A Blanket of Unease Descends on Oil Markets and Indeed the World

The black hole of Middle East current affairs takes precept of all oil price thinking and nothing can break its gravity, with both meanings of the word intended. Our market is settling into a world where missile exchanges are commonplace but the cynicism of it being normal has yet to set in because of how easily the situation could escalate. At present damage at Bazan oil refinery complex near Haifa, Israel and at the world’s biggest gas field, the South Pars along with the Shahran oil facility in Tehran, Iran, are an indication that domestic and civilian-serving plants are targets enough. Whether these attacks interfere with international oil stuffs commands price premium, but with the President of the United States now considering the country’s position on dealing with Iran’s nuclear capabilities brings another level of anxiety. Listing the roll call of ‘what ifs’, should the US get involved, would run to several pages and might well be irrelevant even by the time this missive hits inboxes. The situation is as fluid as the underlying commodity it mostly affects and while there is a fraternal ‘your guess is a good as mine’ in future price divination, positioning will continue to be at least defensively long.

Such is the concentration by oil watchers on the Middle East that oil prices have slipped this morning because the US military did not involve itself in actions in Iran overnight. The mind boggling 10-million-barrel decline in the API Crude inventory data should be the banner headline of the day, even if it is just some sort of adjustment. Of course, every part of the fundamental backdrop ought to be tracked particularly at this time of year when refinery runs are paramount in oil price thinking, however, even if the EIA data this afternoon in some way confirms the picture the API paints, an utterance of war or diplomacy from the White House will make the data irrelevant. This is much the case in how the IEA Oil Market Report yesterday held little sway, although it must be said there were hardly any fireworks. It trimmed 2025 world oil demand growth forecast to 720kbpd from 740kbpd and raised world oil supply increase to 1.8mbpd from 1.6mbpd. Associated with oil prices and presumably a boon for Vladimir Putin was the inability of Volodymyr Zelensky to either meet Donald Trump at the G7 summit or secure more weaponry in Ukraine’s defence of its lands. The Middle East nightmare does not just overshadow mere market metrics; it occludes what is happening in the world’s current bloodiest conflict which must be music to the resounding great halls of the Kremlin.

Central Banks face a central problem

It comes as little surprise on the decision by the Bank of Japan to leave interest rates well enough alone. Rumination and pontification are bywords in Tokyo and rarely do investors worry that which has been widely publicly debated in the days before is not then replicated in official announcement. In fairness, Kazuo Ueda and his brethren of policy makers find themselves with very little room to play with. What once seemed a steady road to both gentle interest rate rises and weening from the bond issues that have helped Japan gorge itself on stimulus, is rudely interrupted by that nemesis of economic plans, one Donald J. Trump.

Having delivered a 25-basis point rise in January, the Bank of Japan has rightly adopted a more circumspect approach because of the uncertainty that continually arrives in soundwaves generated from the beacon in Washington. It also slowed down its tapering of Japanese Government Bond (JGB) purchases. This then is the third meeting in a row where an increase has been delayed even though the economy has largely enjoyed moderate recovery. Exports and industrial production are flat even though there was previous evidence of front loading before tariffs. Business investment, private consumption and corporate profits all continued to enjoy small trends in improvement and inflation is expected to rise moderately. A background then of decency where a small tick higher in interest rates and a lowered plan of stimulus ought to be easily tolerated. This is when the Donald-shaped apparition sends its chill hand of disruption. In its post-decision press release the BoJ said, “there are various risks to the outlook. In particular, it is extremely uncertain how trade and other policies in each jurisdiction will evolve and how overseas economic activity and prices will react to them.” There would have been too little time for the BoJ to take into account what transpired at the G7 summit in Kananaskis, Canada. President Trump and PM Shigeru Ishiba’s inability to find accord on a trade agreement in a side meeting means the BoJ’s dovish stance might just prove to be prescient for any elongation stalemate and eventual full tariff implementation will damage and reverse the small improvement in the state of Japan’s economy and even Ishiba’s premiership.

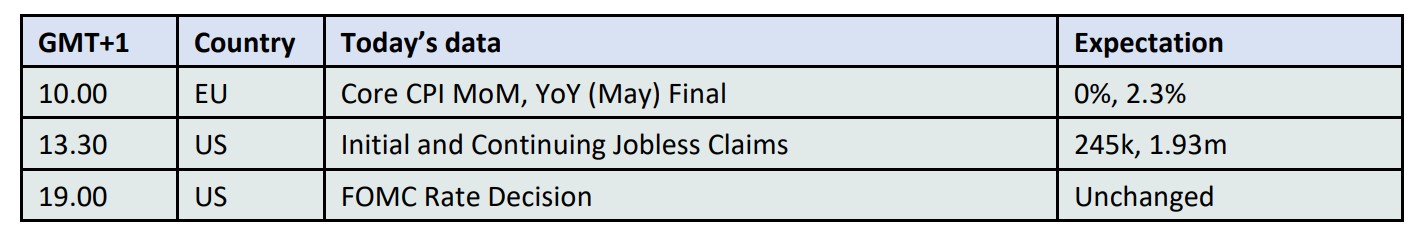

One can only imagine the faux-anger noises that will be emanating from the White House tonight after a similar and likely decision by the US Federal Reserve to also keep interest rates unchanged. Never one to shift himself from blame, the early hours financial news that is not dominated by Iran and Israel, will likely be loaded with another bout of Powell-bashing from the US President. The FOMC faces a thankless and unenviable task as its main priority to offset higher interest rates to ward off inflation against their dulling growth and stability. Reasonable employment data is contradicted by shrinking manufacturing and all is made worse by a bout of tariff front running that skews many metrics. Worryingly yesterday’s Retail sales were down 0.9% month-on-month and the poorest reading for two years and is attributed to a change in behaviour bought about by tariffs. Given the enormity of the ‘Big Beautiful Bill’, if it passes the Senate’s scrutiny and usual horse trading, and the extra debt burden faced by the US Government, the FED will hardly be in a state of hurry to ease in any form. The opaque state of world trade keeping the BoJ from being confident in decision is exactly the same state keeping the US Federal Reserve defensive. While the all-consuming conflict between Israel and Iran hold the market’s gaze and rightly keep oil prices elevated due to perceptions of supply risk, central banks will quietly carry on going about their business of doing nothing, because nothing is the only real logical choice. A BoJ and FED with little room to manoeuvre and cash to cajole markets forward is a real worry for forward demand in industrial commodities and while this concern will lay fallow until the missiles stop flying, it will at some stage grow to bother bullish convictions.

Overnight Pricing

18 Jun 2025