China is on Holiday but not its Influence

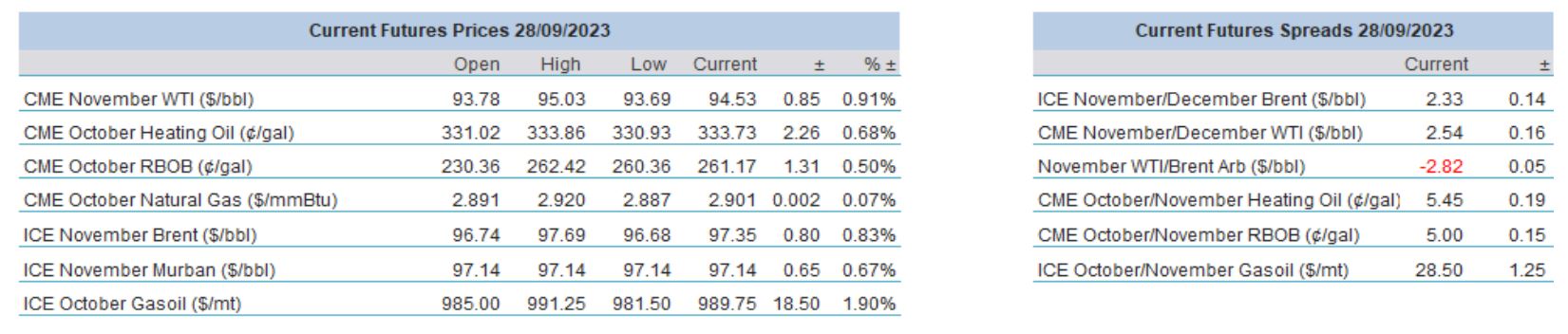

For all the machinations and wild rides experienced last week, the weekly progress made by the oil complex indicates the convoluted environment oil finds itself in at present and while overall the crudes tangoed their way higher with an on/off relationship with distillates, WTI and Brent’s new yearly highs found a rarefied atmosphere and rallies ended up being compromised by the goings on in the wider macro suite. M1 contracts week-on-week saw WTI finishing +$0.76/barrel, Brent +$2.04/barrel largely due to an expiry, Heating Oil +5.60c/gal, RBOB -5.65c/gal and Gasoil +$19/mt. Commitment of traders reports when showing little change become a matter of opinion on sentiment and this week’s are such a time which allows for alignment with how prices performed. CFTC data showed WTI managed length increased by 16.191k lots, Heating Oil by 1.901k lots but RBOB decreasing by 13.220k lots. ICE Brent managed length decreased by 21.989k lots which will be due to the aforementioned expiry. With such a large M1/M2 spread expiry close in Brent at over $3/barrel, the ensuing technical ‘gap’ value will take some time to digest, but for the moment momentum looks set to continue in a similar staccato fashion as oil’s rally survives a quieter weekend news cycle.

Oddly enough, this week will be without any influence from China (apart from today) due to the Autumn Golden Week Festival and as China has not exactly been a boon for bulls of late, speculatively its lately negative influence might just allow for more expression in rallies. Missing the forecast of 51.2, China private Caixin manufacturing purchasing manager’s index decreased to 50.6 which is also lower than last month’s 51.0. The influence of this will be negated by the official PMI released on Saturday showing a 50.2 reading opposed to 49.7 in August. The market should expect little other than the news on volumes of travel which for the most is healthy going into the holiday with Saturday’s passenger travel by rail achieving 20-million trips, a single day record (Reuters).

The unsightly mess within the US legislative bodies has finally sorted itself out and the government shutdown has been avoided although it is only a stopgap bill, and this farrago is likely to be repeated when pressed up against the new deadline of November 17. The United States for ill or good will continues to have outsized impact on global investors as it remains the only growth nation of influence, but warnings are never far away and If the continuance of the high bond yield environment remains unabated, confusing signals will continue with massive bouts of in and outflows that will buffet oil. Oddly, and arguably, the less attractive stocks and bonds become, and the more oil can hold onto a trending rally one wonders if energy will attract more financial tourism.

Will Saudi’s Policy Backfire in China?

Last week, we discussed that a wholesale global shift to green energies is likely to be just too expensive at present, but some individual nations are better equipped for such transition. As we get into the meat of the Golden Week celebration taking place in China, there will be somewhat of a hiatus in news drivers for markets to attend to, with oil participants and watchers likely feeling the pinch of information starvation more keenly than most. Being that future data from China will be much more ‘managed’ (to be polite) is something the oil fraternity and indeed markets in general will have to get used to.

Still, however news flows are produced, garnered, and consumed, China will always be an agitator and an initiator to oil price moves be they positive or negative. The vastness of its refinery capacity and the heavy involvement China has in the production of motor fuels means it has been one of the main benefactors of the recent rise in refiner margin profits. Fuel exports in August, according to customs data, increased to 5.89mmt up some 23% year-on-year. However, this belies what is happening domestically. Last month and quoted on Bloomberg, Ma Yongsheng, the President of Sinopec commented that although run rates would be kept high, internal demand is set to fall away from the year-on-year increase in 1H 2023 of 16.2%, data from China’s National Development and Reform Commission reveals, to 12.9% year-on-year for 2H 2023 in his estimation. Ma also went on to say that China’s demand for gasoline and diesel could peak around 2025.

A peak-fuel prediction of this nature must send shudders through the production cut axis of Saudi and Russia who have contemporarily relied on the Southeast Asian powerhouse as a constant destination for their crudes. What is striking in Ma Yongsheng’s revelations is that he purposely singled out gasoline and diesel as possible laggards, which can only mean his considerations are based upon the ever-increasing EV market in China. As of June 2023, 3.2 million new electric cars were registered in China, constituting a year-on-year increase of 38%. Predictions are now finding unison that this move to EVs will continue with the likes of the Chebai think tank forecasting EV market share will increase domestically to 60% of all new sales by 2025. The International Energy Agency, a cheerleader for alternative energy, is however a little more circumspect and does not see a China oil demand peak until 2030, but the idea of an inflection point remains.

There is an argument that switching to electric cars will only mean a substitution of oil burn in cars to power stations, but China has a unique and peculiar positioning in generation capability. Shunned by much of the world, China bases much of its electrical generation on coal and accounts for 50% of global use. The IEA estimates that China’s coal demand increased by about 5.5% in the first half of 2023 and expects total yearly demand to grow by about 3.5% to 4,679 mmt, with demand from the power sector up 4.5%, which arguably allows for confirmation in higher use from EVs.

China is already crimping crude imports from Saudi Arabia; recent customs data showed the amount to be around 1.3 million barrels per day being the lowest since June 2022. There may be a fleeting alliance between the countries, but China can hardly be happy with the upward manhandling of oil prices. Despite having enormous crude oil reserves, it will still need to carry on ‘topping up’ but it is paying higher prices with a stalled economy and a longevity in financial downturn that will not reverse any time soon. China longs for energy independence, for security of supply; domestically massed produced EVs running on power generated through coal and other alternatives may not be the full answer, but it will certainly solve many of the energy issues faced. Could it be that Saudi has overplayed its hand and pushed China onto an energy path that ultimately takes away the very petro-dollars the Kingdom was trying to create? Posterity will tell, but a surge in EVs within China, will not stay within China for very long for its influence in the region will see other nations following the lead, meaning this bout of Saudi success might just ultimately turn into failure.

Overnight Pricing

02 Oct 2023