Record Trading Activity in a Volatile Year Drove Growth in Exchange Revenues in 2020

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Record Trading Activity in a Volatile Year Drove Growth in Exchange Revenues in 2020

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Record Trading Activity in a Volatile Year Drove Growth in Exchange Revenues in 2020

The exchange industry grew 6.7% in 2020 on the back of record trading, clearing, and settlement revenues, fueled by a volatile trading environment during the throes of the COVID-19 pandemic

Whiplashing economic conditions created a perfect storm for exchanges, most of which saw record revenues through a tumultuous year. Surging trading volume paired with a rapid increase in demand for real-time trading data led to a strong year for the global exchange industry.

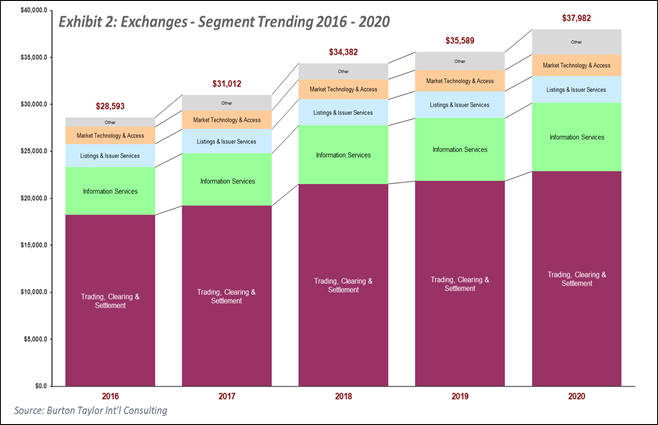

Exchange revenues reached $38 billion in 2020, increasing 6.7% and bringing 5-year CAGR to 7.3%. Exchanges have shown resilience through the pandemic, displaying their ability to generate revenues in varying market conditions through diverse offerings. Trading volumes skyrocketed across all major exchanges in 2020, driven by record retail and institutional activity during the COVID-19 pandemic. Additionally, exchanges capitalized on sharply increased demand for data as the market looked to leverage trade data for their own risk management and trading algorithms.

The exchange industry is leaning more into its information services businesses, marked by LSEG’s flagship acquisition of Refinitiv. As demand for data expands to seemingly infinite levels, exchanges look to cash in by leveraging their current infrastructure to facilitate data needs, as well as expanding their offerings through aggressive acquisition strategies.

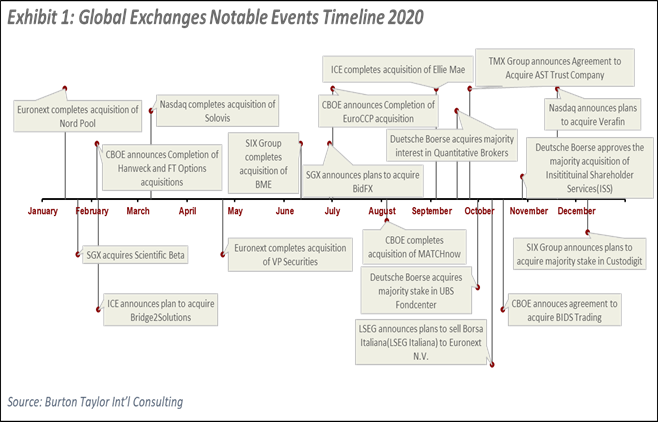

M&A remains an industry focus, with activity ramping up in H2’20. Exchanges are looking to extend market share rapidly, with new acquisition targets attracting more and more bidders as holding companies look to avoid “missing the boat” on growth opportunities. Information service providers are a top target of exchanges looking to capitalize on a boom in data demand.

Trading, Clearing, and Settlement revenues continue to represent a majority of exchange revenues, though growth in other key segments indicates exchanges are looking to diversify offerings to ensure future sustainability. TC&S revenues grew rapidly in a year marked by pandemic volatility, but a potential for lower volatility in coming years could threaten growth potential in the segment.

Information Services continue to see strong growth, climbing 4.4% on the year. Growth came on the back of increased need for real-time data to facilitate an evolving list of market needs. Data costs have become a hot topic of late, with SEC regulation on data feeds being challenged by larger exchanges this year. If regulation is upheld, proprietary exchange data feeds will be severely devalued, challenging exchange revenue models. Additionally, as trade volume moves more and more off-exchange, the value of on-exchange data could be questioned. Exchanges will have to be adaptable to continue capturing revenue as needs and regulation shifts out of their favor.

Exchanges are amidst a structural shift in business models, with data & analytics shifting from a byproduct of trading operations to a central focus of growth strategies. As markets become more and more complex, exchange trading and data services will only become a more integral part of the financial system, and holding companies able to facilitate these needs will see little obstacle to sustained growth moving forward.

Sean Eskildsen is an analyst with Burton-Taylor International Consulting. Visit our newly redesigned website at https://burton-taylor.com/ and see Burton-Taylor’s 2021 benchmark report on the exchange industry at https://burton-taylor.com/exchangereport-2021/ and look for our other benchmark reports for exchanges and indexes, to be published in Q2.