China Shapes the Mood, Israel’s Pragmatism Accelerates it

Yet again China comes to the aid of bears and embarks on a three-pronged attack on the high oil prices registered due to Middle East war premium. Not just happy with an inconclusive Ministry of Commerce Saturday announcement of, well, not very much in terms of stimulus, the Southeast Asia giant posted yet another bout of inflation data the keeps it firmly rooted in deflationary territory. The final part of the triumvirate of disappointment came via a third-party source. Yesterday, in its Monthly Oil Market Report, OPEC for the third-straight month revised down its global demand forecasts for both 2024 and 2025. Staying with 2024, which is the price sensitive part of the downgrade, oil demand growth was reduced to 1.93mbpd from 2.03mbpd of last month and the outstanding contributor was indeed China seeing this year's demand forecast trimmed to 580kbpd from 650kbpd in September. Dwelling on how construction and economic activity had subdued diesel and the rise of LNG (touched on below) as a replacement in some quarters, the negative revision could hardly be avoided and while it is far from the much lower IEA 2024 demand growth forecast of 900kbpd, the run of lower adjustments is something of an admission of wishful thinking.

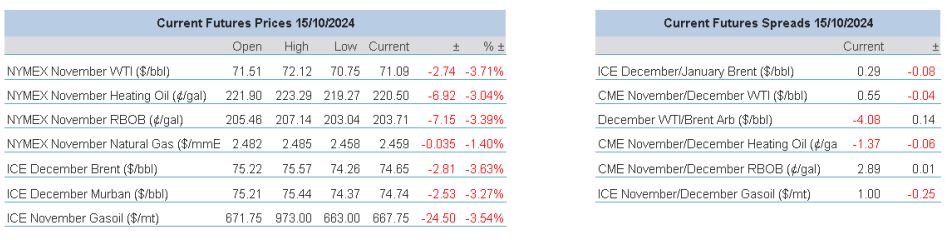

The lower prices seen into yesterday's settlement have accelerated again this morning due to a late piece reported widely from the Washington Post. According to various media, and quoting the Post, Benjamin Netanyahu had told the US that Israel was prepared to attack military, rather than nuclear or oil installations in Iran. Whether or not the statement, is indeed verified and true, does not necessarily mean that Israel will not once again use appeasing language while continuing to operate in the opposite. Still, the report is enough to put Brent prices back down to October 3 levels, when Iran sent the barrage of missiles into Israel. The next moves will hinge on whether the market believes this new conciliatory political speak, and if it does and sees Israel behaving in accordance with it, this will not be the end of lower prices.

LNG is all aglow

Ever since the Russian invasion into the Ukraine the world has undergone a ‘gas’ shock that it really has not recovered from. Losing the ready cheap source of fuel by Europe has arguably been the root of all its economic travails and none more defined than the abject and alarming performance in Germany. There can also be little doubt that some of the success enjoyed by the economy of the United States is because of its insulation from rocketing gas prices and the costs involved in converting Europe’s infrastructure to receive other sources of energy. According to the Shell LNG Outlook for 2024, global demand for liquefied natural gas (LNG) is estimated to rise by more than 50% by 2040, as industrial coal-to-gas switching gathers pace in China and South Asian and South-east Asian countries use more LNG to support their economic growth. In China it is not just heavy industry that is in the process of transferring reliance from coal to LNG, it is evident in road transportation. According to Wood Mackenzie, there was a rapid rise in the sales of LNG trucks in 2023. The gas-powered vehicles accounted for just 10% of heavy-duty trucks in the early part of last year only to significantly increase to 30% of sales by its end.

An increasing belief is emerging that LNG deliveries when purchased over term deals might just be more reliable than long-distance ones in pipelines. Gas routes that transit many countries before final destination are subject to localised political intrigue and in current climes possible conflict. Energy transitional policies in a vast array of countries can only work when there is a secure back up to green energies in times of power generation crisis. LNG, therefore, is becoming increasingly favourable to inter-country pipelines. Import capacity for the liquified fuel in 2023 through either floating storage of regasification units increased the most in Europe and Asia says the EIA. Using data from the International Group of Liquefied Natural Gas Importers (GIIGNL), global LNG import capacity is set to expand by 16%, or 23 billion cubic feet per day (Bcf/d), by the end of 2024 compared with 2022.

The rise of the LNG market is not lost on Russia. Clearly the loss of Europe as its biggest energy client leaves it looking for homes for its vast reserves of gas to find. There was a recent disappointment to such intent when Mongolia did not include the Power of Siberia-2, a proposed avenue for gas across its land, in its long-term action program which normally lasts four years. Dismayed but never cowed, Russia, along with the rest of the world’s hydrocarbon producing countries, will now look to get its gas to sea. According to Energy Intelligence, Gazprom have recently offered a draft strategy outlining the possibility in which Russian LNG exports increase to 183Bcm by 2036, to 245Bcm by 2050 from a start point of only 42Bcm last year. The trouble is that none of these high-vaulting aspirations factor in the damaging restrictions of sanctions. It is not necessarily the LNG itself, but the technologies and hardware involved in production and export that Russia will not be able to buy on the open market.

LNG is increasing in its role of energy security across the major centres of global trade. There is much for the green lobby to bemoan about LNG as its carbon emissions are, according to UK Government data, three-quarters higher than that of piped natural gas. Which is intriguing, for the new Labour government in the UK has promised to withdraw new North Sea licenses across oil and gas and unless a green bunny is pulled from the power generation hat, there might just be trouble ahead, or indeed, more ironical LNG imports. Over the coming decade there are predictions of falling domestic output from Southeast Asia, which is not political, but caused by natural degradation. The rise of LNG, in the face of global strife and geological exhaustion means it is likely to become the baseload supply source for not just Europe but for many other industrial economies reliant on gas-burning industries and now indeed transport. The knock-on effects in the energy puzzle, green ambitions and oil prices will be a fascinating watch for us all.

Overnight Pricing

15 Oct 2024