Anxious Equity Markets, Revived Peace Hopes

Job creation and a reassuring earnings report from the world’s most valuable company would normally trigger a stock market rally. These times, however, are anything but normal. After Nvidia reported solid financial results and upbeat forward guidance, and the US economy created more jobs in September than anticipated, stocks took a handbrake turn and finished the day significantly lower, infecting Asian markets this morning. Why? Possibly for three reasons, none of which are likely to disappear in the foreseeable future.

The delayed September nonfarm payroll data showed that 119,000 jobs were added to the economy, exceeding projections. Unemployment, nonetheless, ticked up. This leads to the second reason. With inflation still stubbornly above target, the Fed may have no alternative in December but to keep the cost of borrowing unchanged. If that is the case—and the CME FedWatch tool now puts the probability of a rate cut at 40%, down from 99% in October—the Fed Chair’s hope of receiving a Christmas card from the White House will be dashed. Lastly, concerns about AI-related borrowing and strains in the private credit market paint an uneasy outlook for bond market lenders, who might raise funding costs, with all the adverse consequences for corporate earnings.

In oil, the most important game in town was the draft peace plan drawn up by Russia and the US and presented to Ukraine. It is discussed in detail below. Judging by yesterday’s performance, which saw crude oil finish the day a tad lower and Heating Oil pushed over the precipice, investors are giving serious consideration to the legitimacy of the proposed framework.

Peace or Not, No Significant Price Fall

To question or doubt the validity and credibility of any major or minor market-moving development has become an unconditional reflex in recent months. Words may be louder at the beginning, but it is action that really counts. In the immediate aftermath of Wednesday’s surprise turn of events — renewed talks between the US and Russia to broker a peace deal and end the nearly four-year senseless and ideological war the latter initiated against Ukraine — algorithms and human instincts swung into action and cut exposure to oil. In the hours that followed, details of the proposed peace deal emerged, and so did doubts about the feasibility of stopping the war between the two nations. Prices started to recover on Thursday morning. Yet, yesterday, optimism of an agreement was on the rise once again.

The details revealed the possibly unacceptable conditions that would be imposed on Ukraine to secure a ceasefire and potentially halt the fighting for good. The new framework would demand serious concessions from the leadership of the invaded country. One could go as far as to conclude that accepting the preconditions would amount to capitulation, and that Ukraine would cease to exist as a sovereign country — the ultimate Russian goal — with US blessing. As the Financial Times reported, the plan consists of 28 points, and the US insistence that Ukraine accept them sounded distinctly unpropitious, as several of the demands constitute red lines for Ukraine.

The proposal, if it can be labelled as such, calls on Russia’s western neighbour to cede territory currently under Kyiv’s control — namely the eastern Donbass, which is not occupied by Russia — significantly reduce the size of its military, abandon certain categories of weaponry, accept less US military support and no further long-range weapons, and allow no foreign troops in Ukraine. Russian would need to be recognised as an official language, as would the formal status of the Russian Orthodox Church. In short, everything the Russian heart desires and very little, if anything, Ukraine would agree to.

You never say never in 2025; the unthinkable has happened and probably will again, but the chances of this framework, in its current form, advancing toward a solid, long-lasting, and mutually accepted peace agreement appear minimal.

And its impact on oil? If it turns out to be a smokescreen or if the US President once again becomes frustrated with exploitative Russian demands, the present status quo will remain in place. Sanctions, primary and secondary, aimed at depriving Russia of crucial oil revenues might even intensify and, with Western help, so might assaults on Russian energy infrastructure. However, let us imagine the rather utopian scenario in which the world becomes one big happy place again, and the relationship between Russia and its political and trade partners normalises or improves considerably.

The Russian economy — and within it, the oil industry — has been under enormous strain, although its crude oil production, after an initial drop of around 1 mbpd, has stabilised. Recent sanctions have forced Russian oil buyers to put their purchases on hold, and if oil currently stored in ships hits the market, the resulting oversupply could send prices lower. In the event of a peace agreement and the lifting of punitive measures, the country’s product exports would also increase, putting pressure on distillate prices and cracks. In November, seaborne product exports fell to 1.7 mbpd, a new wartime low, so there is room for recovery. In general, the country’s fossil-fuel revenues fell to €524 million per day last month, according to the Centre for Research on Energy and Clean Air, the lowest post-invasion. A rise in Russian refinery runs — which may have been cut by as much as 20% due to drone strikes — will contribute to improved product availability in the medium term.

Lack of data transparency is the idiosyncrasy of a country waging war against its neighbour. Several independent analysts and consultants nevertheless estimate that, until the first half of this year, Russian export volumes did not plummet; they were simply redirected. (No re-re-alignment is anticipated when the war is over, as Russia’s reputation with its former partners as a reliable supplier has suffered a fatal blow.) Ukrainian strikes on the Russian refinery sector over the past few months have been the most effective way to inflict quantitative damage on the invader. In the event of a peace deal and the lifting of sanctions, the price realignment will be felt less in outright prices and more in refinery margins – just recall yesterday’s price action. And even if flat prices fall initially, and crude oil producers — particularly in the US shale sector — begin to feel the pinch, Mr Trump, relying on his apparently ironclad friendship with Saudi Arabia, will ensure that the $50/bbl price floor is not breached.

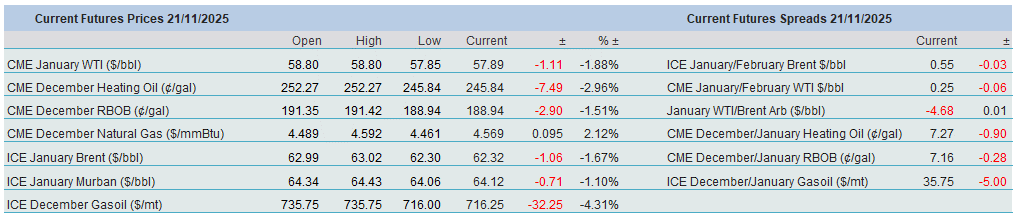

Overnight Pricing

21 Nov 2025