Betting on a Pause

The global economy from China to Japan, the EU and the US is in trouble and investors like it. A string of reports on contracting manufacturing and service sectors was greeted with a convincing stock market rally. Manufacturing in the land of the rising sun shrank last month, in the euro zone both the service and the manufacturing segments of the economy grew smaller, business activity in the UK foreshadows a mild recession in the incumbent quarter and the Composite PMI in the US retreated from 52 in July to 50.4 in August. So why the optimism despite the lukewarm readings? Well, rate hikes, the thinking goes, have done the trick, economies across the globe are cooling, consequently pausing the increases of lending rates soon and loosening monetary policy sometimes next year are entirely reasonable. Clarity will hopefully be provided at Jakson Hole today and tomorrow. What is, however, buoyant for equities can spell trouble for oil.

The outlook of the world of manufacturing is genuinely bleak and could suggest well-justified downward revisions in oil demand growth. It was unquestionably the main reason, together with the dollar strength, for the performance in the first half of yesterday when oil prices came crashing down like the private jet of those who dare to question and challenge the authority of Russia’s omnipotent ruler. Relief, nonetheless, came from two directions in the afternoon. To begin with, there is a healthy conviction that OPEC heavyweight Saudi Arabia will roll over its voluntary production constraint into October - even if it reduces it. Apparently rising Iranian production, the ongoing talks between Iraq and Turkey to resume exports via Ceyhan, US intention to ease Venezuelan sanctions and the upcoming US refinery maintenance could all point to the extension of the output moratorium.

Secondly, the latest Weekly Petroleum Status report from the EIA was probably also more on the supportive side, if anything. Nationwide crude oil stocks drew 6.1 million bbls. More than half of it took place in the Midwest where refinery utilization rates jumped by 0.9% to 98.9%, the highest weekly reading there for nearly 4 years. Product inventories climbed higher, gasoline by a disappointing 1.5 million bbl and distillate by just under 1 million bbls. However, products supplied, the proxy for refined fuel demand is encouragingly stubborn above 21 mbpd with gasoline flirting with the 9 mbpd mark and distillate growing close to 200,000 bpd on the week.

The net result was a 3 million bbls decline in commercial inventories, which is now 34 million bbls or 2.6% under the long-term seasonal average. At this point it is useful to take a step back and look at the bigger picture. US oil stocks make up around 45% of OECD oil inventories. The “other oil” category, which is basically petrochemical feedstocks, is an integral part of the collective commercial stocks and currently stands at 311 million bbls. There is a perceptible seasonal pattern in this group whereas inventories start declining meaningfully around September-October and tend to bottom out around March. This seasonality directly helps deplete US commercial stocks and is indirectly responsible for part of the changes in OECD stocks movements. So here we are, forecasting supply deficit and fairly price supportive prospects heading into the final stretch of 2023 with a rather unpromising economic backdrop. In the last few weeks undoubtedly, the latter was the dominant factor in the formation of oil prices and might make its presence felt in the immediate future but unless the oil balance deteriorates markedly what our market is going through right now could turn out to be the mother of all corrections.

|

GMT +1 |

Country |

Today’s data |

Expectation |

|

US |

Jackson Hole Symposium August 24-26 |

||

|

13.30 |

US |

Durable Goods Orders July |

-4% |

|

13.30 |

US |

Initial Jobless Claims August |

240,000 |

Ominous Bond Yields

There is a whole gamut of factors that are currently influencing the price of oil. The view on the effectiveness of the fight against inflation, consequent qualm or calm on the plausibility of recession and China’s economic malaise all have a profound impact on the demand side of the oil equation, whilst the determination of the OPEC+ producer alliance to counterbalance any actual or perceived decline in oil demand affects the view on global supply. Below we look at a narrow angle of the economic aspect.

China’s economy has not stopped sneezing after the Covid-era restrictions were lifted last December. The country’s leadership has failed to achieve the desired result and the salient question is now whether the rest of the world has caught a cold. In today’s interconnected word and notwithstanding the worsening relationship between the world’s two largest economies, the 2 and 10-year US Treasury yields are trustworthy indicators of the health of the US and global economies. The signs, whilst not exactly ghastly, are inauspicious.

The worrying snapshot of the US bond market displays inverted or negative yield curves. That is when the longer-term yields are below the short-term ones. Conventional economic wisdom states that bond yields act as reliable gauges of inflation and the health of the economy, in general. In equilibrium short-term yields are under that of longer-term because a.) economic uncertainty grows with longer maturity and b.) the higher the time value of the money the higher return is demanded.

There are, however, times when the yield curve becomes inverted as it the case currently. The 2-year yield settled at 4.965% yesterday whilst the 10-year bond yield closed at 4.194%. In fact, this yield curve inversion has been the main feature of the US bond market for more than a year now. Such a phenomenon happens when demand for the 10-year bonds exceeds appetite for those with a maturity of 2 years.

Inverted yield curve is ostensibly worrisome. It might imply growing expectations of economic downturn (well, let’s call a spade a spade – recession), it could be a harbinger of credit market stress and could impact bank’s profitability as banks borrow for the short-term and lend for the long-term. Inverted yield curves, with all their consequences and side effects foresee considerably weaker equity markets and this is where the present situation gets confusing. The downward slope of the yield curve has been conspicuous since June last year, yet the US equity markets (the DJIA and the Nasdaq Composite Index) or the global MSCI All-Country Index are all above last June’s levels despite the recent weakness. Investors seem to be weathering the recession storm (and recently Chinese woes) confidently, nonetheless, only returning to the “yield status quo” will be an unmistakable sign that the economic storm has irrevocable passed. Until then the risk of protracted downturn will persist.

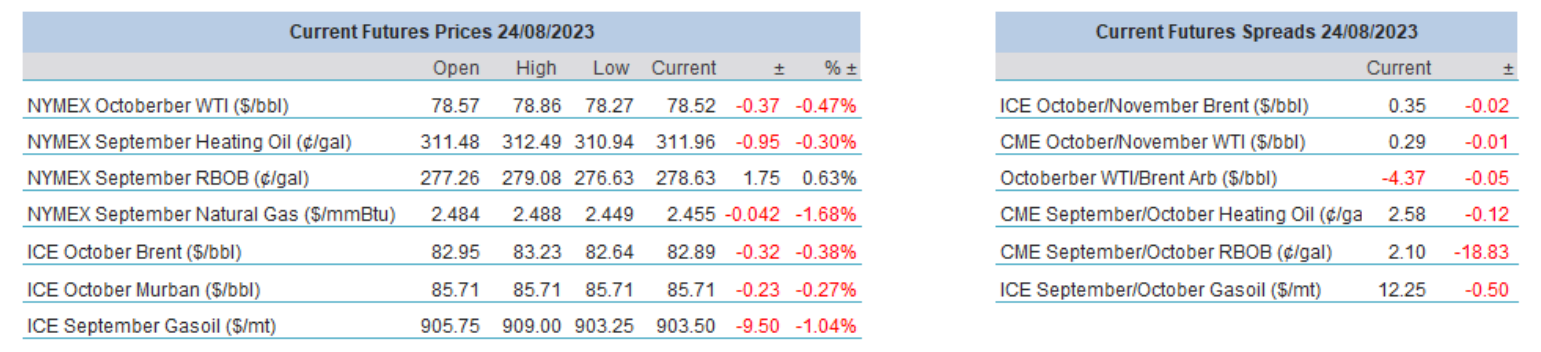

Overnight Pricing

24 Aug 2023