An Anniversary Not to be Celebrated

The world is one year older and none the wiser as the anniversary of the latest atrocity in the millennia of similar outrage is upon us. There is no build up to a listing of what has transpired in Middle East that leads to a hopeful 'but', with ensuing descriptions of a placatory future. It is and remains a shocking mess. The initial fear of war spread that dissipated has been reignited after last week's missile attack from Iran into Israel, and the dire imaginations of burning oil infrastructure from Kharg Island to Riyadh plot their paths across the media once again. Yet over the year, the oil price has voted with its feet. At the close of business on October 7 last year the Brent M1 futures price settled at $88.15/barrel, the settlement on Friday registered at $78.05. While nothing can touch the emotion that the conflict has brought to the oil community, it has been well and truly smothered by macro-economic considerations that have thwarted any idea of an increase in global demand. Ten dollars lower and back to square one on balancing war sentiment against the misaligned demand forecasts, interest rates and an-at-best mixed industrial/manufacturing backdrop, oil participants might be feeling a touch of deja vu.

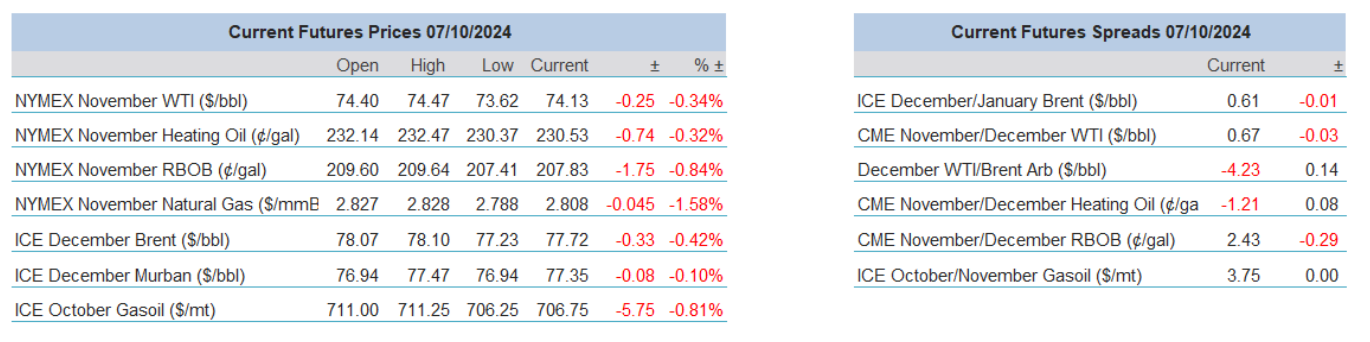

Still, the attacks of Israel into its neighbours and Iran's defence of its proxies remains the greatest driver of oil prices and on the week M1 WTI finished +$6.20/barrel (+9.09%), Brent +$6.07/barrel (+8.43%), Heating Oil +18c/gallon (+8.44%), RBOB +14.28c/gallon (+7.31%) and Gasoil +$55/tonne (+8.37%). There is little doubt that the push on in prices was abetted by short covering from the likes of CTA's and other such financial positioning. Options positioning turned with a bullish 'skew', the tracking of calls and puts, while in futures short only positions and long only positions decreased/increased by the largest in 5 weeks. This morning has a light touch feel to proceeding as the market drifts with no news of the feared attack into Iran over the weekend by Israel. The campaigns in Lebanon and Gaza that increased again keep sentiment pricked, but without direct clashes between the protagonists, prices are easing as defensive weekend positions are withdrawn.

Oil is so besotted with the Middle East that not even the bumper US Non-Farm Payrolls that has spurred stock markets on registers with oil prices. If anything, and using falling Gold prices as an example, commodities ought to be pressured by the sharp rally in the US Dollar. With the concerns of the US jobs market disappearing, so is the aligned pricing of a FED rate cut. Last week, the FedWatch pricing tool still had the chances of a 50-basis point cut at 35%, this is now firmly at a resounding zero. The US Dollar Index (DXY) has rallied to 102.55 which is a 3-month high. The resilience and exceptionalism of the United States keeps the bourses of the world very much buoyed and the outperformance of equities over oil is once again highlighted.

Saudi must take the bull, or the bears, by the horn

Calling anything fortuitous involving the breakout of a possible full-blown war is rather crass. However, for Saudi Arabia, and how it should manage the next phase of an OPEC+ manifesto, the sharp rally in prices has bought some time. There has been recent uncorroborated speculation that Saudi was about to repeat something akin to its early 2020 tantrum when it went about raising both its production and capacity in response to a lack of adherence to quota from fellow members, particularly Russia. However, the amount of work and sacrifice undertaken by OPEC’s de facto leader would be easily undone in a fit of pique, and the shakers and movers of the Kingdom are just too wise. Cranking the spigots and blowing the dust off of its 3.2mbpd spare capacity would cause a cascade of not only reciprocal production hikes within the group, but a fall in prices of tens of dollars and more importantly question the very survival of the cartel and the wider Declaration of Cooperation.

There have also been murmurs on various wires that the Kingdom has abandoned the targeting of a $100/barrel crude price in order to regain market share. One wonders if the idea of having any sort of target is relevant in such time of competition. The idea that OPEC can control the oil price by supply is one that at present is losing pertinency. Since the forming of OPEC+ in 2016, the IEA reports that its slice of the global market pie has slipped to all time lows due to the competition from the likes of the United States among others. Indeed, and breaking the IEA data down, Saudi’s crude output stands at 10% of the world’s supply whereas the US is now enjoying something close to 20%. The current plan of action is clearly not working and if the status quo is left to its own devices is there any other fate than an OPEC+ influence that grinds eventually into irrelevance?

There do seem to be some glaring options available and while everything in modern politics is all about the here and now, Saudi as the cartel’s leader will have to look beyond the pressures of contemporary economics and embark on a change in long-term goals. The very first issue that needs addressing is one of compliance. The quota busting by the serial cheaters of Russia, Iraq and Kazakhstan have brought the group to disrepute. The oil market now expects cheating and at present those assumptions are rewarded. In comparative terms, think of the sport of cycling and how it cannot shake the dark clouds of wide-spread drug use. As stated above, strong-arming with a gush of oil is not an option, but the clout and influence of Saudi cannot be underestimated in the region both financially and militarily and while such undertones in the dark back rooms that discuss such things, a new bout of pressure must be undertaken with a new bill of laden.

The delayed 180kbpd return of barrels postponement is desperate and reactionary, the oil could be released immediately along with a firm plan on the reintroduction of all other shuttered barrels. With a firm 18-month calendar planned, the oil market will price-in extra barrels, it is incredibly efficient in doing so. Of course the price will come down, and likely settle into a range of $50-$70/barrel rather than the $70-$90 of recent times, but OPEC+ market share will be given a chance to increase. Such an increase of oil supply will be roundly applauded by the like of the US Federal Reserve. Can there really be any doubt that there has been a battle between the FED and OPEC+? Free flowing oil will crush inflation and if investors were looking for reasons that interest rates would come down, this would be much more influential than any employment data. Lower oil prices and lower interest rates will create demand in a world suffering from industrial and manufacturing fibrillation. Even crestfallen Germany which has paid such a heavy price in economic terms due to its interned access to cheap energy might pick its chin up from the floor. Cheaper feedstock will mean easier refiner margin leading to lower motor fuel prices. If a massive blow to the EV threat to gasoline and the like were sought, this might just be it. Batteries and such other modes of power are not going away, we all accept that, but this will bring so much competition for vehicle buyers and the current troubles that EV sales are facing will be very much elongated and inversely increased for fuel.

In the recent Exxon Global Outlook, and due to well depletion and natural cycles, the oil giant predicts that an absence of further investment in oil infrastructure would lead to a loss of up to 15% per annum in world supply. If, say, the current global supply is 100mbpd it is a sobering observation. According to Goldman Sachs data, Saudi invests $250 billion in the oil sector at present. This then helps maintain the 3.2mbpd of spare capacity that every bear in the woods keeps pointing to. The Wall Street bank offers a prediction that a capex cycle will see $40 billion disappear per annum over the next four years. Cutting investment by the Kingdom in oil at a greater rate than the bank currently assesses will see the very bearish capacity surplus disappear which along with increased demand speculated on above, will also counter the lower prices expected after supply increases.

“The definition of insanity is doing the same thing over and over again and expecting different results”, so the saying attributed to Einstein goes. Saudi Arabia, and its rebellious cohorts can ill afford to keep carrying on in its present behaviour and policy. Markets and narrative need wrestling back, but in a very much different approach and while the ideas above are notional at best, they highlight that the leader of OPEC+ must bring something new, and afresh the table.

Overnight Pricing

07 Oct 2024