A Belligerent Israel and Strong Gasoil Chase Prices Higher

The oil market exhibited its bullish twitch yesterday in frankly what was a rather benign news backdrop. Such twitch can only be brought about by geopolitical actions, or as in this case, words. The Prime Minister of Israel, Benjamin Netanyahu seemed to abandon the diplomatic language of a statesman, extraordinarily rebuffed the US fronted ceasefire, and delivered prose that would be worthy of trash talk in the lead up to a championship heavyweight boxing match. With the words that, 'no part of the Gaza Strip would be immune from Israel's offensive', it was not hard for oil participants to conclude that without even a passing regard for peace, there was not enough conflict-premium priced in and began about setting prices higher as Brent put in a spurt of $2.42/barrel being the largest rally for over a month. The latest bombing of the southern border city of Rafah by Israel even prompted the US President to utter that it was "over the top", but it does appear as if the Biden administration is about to give teeth to such protestations. According to the Times of Israel, those that receive military aid from the US will have to provide credible assurances of adherence to international human rights, and although Israel is not mentioned by name, the timing cannot be coincidental.

Shoving oil prices along and the initial author of the latest rally are product prices, particularly Gasoil with the futures price rallying $79.75/tonne from the low of Monday to the new year-to-date high of yesterday. The recent drone attacks by Ukraine into the oil producing infrastructure on Russia's Baltic coast have caused damage that is unlikely to be repaired any time soon. According to Reuters, Russia's Tuapse refinery on the Black Sea will not resume operations until March, weekly oil-processing rates dropped to the lowest in almost two months, but this decrease of throughput might just bring another headache for Russia as it tries to stick within its OPEC+ promises. Crude is now building up and with no place to go is likely to find its way to water for export with an estimated extra 2.1mbpd of loadings. Oil prices rallies are draped with warnings that include the awful state of the Chinese economy, the pricing/repricing every month of when interest rates might start to come down and the continued glum outlook for global industry and manufacturing. However, for the moment, such negatives are cast aside for as long as the horror continues in Gaza and the retribution is accompanied with aggressive language, oil bulls will continue to be armed with 'what ifs?'

China’s most important export at present might be deflation

China does not seem to be able hide from the spotlight of economic scrutiny as much as the powers that be wiggle and squirm with tinkering of stock market rules and frankly unsubstantiated allusions to mighty government intervention. This time, the shepherd’s crook that hauls China back to front and centre is, and judging by yesterday’s data, the reality of deflation. The Consumer Price Index (CPI) in January fell 0.8% against a forecasted -0.5% year-on-year and represents the biggest decline for 15 years, compounding the malaise of deflation is Produce Price Inflation (PPI), that while at -2.5% year-on-year for January is a pip better than the -2.6% call, it has now registered negative readings for over a year.

Deflation indeed, does need such heraldic headlining because of its difficult and circular nature to break out of. Prices fall and at first are a boon for consumers who then reduce spending in anticipation, which leads to falling revenue for corporations that might in some cases trim costs including employment leading to less buyers in the workplace and reticence from those that remain; prices drop again, and the cycle worsens. All rather ‘back of a beer mat’ economics, but the point is valid and leads to how this will again be a force that can only be negative for the idea of commodity demand and indeed, that of oil. If deflation plays out in textbook fashion, then domestic refined product use within China will reduce and may possibly be made available for export.

Quoted both in the WSJ and FT, Eswar Prasad, former head of IMF’s China division said, “a multitude of indicators are now flashing red, signalling a perilous period ahead for China’s economy and financial markets, […] deflation could also impinge on the world economy if it means that China, rather than serving as an engine of global growth, counts on global demand to revive its economy.” This international influence can arguably have a many-pronged effect on the journeys of other economies and the price of oil. In a fascinating article from Bloomberg Economics the observation is made that China has an outsize impact on producer prices because its manufacturing value was $5 trillion in 2022, nearly that of the US and EU combined and exported goods were 19% of the global total. It goes on to report that US import prices from China are dropping led by manufactured goods, and makes the argument that it is one of the reasons how the US is able to keep inflation shuttered in the face of a booming employment market.

A prolonged period of deflation in China must have world-wide ramifications, the size of its economy and how it is woven into the fabric of most markets that can be thought of, makes it so. Flooding the world with cheap goods will threaten other national employment and who can forget the Sino/US tariff war? In a recent interview with Fox News, former President Trump said he would impose more tariffs on Chinese goods if he should win the US election and that could be in excess of 60%. Until the reticence of stimulus in the name of security is abandoned by China and debt burden relieved, China will continue to be the leading act of economic tragedy on the world stage and deflation is just a chapter in a very complicated play.

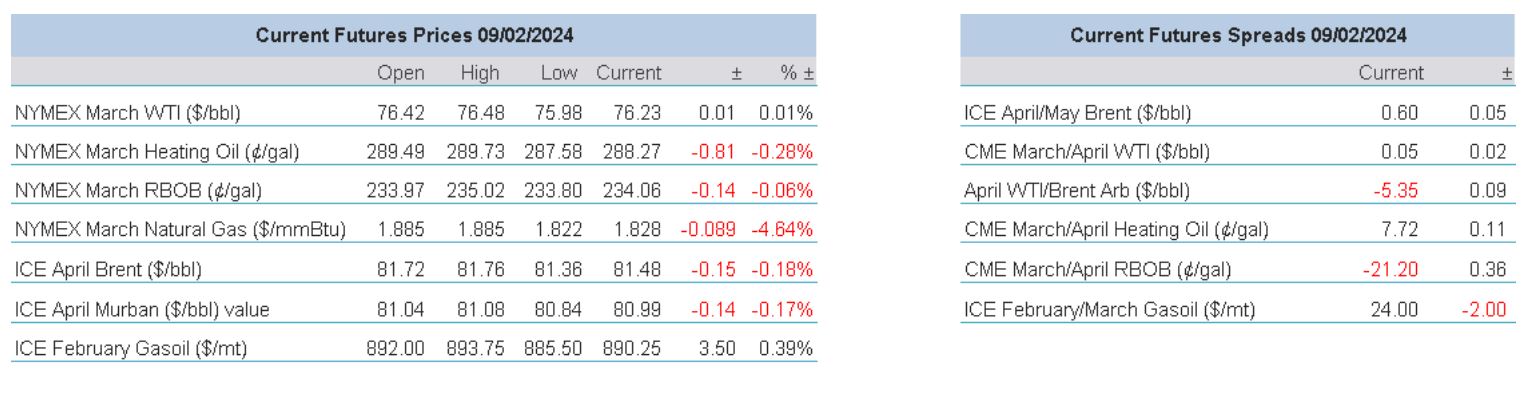

Overnight Pricing

© 2024 PVM Oil Associates Ltd

09 Feb 2024