Bull Retribution

The key takeaway after yesterday’s confident performance in the oil market is that currently events around Israel and Gaza together with Ukraine’s war against Russia weighs more on the sentiment than disappointing US inflation data. The two major crude oil contracts advanced convincingly and so did RBOB. The impressive widening of the backwardation on both WTI and Brent is a clear indication of the underlying strength in the physical market.

Although truce talks started in Cairo the continuous Israeli assault on Rafah will entail renewed and elevated tension around the Red Sea, a key artery of world trade. Raising the geopolitical temperature further were reports of the US’s rejection of a Russian proposal of a ceasefire in Ukraine. And whilst the US Senate passed a $95 billion aid package for Ukraine, Israel, and Taiwan it is dead cert that Donald Trump’s unconditional Republican servants in the House, including its Speaker, will not allow the bill to go through as it is linked with US border security, something that Trump wants to use as a leverage in the run up to the elections. Ukraine is a hostage of US electoral tug-of-war and although the country will likely avoid economic recession the political ambience presages harmful democratic recession in 9 months’ time.

The resolute performance in the oil market is all the more impressive in the light of dispiriting US inflation data. Consumer prices in January did not rise more than in December but could not match expectations. The final reading was 3.9% whilst the core data came in at 3.1%, less than the December figure of 3.4% but above the 2.9% forecast. The upshot of all this is that the first step of switching from restrictive monetary policy to expansionist is being pushed further down the road. The first rate cuts are now not penciled in until June. Stocks were sold off and so were bonds whilst the dollar’s safe haven status appreciated.

Oil has weathered the financial storm decisively, but copious upside potential might be too much of an ask. One of the reasons for the recent strength was the scarce availability of products, partly because of US refining maintenance. For the week ending February 16 US refiners are expected to have 520,000 bpd less offline capacity than the week before, research company IIR reckons with further capacity coming back online the following week. Judging by last night’s API data maintenance work still depletes product inventories (gasoline -7.23 million bbls, distillates -4.02 million bbls) and helps crude oil stocks build (+8.532 mbpd) but the trend might start reversing from next week leading to a liquidation of long crack spread positions and to renewed pressure on outright prices.

Undeterred Optimism

OPEC will likely remain the most upbeat on global oil demand as well as on balance even after the IEA publishes its updated view on the latest supply and demand developments tomorrow. The research arm of the producer group has remained true to its recent self in its latest Monthly Oil Market Report as it foresees nearly unquenchable thirst for oil in 2024 and 2025, trumping the somewhat moderated views of others. It predicts oil consumption expanding 2.24 mbpd this year to reach 104.40 mbpd and grow by another 1.85 mbpd, to 106.24 mbpd in 2025. Both annual demand estimates are an upgrade of 40,000 bpd from January. What is intriguing to observe is that these amendments are the function of 190,000 bpd upward revisions in 4Q 2024 and 4Q 2025 projections whilst the rest of both years were left unchanged.

Healthier demand prospects are precipitated by a buoyant economic performance. Global GDP will expand 2.7% in 2024 and by 2.9% in 2025, slight improvements from last month. In its feature Article OPEC takes stock of demand developments between 2019 and 2025 and finds that the developing part of the world will be responsible for the lion’s share of the rise in consumption. Global oil demand will have risen by 9 mbpd or 9.3% between 2019 and 2025, with consumption in non-OECD countries growing by 7.7 mbpd or 14.6% from 52.4 mbpd to 60.1%. It leaves the rich part of the world with a growth rate of a meek 1.3 mbpd or 2.9% from 44.8 mbpd to 46.1 mbpd. Developing nations will be the engine room of demand growth and will play an outsized role on this side of the oil equation.

At this point it is worth spending more time on and have a thorough look at Chinese forecasts. As pointed out in one of our recent notes we find resilient Chinese demand predictions perplexing and OPEC stays firm on the sanguine prospects of consumption of the world’s second biggest economy. In fact, it penciled in a 40,000 bpd improvement on annual Chinese demand for both 2024 and 2025, which now stands at 16.82 mbpd and 17.23 mbpd respectively. The recent economic turmoil, the crisis engulfing the country’s property sector, meagre consumer spending, the barren fight against deflation and the resultant growing pessimism of investors seemingly do not have an inauspicious impact on oil demand estimates.

Whilst the outlook on global oil demand remains healthy there has been a noticeable increase in non-OPEC supply projections. It is actually rooted in 2023 when US and Russian liquids production have been upped by 130,000 bpd and 140,000 bpd respectively. The net effect is an upward revision of 150,000 bpd in non-OPEC liquids production and in OPEC NGLs for 2024 and 2025. The US will bear the brunt of these changes as half of the improvement originates from the other side of the Atlantic, a testament to the resilience of the shale sector.

Solid demand estimates and upgrades in non-OPEC production aptly illustrate the motivation behind the latest Saudi decision of halting output expansion. The message is conspicuous: output growth from non-aligned producers is more than sufficient to cover accelerating demand even if OPEC’s own numbers suggest otherwise. Demand growth, according to the latest MOMR, will exceed non-OPEC supply increase by 1.06 mbpd this year and 580,000 bpd in 2025.

Nonetheless, the upward revision in non-OPEC output implies dwindling calls on OPEC. It is now seen 110,000 bpd lower than in January for the incumbent year as well for 2025. The global oil balance is getting looser, one might conclude, which would be a valid observation had OPEC’s own production not been part of the formula. It, however, is and it shows a genuine struggle or reluctance to climb, as it fell by 350,000 bpd to 26.34 mbpd in January. Set it against the predicted 2024 quarterly calls of 27.81 mbpd/28.21 mbpd/28.75 mbpd/28.77 mbpd averaging 28.37 mbpd for the entire year leading to a global stock depletion of 2.03 mbpd. Does it sound awfully tight? Well, let us see what the IEA comes up with tomorrow.

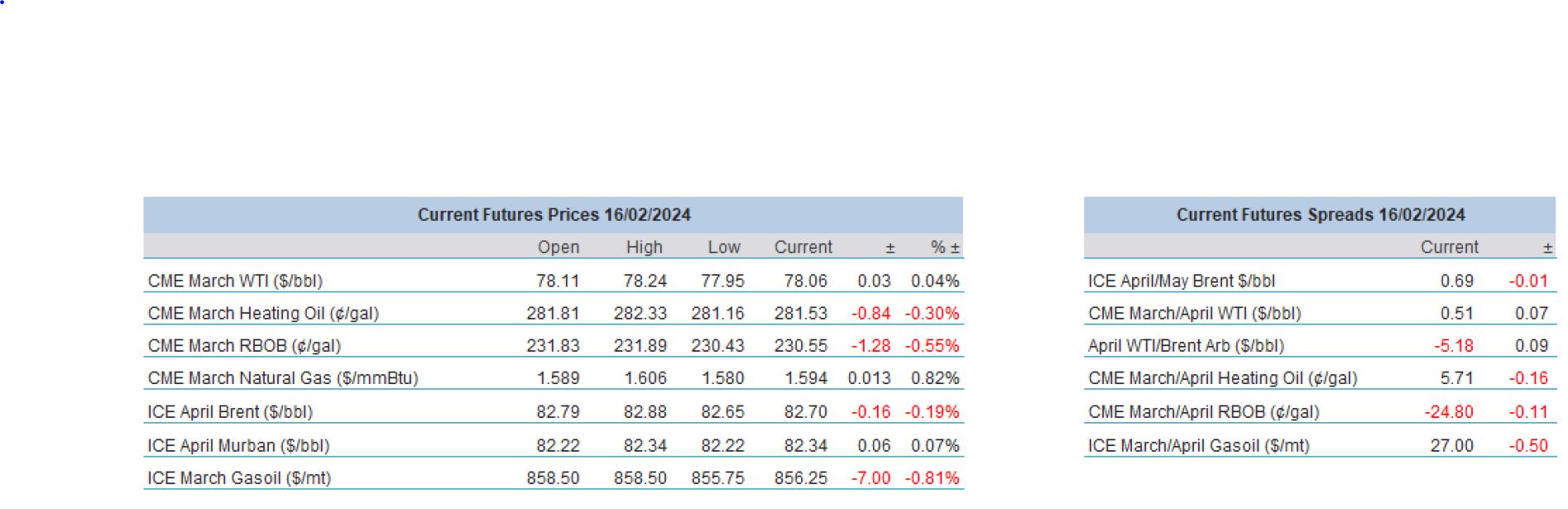

Overnight Pricing

© 2024 PVM Oil Associates Ltd

16 Feb 2024