Buy Friday, Sell Monday, Watch Macro, Repeat

The Friday to Friday, week-on-week closes played out thus for the major contracts; WTI -$2.54/barrel, Brent -$1.68/barrel, Heating Oil -10.47c/gallon, RBOB -6.11c/gallon and Gasoil -$54.5/tonne and a macro glance would suggest to a casual observer that the influence of the Middle East might have eased a touch after a fortnight of rallying. However, pick over the days in micro sessions, and taking Brent as the example as it did lead most of the week, there were over $2.50 ranges every day with bulls and bears taking turns to rend their clothes and on odd occasions probably at the same time. Positions in the main were intraday and the commitment of traders (COT) reports saw little change in exposure from money managers.

The pattern is now set as there is a propensity for market users in all their guises to have at least some oil length going into the weekends and when the fear of conflict spread shows no validation come the early hours of Monday mornings’ openings, that fear hedge is ordinarily unwound. Logic would suggest that continuance of this pattern would end up with a watering down of any effect that might be felt from the misery currently being suffered in Gaza, but since when does logic have anything to do with this eternal strife? The other centre of war, Ukraine, has fundamental and physical reasons to be more influential than what might occur in the Holy Lands, but there is no tangibility to the Middle Eastern conflict, yet. It is perceptual and emotional and then in some ways more dangerous. Trading around and pricing oil in this shifting, unfathomable outrage does not come with a set of instructions and the heaves and haws are set to continue.

As December Brent expires tomorrow, valuation and assessment will become even more tricky and being a ‘pricing’ pillar in the calendar, the market ought to be expectant of continuing dips and soars. Howsoever oil plays out this week, at certain times during the trading sessions, focus, quite rightly, will come to dwell on what is happening in the grander macro suite in a data-heavy period.

Today: Will see not only its year-on-year inflation rate due in at 4%, but Germany’s GDP year-on-year flash for Q3 and the predictions do not go against the failing economy so epitomised in last week’s PMI data. The forecast is that GDP will again decline and register -0.7%, bringing further fear that Germany’s economy will be charged with ‘stagflation’, particularly as the ECB kept rates static. The Euro Zone will also publish for October; Consumer Confidence (forecast -17.9), Economic Sentiment (93) and Industrial Sentiment (9.5).

Tuesday: The much awaited China NBS Manufacturing PMI (forecast 50.2) and Non-manufacturing (previous 52) will give a lead on how stimulus is working. Last week’s better Industrial Profits argue the case that it has, but PMIs need to act as confirmation. This will then be closely followed by the Bank of Japan’s interest rate decision which in keeping with the continued loose policy, is forecasted at -0.1% and the country’s Consumer Confidence which previously printed 35.2. French year-on-year inflation (previously 4.9%) is due just before the Eurozone’s Flash October YoY CPI forecasted at 4.2%. This will accompany GDP for year and quarter expected to be flat readings. Along with the week’s spate of Consumer Confidence will be the publishing of the US CB number due in at 100 versus last month’s 103.

Wednesday: Will see the private Chinese Caixin Manufacturing PMI due in at 50.8 and again, alignment with the NBS PMIs might offer proof that stimulus is working. Catching up with last week’s S&P Global PMI’s for the major trading centres, markets will get to see how the rest of the world is faring as final readings are produced. More importantly will be the ISM Manufacturing PMI from the US which is forecasted at 49. With employment very much on the mind of the Federal Reserve the ADP Employment Change number, that is always a good barometer for Non-Farm Payrolls, is due in with an increase of 150,000 as is the JOLTs number of job openings due to read 9.2 million for September. However, these employment readings will be too late for the FED to have much of change of heart as at 18.00BST the FOMC interest rate decision will be published at a forecasted hold of 5.5%. The press conference after by Jerome Powell will have every word and nuance studied in a manner that would make Shakespearean students proud.

Thursday: The end of the week starts to lighten up with only final readings of PMIs from last week due, but the unemployment rate for Germany due in at 5.8% will round off a fortnight of horrible statistics for the once star of the European economy. The Bank of England will keep its interest rate at 5.25%, it will have little room not to do so having been previously seen unsurprising holds from the ECB and probably the FED.

Entering into the game of stock picking is a dangerous affair, particularly from a publication that reports on macro-economic drivers only as a lead into oil price influence, but one cannot ignore how the state of play with big ticket corporations have such a massive influence on surrounding markets. This of course refers to the APPLE results due at COB on Thursday. The Nasdaq saw great swings last week due to the negative influence of Alphabet (Google) and then positive from Amazon and Microsoft. Arguably, APPLE will have even more so due to the importance of manufacturing and not just data-related earning such as AI and Cloud.

Friday: Will see the publication of the private Chinese Caixin Services and Composite PMI’s but their influence will not see much action as market will have become data-weary. The big one would normally be the US Non-Farm Payrolls due at increase of 188,000, but with the FOMC decision still ringing in the ears of investors, unless the change is outlandish the perceived effect on interest rates will be nominal. Last of all the major movers will be the US ISM Services PMI, but with same reason as NFP the reading will probably fall onto very fatigued investor ears.

Overnight Pricing

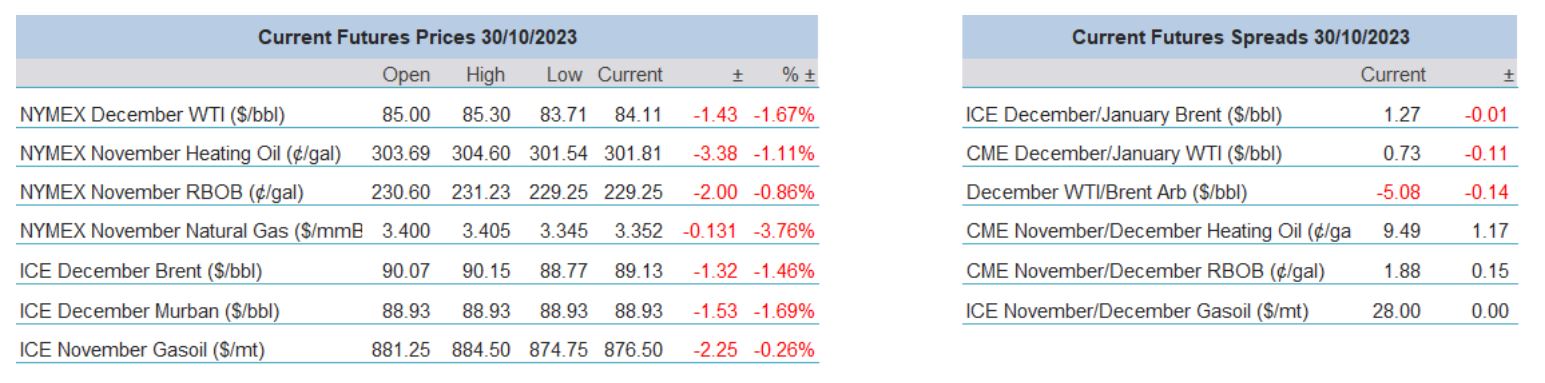

30 Oct 2023