China remains antidote to bulls

After improving $3.47/barrel in WTI and $3.28 in Brent to make new highs on Thursday from start of play on Monday, the market is in the process of eroding such hard fought gains and both crudes now sit only some 50c/barrel higher than from the outset of last week. After the US CPI was well received by bulls, aided with protest-inspired closures in Libya and testing towards the vital technical area of the 200-day moving average for both WTI and Brent, a correction ensued and continues today. With El Feel and Sharara now both open as of Saturday according to engineers, the market has lost part of the North African bull prop which has been replaced by Chinese data bear pressure.

At first glance the data looks a little benign and the reaction muted. However, it could be argued that the typhoon in China that has closed the markets and Japan’s holiday might have just stayed the hand of more selling. The Q2/Q1 comparison actually beat its forecast by coming in at +0.8% versus a +0.5%, according to the National Bureau of Statistics. However, the Q2 figure of +6.3% compared with Q2 2022 was below the +7.3% forecast but more worryingly is compared to data conceived during China’s pandemic shutdowns. Retail sales were lower than expected and although the unemployment rate remains steady at 5.2%, youth employment has now reached another new record of 21.3% adding another degree of doubt as to any idea of a Chinese economic recovery.

It is a curious change in the shape of the market and participants’ attitude. China data was always looked forward to with a degree of hope, well for bulls anyway. However, the contemporary economic backdrop for Asia’s driver seems to now be wheeled out for the bears and what is curious and a sign that the PBoC have commodity inflation in mind, is how it kept its main lending MLF rate unchanged. This is hardly the stuff of stimulus and is now causing some analysts to question even China’s conservative 5% 2023 GDP target. What is intriguing for oil is the news again of increased China refiner activity in such a poor demand backdrop. June throughput was 1.6% higher than that of May and makes for an interesting study.

China in the margins

The plight of distillate will become more and more in focus as we creep towards refinery turnarounds. As plants become idled and endure the intricate processes of switching to run more in terms of product that populate the distillate family, end users and traders will be looking for drawdowns in heating oil, jet fuel and diesel to name but a few.

Gasoil in Europe has been upwardly twitchy of late due in part to some refiner outages, particularly in Germany accompanied by the age-old problem of the water levels on the Rhine. A myriad of goods can become stranded in the Rotterdam area, unable to make the journey south which is felt even more keenly by fuel barges. This navigational issue, along with the refiner troubles, are the reasons why Gasoil, counterintuitively in the middle of the gasoline driving season, pulled itself from the worst performing of the 5-major futures contracts to the best. Now, of late the Rhine waters have climbed allowing vessels to pass through troublesome areas such Kaub and its bottleneck and so it logically follows that Gasoil begins to wallow.

Current geographical and meteorological issues aside, one cannot help wondering where the demand for distillate will appear even as we approach the darker seasons in the Northern Hemisphere. There ought to be thoughts of tightness occurring in distillate during refinery turnarounds but what makes predictions unusually tricky is the heavy hand of China interference in refiner margin. We read last week of 3-year high China crude imports into an onshore inventory level that is only 20-million barrels shy of 1-billion barrels. Fortunately for the world there is no imminent likelihood of China entering into a war, so why such a build of feedstock? There is no demand from China’s industry as it limps along at well below post-pandemic expectancy, as portrayed by continued poor manufacturing PMIs, with property only propped by stimuli (or at least the promise of it). Indeed, a takeaway from last month’s World Bank China Economic Update opines China’s ‘growth momentum has slowed since April, indicating that China’s recovery remains fragile and dependent on policy support’.

China has just increased quota to independent refiners by 10%, there are also reports of relaxation in terms of pollution restrictions, is this then a form of policy support? Red-hot running China refiners, fed by a massive strategic crude stock and an eager supplier in Russia, are now then able to compete with and hunt down lucrative refiner margin wherever in the world it occurs. This ability to chase derivative markets that offer greater returns has seen China’s refiners eyeing petrochemicals. With domestic fuel demand tepid at best, and global industry in no hurry to acquire distillate, motor fuels have for some time given poor returns for China’s refiner sector. Therefore, petrochemicals, the arguable driver of oil profits across the world, has been in the sights of South-East Asia’s powerhouse’s malleable and reactive fuel processors.

The plastics market has been a growing alternative as demand has thinned for customary end products such as gasoline and gasoil. What has exacerbated the situation is the domestic switch in China from gasoline to electric cars. Plastics then becomes an obvious target and so much verve has gone into this idea, ICIS reports that 20 new petrochemical plants will open in this year alone. Problematically, the shrink in demand for motor fuels is echoed by plastics as China’s industry does little better than stutter after the travails of COVID-19. The ensuing glut of plastics has found its way onto international markets.

This new stream of product has not exactly landed with finesse. Taking naphtha as a measure for petrochemicals, the recent moves in naphtha’s crack spread will give a warning to other specialist markets blessed with a bankable production margin. The Naphtha NWE Swap Crack has traded from -$2/barrel at the beginning of March 2023 to a recent low last week of -$17/barrel. Admittedly, this is tempered by a recovery to -$14/barrel in line with the rest of the oil complex rally. Of course, the argument that a hike in domestic activity and therefore demand, will disable some of China’s ability to export product, owns merit; but currently, wherever a decent oil derivative margin can be found, sooner or later China product or at least its influence will turn up.

Overnight Pricing

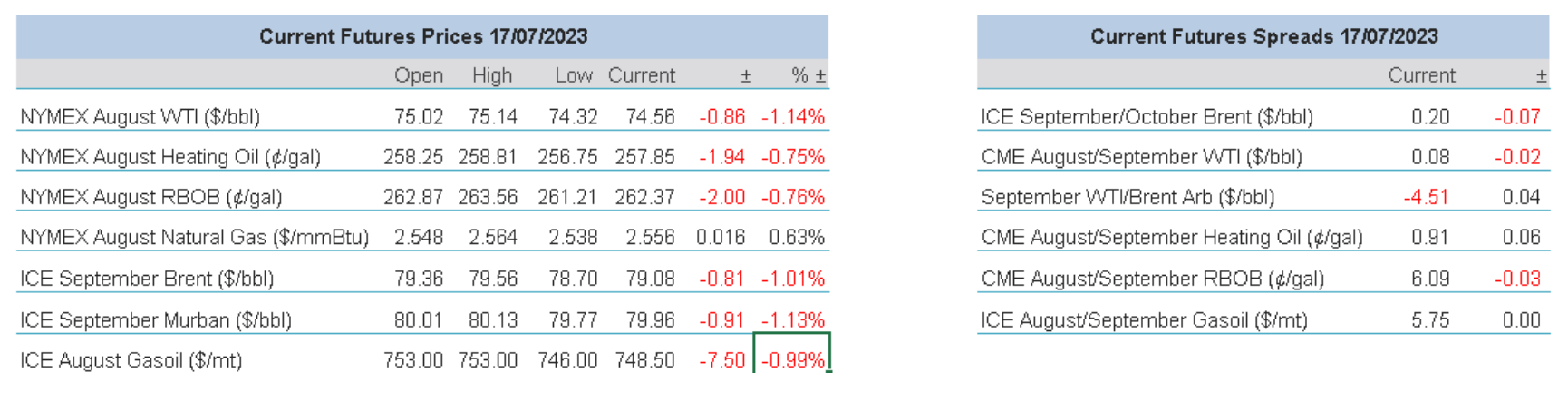

17 Jul 2023