China Serves Oil Prices Poorly as the Market Gaze Ponders US Data

China has yet again sent a shiver through oil market thinking that not even another force majeure in Libya will warm. The declaration on the El-Feel oil field actually gives breathing space for OPEC+ as it appears, in most opinion, to be on the path of bringing shuttered oil back to the market. However, there seems no escaping the black hole gravity of negative thinking around the world's biggest importer of oil. The NBS PMIs published at the weekend were only slightly soothed by a small increase in the private Caixin Manufacturing PMI, but even that is undone when the breakdown of data is pondered.

China has doubled down on reliance of international trade and the only plan for recovery seems to be in exporting its way out of economic doldrums. Yet external demand flounders in the face of a global economy that on the whole is sputtering at best. New export orders are at their lowest since November 2023 with inventories increasing and producers offering discounts. Quoted in the South China Morning Post, Wang Zhe of Caixin said, “considering the government’s ambitious annual economic growth target, the challenges and difficulties in stabilising growth over the coming months will be substantial." The issues in the property sector remain easy pickings for bears and serves up another opportunity to point to the woes of real estate. Hong Kong's New World Development has forecasted a $2.6 billion loss for the first half of 2024 with oversupply and China's ailing consumption listed as reasons.

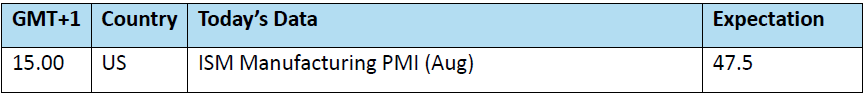

Much of the rest of this week will be taken up by the data surrounding US employment. JOLTs job openings, ADP employment data, jobless claims all lay the path to the Non-Farm Payrolls due on Friday. These are monthly occurrences and nothing new, however, they take on much more poignancy in the light of the recent focus on how that state of the job space will influence the Federal Reserve's thinking. Before that, and another lamp on the path to interest rate easing, will be today's US ISM Manufacturing PMI. The forecast is 47.5, a slight improvement on July's 46.8, but still in contraction. If a poor reading abides, is coupled with possible contained employment data, then it will only be the staunchest of hawks that can deny a rate cut is coming in September.

Who would be a price predictor?

The oil market is taking a cautious approach to anything that might be deemed bullish as the world enters the last month of the third quarter. A quarter that was heralded with being the saviour of the oil year and one in which we have been most assuredly canvassed by positive rhetoric. Yet the stars have not aligned. Gasoline has been decent enough; the US has enjoyed good demand and bulls cast into the mix such positive bedfellows of geopolitical strife and the promise of renewed demand from quantitative easing from the world’s central banks. Yet here we stand, the ‘we’ being the oil fraternity, in increasing confusion. While the US has been a paragon of demand behaviour, it is a struggle to find any such call of equal magnitude in the rest of the centres of global commerce. The stellar backwardation of the crude markets is undone by the contangos of distillates and flat price is mowing a very low cut towards the roots of 2024 lows.

What has become equally stressful is the market’s refusal to consider the lack of oil inventory in the OECD. In a recent opinion piece from Reuters, the Organization for Economic Cooperation and Development now indicates levels at 120 million barrels or 4% below the ten-year average. This chimes somewhat with the EIA US Inventory Report last week showing crude stocks at -3.7% to the five-year average, bearing in mind the large part the US is in the makeup of OECD data. Whatever draws might be on US and OECD oil stock levels, a consequence of the program of OPEC+ voluntary cuts, they do not seem to be giving the pep to prices one might have imagined. This apparent lack of price performance in the face of OECD inventory shortfalls is picked up by Petroleum Intelligence Weekly. PIW recognises the OECD draws, but its data sees global commercial crude stocks rising by 160 million barrels for 2024 with China dropping some 440kbpd into storage. The respected industry publication observes challenges to oil balances with the complications of oil storage measurement. It points to the possibility of missing data, overstated demand or supply and the considerably arduous task of tracking inventory in China. It also observes global refiners only processing 200kbpd more than a year ago, which if measured against demand forecasts should be nowhere near enough, yet rising global product stock and sinking margin due to moves away from industrial diesel are hampering forecasting.

Those that shoulder the responsibility of collating data and publishing forecast around them will find their reports subject to much more scrutiny as we enter the back part of 2024. The IEA has been something of a flag-waving bear and will embark on some rather important publications that should make for fascinating shared analysis. In October it will print its World Energy Outlook for 2024 which it grandly describes as ‘the most authoritative global source of energy analysis and projects’. Before that comes its Oil Market Report next week, which will give an opportunity for a side-by-side comparison with OPEC’s Monthly Oil Market Report. Even though some accord was found last month as they agreed, with varying extents, on China’s demand woes, oil watchers await with expectation of more confusion. The biggest predictable will be divergence and the usual assumption that each has bias. But agreement is hard to find anywhere. BP and Exxon cannot agree on future oil demand, Wall St banks spin price divination faster than Spiderman spins webs and the data holes that Petroleum Intelligence Weekly points to, will make price prediction a precarious pastime. The way forward is muddied and will only be more occluded by macro machinations. Therefore, data, opinion and how they are collated will be pored over in the vain hope of clarity. If 2024 so far is anything to be judged by, such transparency is likely to remain elusive.

Overnight Pricing

03 Sep 2024