Another Friday in a Year-Long List of Being None-the-Wiser

Please note, PVM Reports will return on Monday, 05 January 2026

Numerically, the amount of central bank decisions over the last couple of days might be considered a bout, but by no means have they caused anything like a rout. The only colour came from the Bank of England which cut by 25-basis points and only by a hair’s breadth margin of a 5 to 4 vote. Norway and Sweden along with the ECB left well enough alone and all have made clear on the need for caution in the face of difficulties ahead. Even the Bank of Japan’s increase of a quarter of a point this morning gets more press due to rates not being as high since 1999 than any great shift in the economic outlook. The central bankers of the world are united in giving themselves room to manoeuvre rather than take risk, and with the Fed in something of a directional crisis, so many considerations involve not being too far away from where US monetary policy might be. The ECB is given another headache from the decision at the EU summit to furnish Ukraine with an interest free loan, which we look at below, but all the recent decisions concerning interest rates have been largely in line with the low bar of market expectations.

It was left to the US CPI reading to give cause for a nudge and a wink. The Bureau of Labour Statistics published 2.7 percent and 2.6 percent respectively for inflation and its core CPI which were much lower than the 3 and 3.1 percent expectations. Because of the US government shutdown, the publishing was eight days late and made all the more confusing as October’s reading had been cancelled. The BLS then has had to deploy assumptions and because these have not been fully explained, the conspiracy theorists are set free to shout on how the numbers have been politically skewed. Stuff and nonsense really and no doubt an adjustment will soon come along when data sets are complete. However, along with stellar results from Micron, equities were at last given their head with the S&P500 putting in its best 1-day rally for over a month.

No such luck for oil prices. Whatever blockade the US might be planning on Venezuelan vessels has yet to materialise with Reuters sources reporting on how two vessels under sanction were cleared to leave for China. Too much oil from too many sources still stalks the narrative and with US and Russian delegates once again meeting over the weekend in what President Trump describes as an atmosphere where talks were “getting close to something”, our market is once again becoming defensive.

Herding cats is not as hard as herding Eurocrats

It appears the naysaying from Brussels has won out and that the EU’s proposed plan to use the sequestered Russian funds seized after the invasion of Ukraine, will not even make it to first base. Belgium fears the legal and financial risks associated with such an aggressive stance, let alone the enormity of making Russia a geopolitical enemy. The pressure on the European Union is self-inflicted. It is insisting on being at the negotiating table that strives to thrash out a peace deal in the Ukraine war but with a lack of cohesion in any joint military capability, or the will to deploy if such a thing existed, the only option is to buy-in at this high-stakes table. Yet, wherever you look in the Union, ministerial keepers of financial coffers ‘squeak’ and whether there is domestic largesse in spending or austerity, burdening exchequers with funding of a foreign war is a massive vote loser which each assenting country leader now risks. What a wheeze it would have been to use Russian money to fight Russian troops. The irony is attractive, but not so much the consequences of a successful passing of the plan.

The Belgian Prime Minister, Bart de Wever, has argued, with some logic, that the use of assets from an aggressor have always been utilised retrospectively. Indeed, it is hard to find precedent where reparations, in whatever guise, have ever been used while conflict remained ongoing and have always been part of post-war settlements. Belgium is key to any progress because most of the frozen assets of Russia are held in Euroclear, the Brussels clearing house. Wever sees Belgium being set up as a sacrificial scapegoat, and he dismisses how EU officials insist on the legal repercussion risks from Russia being minimal as insulting. In a recent letter he wrote, “Let me use the analogy of a plane crash; aircraft are the safest way of transportation, and the chances of a crash are low, but in the event of a crash, the consequences are disastrous.” Being the keyholder to these legally ambiguous riches is also bringing unwanted attention from the United States. Washington views the assets as a bargaining chip in trying to strong-arm Russia to the negotiating table. It is not the first time the US has considered how best to utilise the monies. Previously, a plan was touted by the Trump administration in which they could be used in a US-led reconstruction of Ukraine. Belgium has had to navigate away from being caught between two of the three biggest international meddlers, the US and Russia (with China the other), and plot whatever course of neutrality is available.

The European aim is to get to a figure of €90 billion over two years as a loan for Ukraine. As explained in Euro News, the first had been and is still an ongoing, groundbreaking proposal to channel the immobilised assets of the Russian Central Bank into a zero-interest reparations loan to Ukraine, which the country would only be asked to repay after Moscow compensates for the damage done by its invasion. The second is common borrowing on the financial markets, which is the one chosen in this morning’s early hours. “We have a deal. A decision to provide €90 billion of support to Ukraine for 2026-27 is approved. We committed, we delivered,” EU Council president Antonio Costa said, as seen in the Guardian. The loan is interest-free and will be drawn against the EU’s existing budget.

Viktor Orban, the Prime Minister of Hungary, among sceptical allies in Slovakia and the Czech Republic had the ability to bring everything proposed to a grinding halt with a ‘nay’ vote. The policy required a full majority of Union members and Orban had indicated his willingness to veto. His pro-Russian stance and opportunism in using his veto power to gain concessions for Hungary are well documented. The trio of potential deal breakers were appeased by a recognition that they did not want to contribute and furthermore it was agreed that their financial obligations to the EU would not be affected.

It is not just Belgium and Hungary playing the proverbial flies in the ointment. Pre-decision, Giorgia Meloni, the Prime Minister of Italy, has been using cautionary language of late and believes plans to tap Russian assets would have unforeseen financial and legal consequences and might well serve to undermine Europe’s credibility. As much as the European Commission President, Ursula von der Leyen and other bullish allies such as Prime Minister Donald Tusk of Poland saying that the European Union will find a way to make Belgium feel more "secure" about the matter, the negotiations and eventual deal is something of a face-saver. By insisting on being a player in what could be the late stages of a peace deal, the EU has placed itself in this minefield, and to walk away without delivering anything other than warm hugs and good intentions, would have its reputation so damaged it might never have recovered.

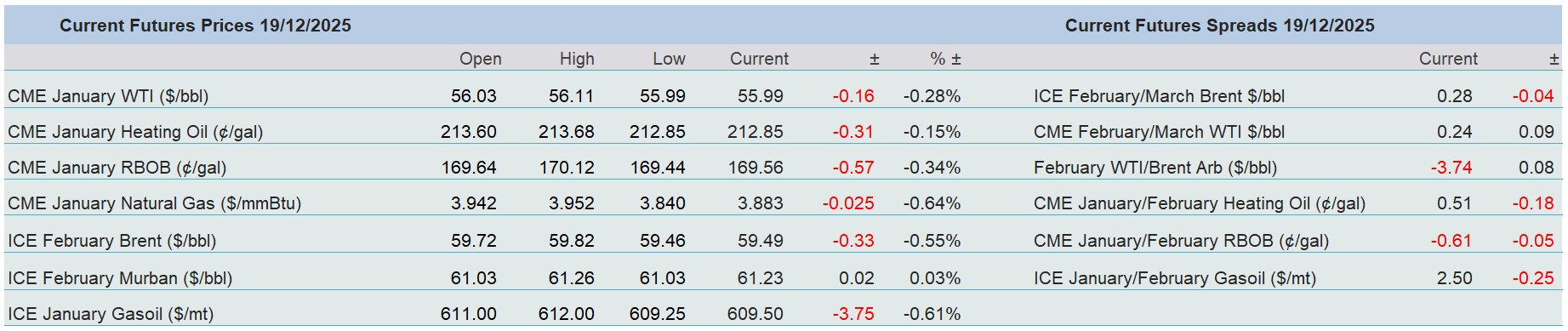

Overnight Pricing

19 Dec 2025