Ceasefire Abandoned, Ceasefire Agreed

In a way, the two major geopolitical hotspots had mitigating impacts on one another yesterday, the net result was a downtick in oil prices as the morning rally turned into a defensive move. Pandora’s box has been re-opened in Gaza. Trading accusations, Israel and Hamas blame each other for breaching the truce agreement, which has brought relative calm to the region since January. The result of the ensuing Israeli pounding of the Palestine enclave is more than 400 dead, according to the health ministry operating in the area. The ongoing tragedy is coupled with US attacks on Yemeni Houthis, thus the morning rally of $1/bbl demonstrated a conspicuous rise in risk premium.

The wind was then taken out of the bulls’ sail as the US and the Russian Presidents shook virtual hands after agreeing on a 30-day pause on striking energy infrastructures in Ukraine, possibly swapping prisoners of war and starting talks on safe shipping in the Black Sea. Unconditional success? Far from it as Russian territorial demands, Ukraine’s NATO membership and peacekeeping in the occupied land are still issues waiting to be discussed. Nonetheless, this dim ray of hope was sufficient to send the price of oil meaningfully down from the day’s summit. The weakness continues this morning, despite overnight airstrikes reported by both sides. The large build in US crude oil stocks, as seen by the API, is another hindrance to an upside reversal, albeit product inventories declined.

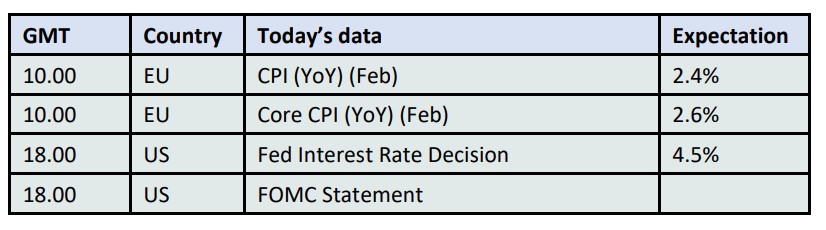

Politics was in focus, but it did not stop equities investors from staying anxious about US tariffs as the April 2 deadline of reciprocal excise duties is fast approaching. The Federal Reserve, amongst the current perplexity and unpredictability, will probably be inclined to keep the cost of borrowing untouched today. Investors are discernibly nervous, and this was exhibited in the 1% decline in US equity prices after two days of upside correction. There is no change in the political, economic and energy backdrop – it is changing relentlessly and frequently constantly sowing the seeds of confusion.

The Precarious State of the US Economy

Investor sentiment presently is anything but ebullient. Wars, military and trade, ad-hoc or impromptu decision-making, and incoherent policy implementation make planning literally impossible and risky. The world is a mess, and unpredictable prospects are most aptly echoed in the US. Cognitive bias is hard at work to explain and convince, pro and con, the current behaviour of the US stock market. If you are a Trump supporter, whether earnest or opportunistic, you are confident that all we are witnessing is just a speed bump on the path to a beautiful future and the bigger picture needs to be observed. The opposing camp argues that the genie has been let out of the bottle, and it is getting ever more arduous to force it back in.

The health of the entire globe is inherently linked to the US economy. Although its relevance and weight have been steadily declining, it is still responsible for slightly over a quarter of the total GDP (down from over 40% in the 1960s) whilst its population represents a mere 4% of the whole world. It is the performance of its economy and the collective value of its goods and services that presently causes headaches amongst policymakers and investors. The OECD, in its latest forecast released on Monday, foresees a decline in growth in Mexico, Canada and the US in case of intensifying trade tension between former allies. Assuming 25% punitive measures between these trading partners the US is now seen expanding by 2.2% this year and 1.6% in 2026, a downward revision from 2.4% and 2.1% previously. Influential investment bank, Goldman Sachs cut its US growth rate for 2025 from 2.4% to 1.7%. The Atlanta Fed released an ominous estimate, which concluded that the biggest economy in the world is currently shrinking at the rate of 2.4%.

These forecasts are based on data, both hard and soft. For the time being there is a tangible difference between the two categories, in that hard data, which refers to quantifiable information, such as past figures remained sanguine, whilst soft data, qualitative information, such as surveys, opinions and feedback, are on a souring trajectory. The latest inflation figures are a good example of the former. The US Consumer Price Index rose 2.8% last month less than anticipated with the core reading at 3.1%, also below expectations. Further encouragement came from the labour market as 151,000 jobs were added in February, up from 125,000 jobs the previous month. The rate of unemployment, although ticked up, remained at a respectable 4.1%. The country’s manufacturing sector expanded for the second consecutive month in February after 26 successive months of contraction.

On the soft data side, US consumers are becoming gloomier. Their sentiment, as measured by the University of Michigan deteriorated considerably in March. The index dropped from the February final reading of 64.7 to 57.9 this month, also well under the forecast of 63.1. Inflation expectations of US consumers also worsened. For the next 12 months it is now seen at 4.9%, up from 4.2% in February. Consumer expectations are the harbinger of hard data a month or two later. After all, it is the US consumer who will or will not spend if her mood is buoyant or defeatist. Their view of the immediate future has already shown up in hard data from March. Factory activity in New York State plunged by the most in two years as new orders are falling, and input prices are rising sharply.

It is premature to draw a conclusion on the fortunes of the US economy. The picture will be more transparent by next month, the end of which will mark the first 100 days of the Trump administration in office. The degrading of hard data, the threat of inflation or recession, or worse stagflation will force the administration to implement changes. It will come in one of two forms. The first one is altering policy course, something that at this stage appears implausible as it would be the admission of failure. The second one is manipulation, the idea of which has already been floated. It would be akin to the decision of the US Supreme Court in 1893, in which tomatoes were legally classified as vegetables rather than fruit so import levies could be introduced on them. Only this time it would be called ‘stripping-public-spending-from-GDP-calculation’ and it would also be a not-so-tacit admission of erroneous economic policies. Given the power bestowed upon an unelected member of the Trump administration to cut government spending the nonsensical move should not come as a surprise but, whilst it would make government data attractive on paper, it would not fool investors, just like the Chinese decision to halt publishing youth unemployment figures in August 2023 did not ameliorate the view on the country’s dismal economic prospects.

By any means, soft and hard economic data, or headlines if you will, will remain the salient driving force of sentiment and consequently prices. In today’s interconnected trading environment, the impact on oil prices has been and will be profound. Returning to Goldman Sachs, the bank, assuming further escalation in tariff stand-off, was forced to lower its 2025 Brent price forecast by $5/bbl. Come hell or high water, data will rule.

Overnight Pricing

19 Mar 2025