API Crude Draw Mops Up After Beryl

At a time when there is expectation of a tightening supply situation within the oil market, then the reaction to Hurricane Beryl is completely understandable. After all, this is sort of unknown territory, having a storm of such magnitude so early in the summer and being a prelude to the expected record number of storms predicted in the forthcoming hurricane season. With latterly forecasts of Beryl to turn into just a storm before entering the Gulf of Mexico and disappearing chances of bringing potential havoc to either Mexican or US oil infrastructure, any storm premium has eroded significantly. However, those that have been predicting 'tightening' and draws to US Crude holdings, will feel somewhat vindicated this morning as the API data shows Crude stocks fell by 9.2 million barrels last week. This decline in Crude levels might just have saved more of a sell off after the hurricane news and definitely dulls the data showing a build in Gasoline of 2.5 million barrels against a predicted 1.3 million draw and any manner of predictions of much increased road travel in the US over the Fourth of July celebrations.

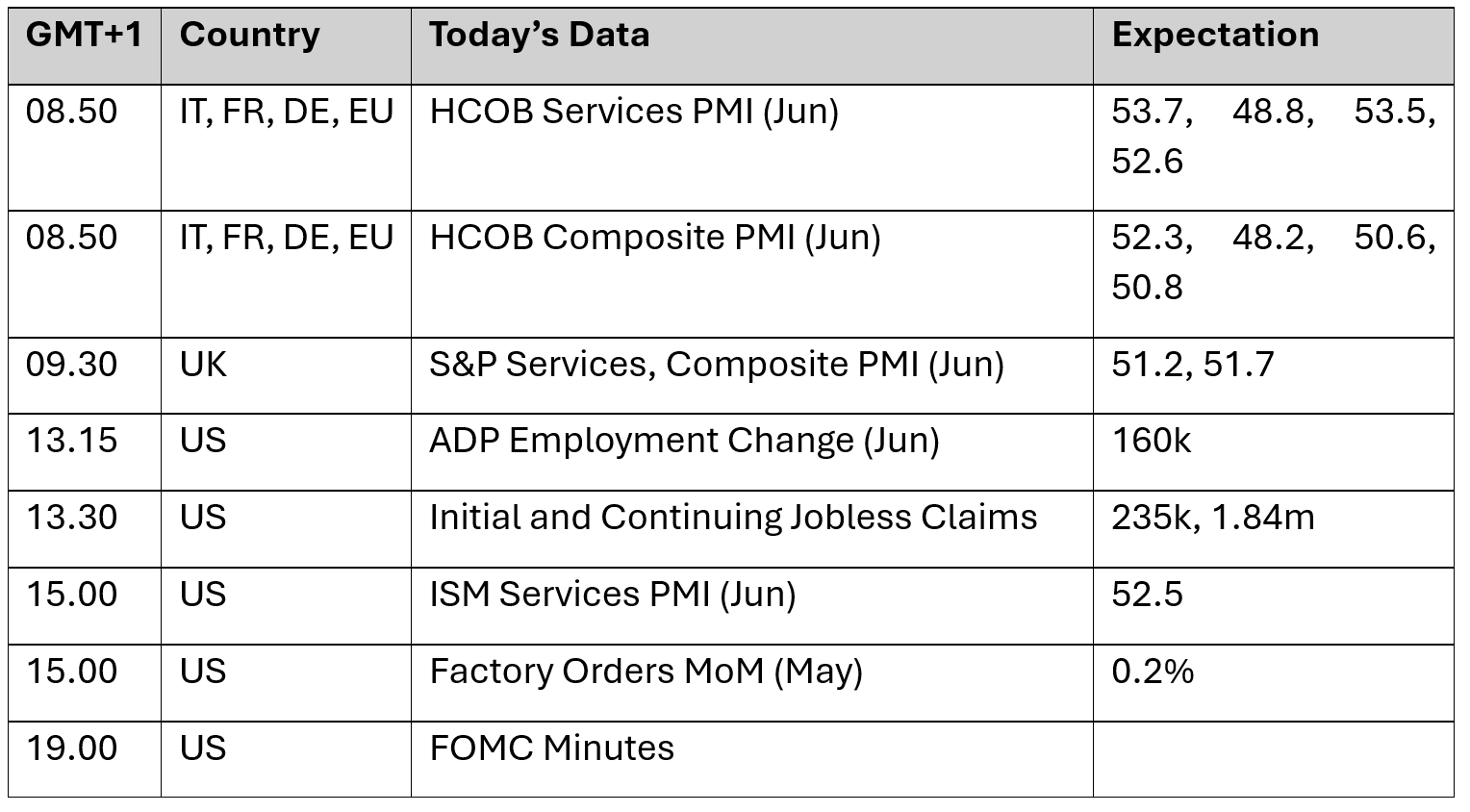

Faced with the impending US holiday, the UK election and the French election runoff at the weekend, investors' enthusiasm is starting to be shelved. Even with a striking amount of data to be published before the weekend it is questionable whether there is enough stomach for risk. This morning has already seen misses to expectation from Australia, Japan and China (Caixin) Services and Composite PMIs and there is a raft more PMI postings to come over the day. Added to these are US ADP Employment and Jobless claims topped off with the FOMC minutes and closing speeches from the ECB's central bank forum in Sintra, Portugal. Yesterday, Jerome Powell danced with language again offering that the US is on 'a disinflationary path', but more data was needed before consideration of sustained interest rate cuts. Of course, the ever-hopefuls took this as dovish, and buying was seen in the tech favourites pushing the Nasdaq to over 20,000. Therein lies the current sentiment in markets. Oil has an expectation of tightening supplies, the macro has an expectation of interest rate reduction, but there are just too many potential potholes from politics or data that might upset an apple cart pulled by bulls.

Renewing of the renewable outlook

The news as reported by Bloomberg yesterday that Shell is mothballing the construction of a biofuels plant in the Netherlands would appear to be another setback to the greener or renewable energies. There should not be much of a surprise, bearing in mind the CEO’s promise to be ruthless in delivering share-holder value. Even as the oil major’s mission is to achieve net zero emissions by 2050, the language that it will be achieved in a ‘measured and disciplined way’ belies the importance of corporate image versus corporate profits. Yet, it is ridiculous to presume that just because of fiscal prudence, renewable energy in the form of biofuels is about to go belly up. However, it does bring to light the growing realisation that the intense and exponentially rising costs of the delivery and rollout of renewables is starting to feel something of a baulk from would be investors, developers and corporations. There was never going to be a singular solution, each of the renewables would have to generate energy in tandem with not only other members of its class but with current fossil fuels. The world’s demand is just too big, despite only moderate growth in electricity demand in 2023.

According to the IEA, the world’s demand for electricity grew by 2.2% in 2023, less than the 2.4% growth observed in 2022. The agency expects a faster rate over the next three years, growing by an average of 3.4% annually through 2026. Modern industrial phenomena and trading will take much of the credit for such growth, referring to AI and the mining of cryptocurrencies. Looking through the prism of energy, it becomes apparent just how far-reaching companies such as darling Nvidia are having on demand. Outlining how consumption from data centres could double by 2026, the IEA expects them to consume 1,000 terawatt-hours (TWh) up from the 460 TWh in 2022. The Paris-based agency has never shied away from being an advocate of anything green, biased you might say if you came from Saudi Arabia, and predicts that all electricity demand growth will be covered by renewables such as solar, wind and hydro with additional generation from nuclear. According to Ember, the energy think tank that actively pushes transition away from traditional fuels, renewables have made marked progress in the energy mix. For the first time last year, 30% of the world’s electricity came from renewables following a rapid rise in wind and solar power. Yet for all the heralds, so-called clean energy supplanted only 2% of fossil fuel generation.

Therein lies the rub and why we choose, in such a politically poignant week, a subject such as renewables. The two at present are inextricably linked and one of the aggravated reasons we are seeing such convulsions within the political classes of Europe and beyond. Subsidies for a green transition and rollouts of renewables run to billions of dollars in the US, China, Europe and elsewhere. Returning to our favourite source of anything green, according to the IEA, global energy investment is set to exceed $3 trillion for the first time in 2024, with $2 trillion going to clean energy technologies and infrastructure. So, what are citizens getting for this 2:1 spending ratio? Certainly not cheaper fuel, certainly not lower emissions and certainly not the infrastructure to benefit from such debt extravagance. For what is going on is common old tax and spend on which many consider an ideologist movement, when all the while ordinary folk endure the taxation to fund it in a high interest rate and high inflation environment.

Such an environment has been punitive to investment into renewable energies. Upfront investment costs and susceptibility to high interest rates and materials, leaves risk takers sidelined. The Morningstar category of sector equity alternative energy funds (which also includes ETFs) posted an average return of -11% in 2022, -10.5% in 2023 and -4.3% up and including April 2024. Investments are complicated with markets micromanaged by governments that enforce lower electricity prices combined with higher auction levels to compete in a particular space, leaving little room for profit. There is not a die-hard oily type among us that does not recognise that change is coming, and the green, clean industries are here to stay. However, what we do know is that all are worthy to contribute to a world that is only going to show growth in energy need and markets have a much better way of introducing change than political enforcement or idealism. Which is why for now, there is a political cost to green-coated world leaders, and why renewables providers are reassessing investments because taxes, price caps, costs and possible changes in the political landscape make such projects less inviting.

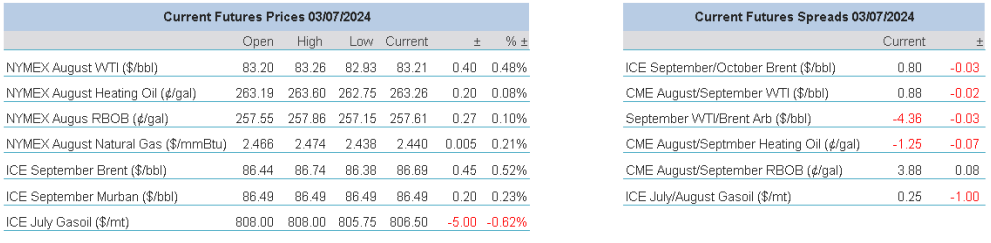

Overnight Pricing

© 2024 PVM Oil Associates Ltd

03 Jul 2024