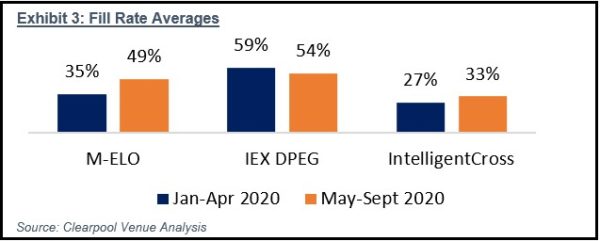

It is worth noting that M-ELO reduced its holding period from 500ms (when the solution launched in ’18) to 10ms in early 2020. Based on the comparative data of pre- and post-tuning windows, Exhibit 3 illustrates the change in fill rate averages across the three midpoint offerings- within the context of VWAP strategies.

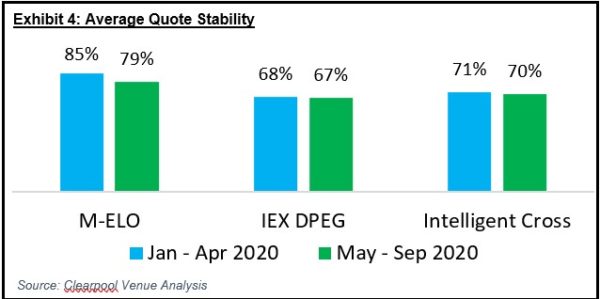

Similarly, exhibit 4 below provides some insight into the average quote stability across the three order types during the same pre and post-tuning period.

Looking forward, this is likely only the first wave of innovation with respect to midpoint order types. As the volume traded on-exchange continues to trend in favor of dark pools, we can expect to see continued innovation as the exchanges try and build upon the successes seen lately. So far, it seems the exchange community has caught on to the market’s demand for improved execution quality and is taking advantage of the moment. After all, due to the asymmetrical regulatory treatment of exchanges and dark pools, the impetus remains upon legacy exchanges to remain competitive and attract liquidity through innovations of all stripes.

_____________________________________________________________________________________________________

Colby Jenkins an analyst at Burton-Taylor International Consulting and has more than 10 years’ experience in research in global capital markets.