The Bark Seems Worse than the Bite

The impact of yesterday’s report by the Financial Times on Saudi Arabia preparing to unwind 2.2 mbpd of voluntary cuts must not be exaggerated. It must be taken at face value. It was the confirmation of a pre-agreed deal. It is the timing that was curious as the change in Saudi/OPEC+ strategy comes as Brent is trading sub-$80. Adding around 180,000 bpd per month for 12 months starting in December will loosen the oil balance and probably lead to global stock builds in 2025.

Nonetheless, the main message was most plausibly directed to OPEC+ members and non-DoC producers that reclaiming voluntarily ceded market share will get underway soon – regardless of the price level. The price impact, whilst naturally bearish, should not be drastic, however. After all, these extra barrels will not make an unexpected re-appearance, have been accounted for in forecasts, and the move will entail a reduction in the group’s spare production capacity. The immediate price reaction, which led to a drop of $1.86/bbl in the European benchmark yesterday was understandable, especially as it was accompanied by Libyan factions signing an agreement to resolve the crisis over the governor of the central bank. Yet, unless a 2020-type supply war breaks out, the downside damage should turn out moderate and even non-existent provided OPEC+ members with compensation plans will stay true to their pledges.

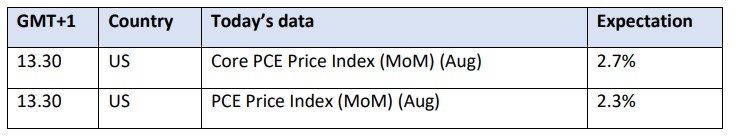

Supply concerns aside, the short-term economic outlook is encouraging. The US economy expanded faster than thought last year, government data showed. The growth estimate was unchanged for 2Q, and jobless claims fell unexpectedly last week. Unless there is a considerable deterioration in inflation and job market conditions in the next few weeks, the Federal Reserve might opt for a 0.25% rate cut. Today’s core PCE data will be seen as the next guide towards how the Fed might act and react but for now the economic resilience, also reflected in the dollar weakness, must be reassuring for investors.

When Bad News Is Not So Bad

China can sometimes be the country of paradox. It is the world’s largest emitter of carbon dioxide and greenhouse gases. According to 2022 data, it released 11,397 million metric tons of harmful gas into the atmosphere, 31% of the total. On the other hand, the sales of electric vehicles (EVs) are skyrocketing. The country’s EV penetration rate is now widely expected to reach 50% next year, 10 years earlier than planned by the government. Energy Intelligence, citing data from the China Passenger Car Association, estimates that EV sales exceeded 1 million units in August and outpaced the sales of vehicles with internal combustion engines for the second successive month. The voices of those predicting peak Chinese gasoline demand are getting louder.

This promising outlook, however, is not exactly matched by global EV sales. There is a noticeable deceleration in the adoption of EVs worldwide, and sales momentum is weak. Goldman Sachs sees three reasons for this phenomenon: falling prices for used EVs hamper the sales of new ones, uncertain government regulations have an adverse impact on EV manufacturing and a shortage of rapid-charging stations also represents a significant obstacle. Declining sales harm battery makers. BMW, for example, cancelled a $2 billion order with Swedish Northvolt, the poster child of the European EV battery industry. The company is forced to lay off 1,600 workers.

Stiff competition from China and the consequential price drop of lithium batteries are forcing the industry to consolidate and at the same time re-think its modus operandi. Car battery producers are joining the increasingly long line of those already focusing on grid-scale storage. The idea is to generate storage during low-demand periods and to release renewable energy when consumption is on the ascent. The storage of wind and solar energy used to rely on hydroelectric systems. Thanks to technological advances in the field and the ruthless competition in the EV battery sector, grid-scale storage of renewable energy has started to expand almost exponentially. The IEA estimates that around 90GW of battery storage was installed last year, double the amount in 2022. Two-thirds of this was for the grid with the rest for other applications, such as residential solar. The Economist points to a study by consulting firm Baines, which projects that the market for grid-scale storage could grow from $15 billion last year to as high as $1-$3 trillion in 15 years.

The trend is conspicuous and encouraging in both comparative and absolute terms. Five years ago, stationary batteries were 50% more expensive than those used in EVs. This gap has narrowed to 20%. The outright price of these stationary batteries per kilowatt-hour of storage declined 40% between 2019 and 2023, research group BloombergNEF calculates. The IEA reckons that solar power, when combined with batteries used in grid-scale storage, should already be making inroads in India as a cheaper alternative to electricity generated by burning coal and should become cheaper than gas-fired power in the US in a few years.

As with EV batteries, China is the Mecca of stationary battery production, chiefly supported by policies requiring solar and wind projects to install storage. Battery production for grid-scale storage increased from nought in 2020 to around 20%, exceeding the share of batteries in consumer electronics. Investment in research and development expanded eightfold since 2018 and reached $2.5 billion in 2023, according to the Economist. Another BloomberNEF research estimates that the Chinese lithium battery industry will more than double the current global capacity of 2.6 terawatt-hours by next year.

The Chinese hegemony in the sector will lead to a massive consolidation and will bankrupt several start-ups. The other side of the coin is that this ruthless competition will incentivize innovation leading to price decreases and ultimately making renewable energy more prevalent, affordable and competitive. The economic and environmental benefits of grid-scale storage will become more widespread as the sector expands. Storing cheap energy and releasing it when availability is scarce will drive electricity prices down, supply will become more reliable, and the intermittent nature of renewable energy sources will be considerably alleviated. As Fatih Birol, the Executive Director of the IEA sees it: Batteries are changing the game before our eyes.

Overnight Pricing

27 Sep 2024