What's Driving the ESG Indexing Market?

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

What's Driving the ESG Indexing Market?

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

What's Driving the ESG Indexing Market?

Index providers have seen exponential growth in revenues from their ESG indexes in past years, with revenues from the segment reaching $208.7 million in 2020, a 29.2% YoY increase. Meeting consumer demand hasn’t come without challenges, with murky data and investor distrust tempering growth slightly, though future efforts from regulators and data providers are looking to address this.

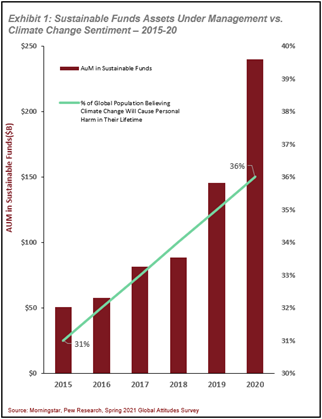

The rapid evolution in ESG investing has reached unprecedented levels in recent years, largely attributed to a younger investor base driven by values more than profits, as well as increased attention on climate related issues by the public trickling into investment decisions. While this may be the case, attention must also be paid to the timing of this boon in ESG assets and fund flows, which has transpired almost entirely through favorable market conditions for ESG products.

Young investors currently comprise a stark minority of total capital in the market, though as is always the case, this will soon change. As millennials enter prime earning years and begin to grow both wealth and income, the decisions made by this group will become more and more meaningful to the overall market. Millennial investors have frequently expressed willingness to forego some profits to invest in companies or funds which mirror their personal values, often pointing to climate aligned ESG funds as investment vehicles they deem worthy. As more millennial capital enters the market and ESG funds begin underperforming the market these claims will be put to the test.

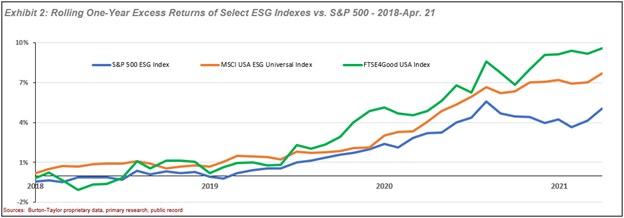

Detractors claim the recent success of ESG funds derives more from momentum than morals, believing investors are more willing to partake in the ESG investing universe when gains are exceeding traditional funds, and many will jump ship when gains turn the other way. Valuations are often surpassing fundamentals, inciting fear of an asset bubble by some market participants. Though capital seems to be flying into ESG funds disproportionately, a shift in societal focus towards sustainability may truly be driving investment decisions, with macro events such as the COVID-19 pandemic and global warming fears prompting investors to deploy capital to what they deem to be more worthy causes.

As has been the case for years, data concerns continue to be the biggest obstacle to more widespread ESG investing adoption. Non-standardized reporting of ESG metrics has led to fears of sustainability misrepresentation by firms, often referred to as ‘greenwashing’. To combat this, index providers are often forced to work with a multitude of ESG data providers to ensure the integrity of ESG claims, increasing the cost of construction and stewardship of indices. Regulators abroad are currently weighing measures to standardize disclosures, though the European Commission is the first and only to outline disclosure requirements.

ESG indexing growth is showing little sign of slowing, and access to higher quality data and regulations around disclosure will likely aid in future growth. Though the segment may see short term disruption in negative market conditions as investors shuffle portfolios to mitigate, the true growth potential stems from younger investors who show strong preference to sustainable investing. Motivations will be tested as ESG indexes are exposed to a wider array of market conditions, giving better insight into the future of the segment.

Sean Eskildsen is an analyst with Burton-Taylor International Consulting. Visit our newly redesigned website at https://burton-taylor.com/ and see Burton-Taylor’s 2021 report on the ESG Index Market.