Calling the Bottom Soon with One String Attached

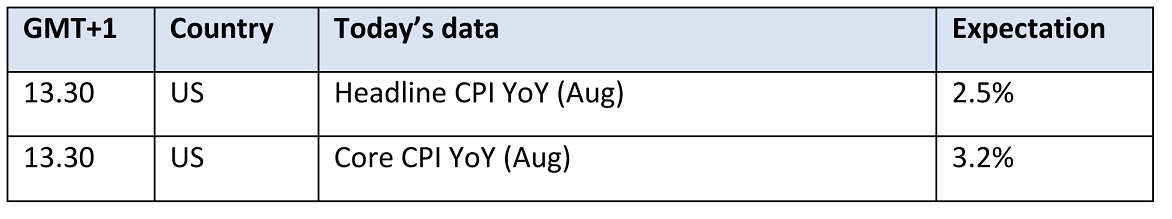

As the saying goes, markets can stay irrational longer than one can stay solvent. It is an open question whether the current sell-off, which started in the second half of August and took the price of Brent below $70/bbl yesterday for the first time since December 2021 is an irrational one and whether it will continue. As usual, there will be several factors to assess and re-assess, starting with today’s US CPI report, which will hopefully help investors guestimate the extent of next week’s plausible Fed rate cut. The ECB will make its own decision tomorrow and it should have a tangible impact on the euro/dollar exchange rate.

Unpredictability, however, does not explain the relentless move lower. Sure enough, Chinese headwinds and the strong dollar together with healthy supply from outside the OPEC+ group have ensured that the $90/bbl ceiling was never going to be violated. Growing fears of recession have also contributed to the darker mood. As discussed below, OPEC continued to amend its demand forecasts downwards. The IEA will likely stick to its recent narrative when it publishes its own version tomorrow. A thorough glance at the updated oil balance from OPEC, whilst justifying the ongoing weakness, suggests that the bottom is not far. This brazen statement, nonetheless, comes with a caveat and will be hastily revised if the group decides to put barrels back onto the market or a supply war breaks out. Until then, our formula shows a floor of around $67/bbl with the new ceiling just shy of $80/bbl.

Tropical storm Francine was not able to help either even though around 25% of the oil and gas output in the USGC has been shut. Post-settlement the API provided some comfort as it showed a sizable decline in crude oil stocks, a forecast-beating draw in gasoline and a tiny build in distillate inventories.

Gradually Re-evaluating the Outlook

It was not exactly throwing in the towel, far from it, yet the views on global oil demand and oil demand growth are more aligned than before – or better say, they are less contrasting. Again, the variation is still enormous by historical standards, yet the latest update from OPEC saw the second consecutive monthly downgrade in absolute numbers as well as in growth. The world will need 104.23 mbpd of oil this year and 106 mbpd in 2025. The revised values are 220,000 bpd and 300,000 bpd less than two months ago. Annual expansion is seen at 2.03 mbpd in 2024, down from 2.25 mbpd in July. For next year, it has been cut to 1.77 mbpd, 80,000 bpd less than in the middle of the summer.

We do not doubt that when the IEA releases its own fresh findings the cleavage will still be enormous. In August the chasm stood at 1.25 mbpd for 2024 and 2.14 mbpd for 2025. In its latest Oil Market Report, nonetheless, OPEC acknowledged the headwinds the global economy is facing. Although worldwide growth was left unchanged for both years demand forecasts were cut and, according to OPEC, the ‘minor adjustment … reflects mainly actual data received year-to-date’ for 2024. The view in Vienna is that the stable increase in economic output in the first half of the year permeated into 3Q with US household consumption stable and, most intriguingly, the Chinese manufacturing sector remaining resilient. Notwithstanding the optimism, Chinese oil demand is now forecast to average 17 mbpd for 2024 and 17.25 mbpd in the second half of the year, a reduction of 100,000 bpd from the previous month.

Supply outside of OPEC+ went the other way, it was revised upwards. The increase was 150,000 bpd for 2H 2024 and 100,000 bpd for the whole year, broadly the same upward amendment as for 1Q 2025 and the entire next year. Non-DoC supply will grow 1.2 mbpd in 2024 and 1.1 mbpd in 2025. Brazil, Canada, and the US will be responsible for the lion’s share of this expansion.

As a result of the cut in demand and the increase in supply estimates, the call on DoC oil has been lowered but it still looks awfully bullish. It is estimated to average 43.6 mbpd in 2H 2024, 42.6 mbpd in 1H of 2025 and 43.45 mbpd in the whole of 2025. Of course, these prognoses are meaningless without knowing or at least attempting to project OPEC+ production levels for the next few months. In August, independent consultants and analysts put it at 40.66 mbpd including countries with no mandatory output ceiling. Although, this figure implies massive drawdowns in global and OECD stocks the alliance decided to delay the gradual unwinding of its 2.2 mbpd voluntary cuts. The move must have been driven by the recent price performance and not the estimated global oil balance.

The quarterly calls on DoC oil seem overly optimistic. The market, judging by the ongoing sell-off, clearly disagrees with them and frankly, past figures are a great challenge to reconcile. Take the second quarter of this year, as a fine example. DoC crude oil production was 1.3 mbpd under the call on OPEC+ oil. Over the quarter almost 120 million bbls should have flown out of global stocks. Yet, there was an increase of 59 million bbls in OECD commercial oil inventories or a slight build of 6 million bbls when SPR and oil-on-water are accounted for. Non-OECD stocks cannot have drawn, especially with China continuously replenishing domestic inventories. The outlook is bewildering, and it exposes the numerous, evidently unquantifiable, uncertainties that need to be reckoned with in any forecast. Still, the salient part of the OPEC report is the decelerating oil demand growth, which clearly was one of the triggers for yesterday’s sharp fall, but the moderate monthly changes suggest that the bottom cannot be too far. The EIA, which upped oil demand growth and cut output growth is even more buoyant and argues that faster stock depletion will send Brent back over $80/bbl this month. We would agree with the direction but not with speed.

Overnight Pricing

11 Sep 2024