Bluff or Not, It Might be Called

Whatever the rationale behind the US’s lust to own Greenland, whether national security, natural resources, geopolitical leverage, or bitterness over missing out on the Nobel Peace Prize, none of these would justify the takeover or annexation of the world’s largest non-continental island. Yet here we are, once again facing threats that have come in the usual form of import tariffs imposed on those European nations opposing Mr Trump’s desire to acquire Greenland. Countries and markets have become accustomed to such ultimatums, but this time it might be different. Unreasonable US demands appear to be unifying those on the receiving end of the President’s ire, who are audaciously contemplating taking up the gauntlet. A trade war could well break out between former friends, in what appears to be the most serious escalation in adversity between the US and Europe. Will all hell really break loose? Intriguingly, investors, who usually find comfort in the embrace of the dollar and US Treasury bonds in times of uncertainty, are now spectacularly abandoning these safe havens and seeking refuge in gold and silver. Whether it will rein in the US President is no shoo-in.

The bad blood playing out in the latest chapter of US foreign policy does not, at least in the immediate future, have a tangible impact on the oil balance. Focus, therefore, has been centred mainly on the relative calm in Iran, precipitating an initial sell-off in oil prices. The recovery that followed, on what can be described as a slow trading day due to Martin Luther King Day, was aided by an upward revision of this year’s global economic growth by the IMF, as well as by a revival in distillates. A cold winter and prolonged attacks on Russian oil infrastructure have provided seasonal support for the middle of the barrel. Although global oil inventories are still expected to swell this year, unmistakable downside conviction remains AWOL so far, as unpredictability breeds pragmatism, temporarily setting a floor around $60/bbl on a Brent basis.

Will it be Worth it?

There is no reliable way to predict how the global economy, and everything related to it, will perform in the future. The world is at the mercy of the US President’s whims, and, oh boy, is he capricious. Paradoxically, it is precisely this unpredictability that has resulted in a very discernible certainty, manifested in determined attempts to become ever more independent of the United States. Concrete moves to coordinate and cooperate are no longer limited to traditional allies. There is a growing tendency to make the best of a US-less political and economic environment. A plethora of trade deals have been, or are about to be, struck, and every single one of them excludes the US.

To begin with, Canada, one of the US’s most pivotal trading partners, is rapidly losing faith in its southern neighbour as a reliable ally. In all honesty, this should come as no surprise. Any country threatened with annexation or invasion will do its utmost to detach itself from the aggressor. The US President recently declared that the revised NAFTA trade deal, now called the United States–Mexico–Canada Agreement (USMCA), is irrelevant to the US, even though the volume of trade between the two countries exceeds $1 trillion. Against this backdrop, Canada has decided, notwithstanding recent trade concessions to the US, to reduce its exports to its former ally from 75% to 50%. New infrastructure projects are being launched to transport natural resources to new markets, while trade barriers, traditionally high between Canadian provinces, are also being dismantled. Last week’s visit by the Canadian Prime Minister to China resulted in reciprocal tariff reductions in an effort to incentivise trade between the two nations.

Trade deals can take an awfully long time to negotiate and conclude. The EU managed to reach an agreement with the Southern Common Market (Mercosur), a South American trade bloc, last week after 25 years of painstaking negotiations. There can be little doubt that belligerent US trade rhetoric and actions helped to galvanise the talks. The agreement would create one of the largest free-trade areas in the world. If approved by the European Parliament and ratified by the Mercosur members, Argentina, Brazil, Paraguay and Uruguay, its importance cannot be overstated. It is designed to eliminate tariffs on 90% of bilateral trade between the two regions, which together account for 30% of global GDP and encompass 700 million consumers. European cars, wine and cheese would become cheaper in South America, in return for tariff-free agricultural products flowing in the opposite direction. In the words of the Brazilian foreign minister, the deal is a “bulwark… in the face of a world battered by unpredictability, protectionism and coercion”.

The European Union’s interests are not limited to South America. A trade deal with India is now on the cusp of being signed after 18 years of talks. The world’s most populous country is the EU’s ninth-largest trading partner, with goods worth €124 billion exchanged in 2023, representing more than 12% of total Indian trade. The free-trade agreement, expected to be signed within a week, will exclude politically sensitive agricultural sectors but will provide the EU with access to a market representing 25% of the global population. Looking further ahead, the European Union has also launched trade and investment dialogue with the twelve nations of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), of which the UK became a member in December 2024.

Other notable accords include the UK–India free-trade agreement signed in July 2025, with the stated aim of boosting bilateral trade and lowering tariffs, particularly on whisky, cars and machinery, between the two nations. Cooperation between the UK and the EU is also intensifying. There are conspicuous attempts by the UK government to reset its relationship with the EU, strengthening cooperation in the areas of trade, regulation and education.

Global efforts to become independent of, or at least less reliant on, the US are anything but lackadaisical. A physically strong, coercive, and dominant husband, asserting his authority, or, shall we say, seeking to achieve “peace and harmony through strength”, can only terrorise his seemingly obedient spouse for so long. Eventually, the spouse has had enough and walks out. One can only wonder whether that “walk-out” moment has now arrived. It is not a divorce, but an unprecedented fallout nonetheless, with all the inevitable consequences: a comparatively adverse impact on the US economy and prolonged weakness in the dollar as trade shifts away from the United States. Regaining trust and reconciliation remain possible, but only after an effective round of detoxification.

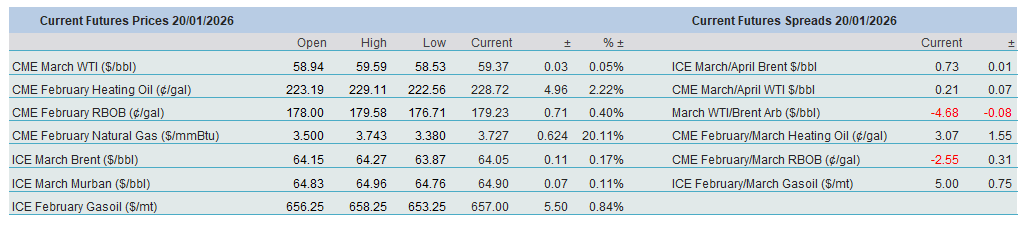

Overnight Pricing

20 Jan 2026