A Change of Heart and a Change of Fortunes

Words are mightier than fundamentals in our world at present and displayed by the cross-market reaction to a softening of tone by President Trump toward the FED Chair, Jerome Powell. After the last few days of stinging words and verbal thrusts indicating an ability to fire the Chair, another volte-face in the dance of the White House directives is completed by “I have no intention to fire him.” Any dismissal of a FED board member is fraught with legal barriers and in such a high-profile removal of the Chair, the consternation in markets is all too clear to see. A degradation in the role of the Federal Reserve would neuter its independence and all investment participants have been imagining an economy officially run by diktats that are as reliable as the lifespan of a Mayfly. With such an own goal avoided, and reports of US Treasury Secretary Bessent expecting a de-escalation in the tariff standoff with China, markets have reacted in kind with equities leaping and flight vessels such as Gold and US Dollar currency antagonists being sat down.

This particular storm might be over for now, but the uncertainty of footing in world trade and therefore markets, is picked up by the International Monetary Fund. In January the IMF predicted global growth to measure 3.3%, this has been altered down to 2.8 percent for 2025. Importantly, and joining in with similar economic warnings of others, the fund warned inflation would decline more slowly due to tariffs reaching a global figure of 4.3 percent for this year and 3.6 percent for next. Because of the besottedness of what emerges from Washington, this has gone unnoticed, but not for long if another fallout occurs in equities and bearish stories are sought for accompaniment.

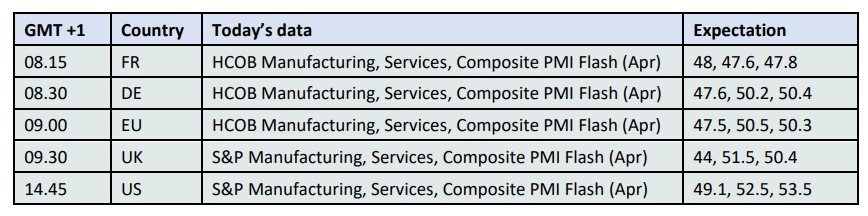

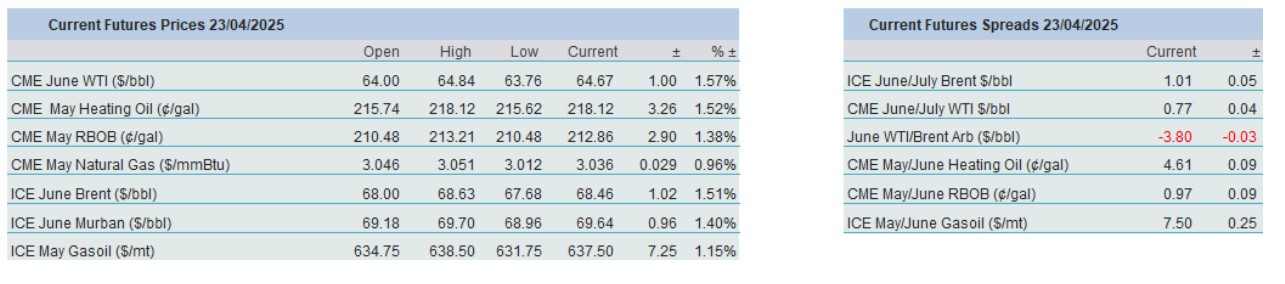

Oil prices are also benefiting from the tail winds of the Trump change of heart. Still, there is a little more meat for would-be bulls to nurture. Japanese Jibun Bank Manufacturing PMI remains in contraction; however, the rest of the readings and Australian S&P PMIs are all in expansion. The APIs are again giving warning of a decreasing level of stock in the US. Crude inventories fell by 4.56mb and the sharpest for some 6 months. With another targeting of Iran with sanctions on an LPG network yesterday, speculation builds that any Iran deal is some way off. Whether or not Vladmir Putin’s offer of halting Russia’s invasion at the current front line will reach receptive ears is anyone’s guess.

US oil will be taking debating space for some time

Following on from yesterday’s detailed analysis of the US EIA’s Annual Energy Outlook 2025, the warnings pertained within are portrayed as vociferously elsewhere. The US in recent history has launched itself into the vanguard of oil industry health and its explosive reach to being the largest global oil producer comes with many acclaims. It now boasts 20 percent of the world’s oil production; 25 percent of the world's gas production having trebled hydrocarbon output in the last 15 years. It still makes for amazing realisation that the US produces more energy stuffs than the second and third highest producers, Saudi Arabia and Russia, combined. This energy feat is music to the ears of the current US Administration who given the chance would ‘TikTok’ a video or make a football terrace chant of “drill, baby, drill.” Imagine J.D. Vance doing the ‘pumping oil jack’ dance, or on second thoughts, maybe not.

However, US President Donald Trump’s promise to export American energy all over the world is about to come against some economic and production opposition. US Crude production is registering at or around 13.5mbpd and while exploration and production companies were laughing all the way to the bank at $80 or even $70/barrel, the current level of $60/barrel for WTI has been largely unforeseen, obviously most unwelcome, but financially prepared for. With corporate consolidation and efficiency drives, Energy Intelligence analysis of 20 large-listed US oil and gas producers shows that their average debt-to-capital ratio fell from around 40 percent in 2019 to 30 percent last year. For all the fiscal discipline and ability to tolerate any sustained period of prices under $60 and possibly $50/barrel, protection of shareholder value might be welcomed by the mighty fund managers of the world, but not necessarily so for forward investment programmes and regional economic well-being. In a localised take and reported via the Houston Public Media outlet, the University of Houston Energy Fellow, Ed Hirs commented that while the combined effect of tariffs and lower oil prices are balancing out, investment is already grinding to a halt, and companies are planning for layoffs in the near future. "The tariffs have backed down GDP and a lot of activity,” he said and went on to warn of decreased activity at the Port of Houston and the follow-on compromising of supporting industries.

Fiscal discipline, according to JP Morgan and cited by Energy Intelligence, could see a production hiatus targeting 50 or 100 oil rigs (500k or 1mbpd) in 2025-2026 if current prices were to continue, and while such a scenario does seem incomprehensible at present, if drillers are enjoying praise for lurching away from spendthrift ways then no way will they sell oil at less than it costs from pulling it from the dirt of South-West United States. Yet, it is not only price which gives cause to believe US production could see a future wane. In an echo chiming with the AEO2025, the Journal of Petroleum Technology warns on an environment of challenges for the future of US production beyond 2030 as it assessed a report from Wood Mackenzie. US global energy dominance is likely to continue for some time, however, it has become a victim of its own success. Indeed, the size of production is so formidable that natural degradation of wells must be constantly offset by over 2mbpd or for perspective, the daily output of Norway. Wood Mackenzie suggest, “additional shale innovation can lower supply costs. Refreshed exploration can help offset overreliance on producing assets. And making the country’s unique upstream fiscal framework even more attractive can help pull in more capital.” Yet one wonders in such a low-price environment, and the once speed bumps that were tariffs but are now tank traps to economic largesse, fits in with investing into such predictions of a plateauing resource.

Such a one would be indeed brave to call an end to American exceptionalism and its extraordinary energy industry success. Yet warnings against complacency in the oil space seem to be coming thick and fast, even with a pro-fossil fuel US President. The Donald’s championing of his country’s oil cause is publicity US drillers could do without and brings focus to energy security around the world in places where oil molecules are scarce and alternative energies seem logical. So-called green energies are not dead, they will just have to be cheaper and smarter. Nor so is the oil industry, it will just have to ride out the current political shockwaves of price suppressiveness. Despite the White House incumbent’s contemplation of meddling with the 25th amendment he will eventually be gone. In the meantime, the described financial hardiness of US energy and production companies will be well tested and will need add fortitude to its formidability.

Overnight Pricing

23 Apr 2025