Churn and Churn Again

We are greeted with a rather sedate entry into the trading day this morning and there is little wonder why. If oil prices can hold onto the current gains, it will be the first week in 8 to register a positive outcome, but whatever the conclusion to prices might be as of tonight’s close, unless one had experienced exposure to a market that in 1-week is likely to have stopped out both longs and shorts, only a cursory study would suggest logic is at play as a dovish FED pivot and a small increased revision in agency short-term demand is easily explained away. However, Brent lost ~$4.5/barrel Tuesday high to Wednesday low and reversed ~$5/barrel Wednesday low to Thursday high leaving those in the oil fraternity with shredded nerves.

There is still so much to absorb including a technical picture that has also been tipping bullish/bearish with an all-important 200-week moving average to consider at the close and yet the fundamental drivers keep coming plying our market with more rabbit holes to let minds disappear into. A hiatus might just ensue today for there is more China data out this morning which has been greeted with little reaction from oil prices so far.

November data shows House Price Index -0.2% against Octobers -0.1%; Fixed Asset Investment 2.9% versus a 3% call; Industrial Production 6.6% versus a 5.6% call; Retail Sales 10.1% versus a 12.5% call and finally an Unemployment Rate of 5% which is unchanged. It is difficult to say whether our market is punch-drunk after this week’s swings, or it is just becoming blasé to poor China data, but to sum up the data, Bloomberg quote Louis Kuijs, chief economist for APAC at S&P as saying ‘it is very hard to see the economy growing significantly […] more needs to be done apparently (presumably referring to the lack of stimulus seen from the CEWC earlier this week), just looking at how dire the situation is’. If the market boxes itself into being a quiet day, there might just be some sighs of relief going into the weekend.

GMT | Country | Today’s data | Expectation |

08.15-09.00 | FR, DE, EUR | HCOB Manufacturing PMI | 43.3, 43.2, 44.6 |

09.30 | UK | S&P/CIPS Manufacturing PMI | 47.5 |

14.15 | US | Industrial Production MoM (NOV) | 0.3% |

14.45 | US | S&P Manufacturing PMI | 49.3 |

Thank you for the pivot, but can you sort the rest too?

The future of oil prices and their predictions were hardly made clearer by the press conference that followed the US Federal Open Market Committee (FOMC) rate decision on Wednesday. Given a predilection by markets (oil being sometimes more guilty) of trading forward thinking in present market values, the US central bank’s outlook for the path of interest rates, or ‘dot plot’, indicating that by the end of calendar 2024 interest rates should fall to 4.6%, close to 1-whole basis-point from the current 5.5%, has given rise to not only a future notions of an easing US Dollar but a cheaper lending landscape for those that participate in financial risk. As fine and dandy as this all seems, a very much gentle easing of commodity finance costs serves to put the brakes on what has been an almost daily fall across the oil-scape and will even encourage some relief rallies, but this important and largely unforeseen turn of events is not the silver bullet that can be shot at and down the negative influences that surround oil.

In yesterday’s report it was pointed out how the divergence in forecasting by OPEC and the EIA is sharply increasing, and using 2024 Global Demand as the example, the EIA estimate of 102.34mbpd is 2.02mpbd lower than that of OPEC’s 104.36mbpd. But what will both bother OPEC and oil’s proclivity in fraternity to trade from the long side is the IEA’s publishing a day later of its own Global Demand of 102.78mbpd, therefore the 2 alternatives continue to adopt a much more conservative outlook than OPEC’s. What will definitely keep the IEA on OPEC’s naughty list, referring to the recent spats, is the Paris agency’s continued dim view with regard to growth, ‘evidence of a slowdown in demand is mounting, with the pace of expansion set to ease from 2.8mbpd in 3Q23 to 1.9mbpd in 4Q23 […] consumption growth is expected to ease significantly in 2024 to 1.1mbpd’, with the latter being half of what it was in 2023. Interestingly, the IEA refers to how high interest rates’ deleterious effects have harmed growth momentum and while the FOMC’s seeming dovish pivot at first glance might allay this, the actual reduction in rates will be less than 1% over the year, if at all, and if high interest rates took such time to bear influence, the opposite is then true of lower rates.

Gasoline has always been a barometer of demand within the United States due to the love affair most Americans have with cars and how they can express consumer confidence in miles driven, but gasoline at present is out of season, out of demand and out of the reckoning in terms of influence on refiner margin. During the post-summer quest to run US refiners at red-hot status, in the main, to build distillate stocks as the world tried to winter-proof itself and in the case of Europe, Russia-proof its Gasoil needs, one of the by-products was an over-supply of winter grade gasoline. One only need glance at the RBOB/WTI M1 futures crack from August this year when it collapsed from $42/barrel to $7/barrel in October. Sacrificing gasoline, and it has been so sacrificed trading under 200c/gallon not seen since December 2021, knowing that a financial shortfall would be well covered by the processing profits of producing Heating Oil and its like seems a decent fiscal judgement.

However, the margin malaise faced by gasoline is now being mirrored in distillate as showcased by the Heating Oil/WTI M1 futures crack reclining by $20/barrel this quarter. According to Oil Price Information Service (OPIS), the fourth quarter move lower is weather related and distillate margins in general have weakened such that they now appear on the verge of collapse, the note went on to say that refiners running light-sweet crude cannot turn a profit, capacity is 500kpd higher than a year ago whereas input is down 600kbpd against the same period, with the inevitable outcome that refiners will start reducing runs. Processors reducing run rates in front of a turnaround period signals a period of crude inventory builds.

This morning and according to the National Bureau of Statistics (NBS) via Reuters, refinery run cuts are not the sole remit of the US. Although run rates were a little higher than last year the month-on-month October/November data shows a decrease from 15.05mpbd equivalent to 14.48mbpd. Plotted lower interest rates on a perceived chart is welcome relief to the world in general, however, and as argued here, there are still many, many reasons to be cautious if one is in the mind to call a bottom in oil prices.

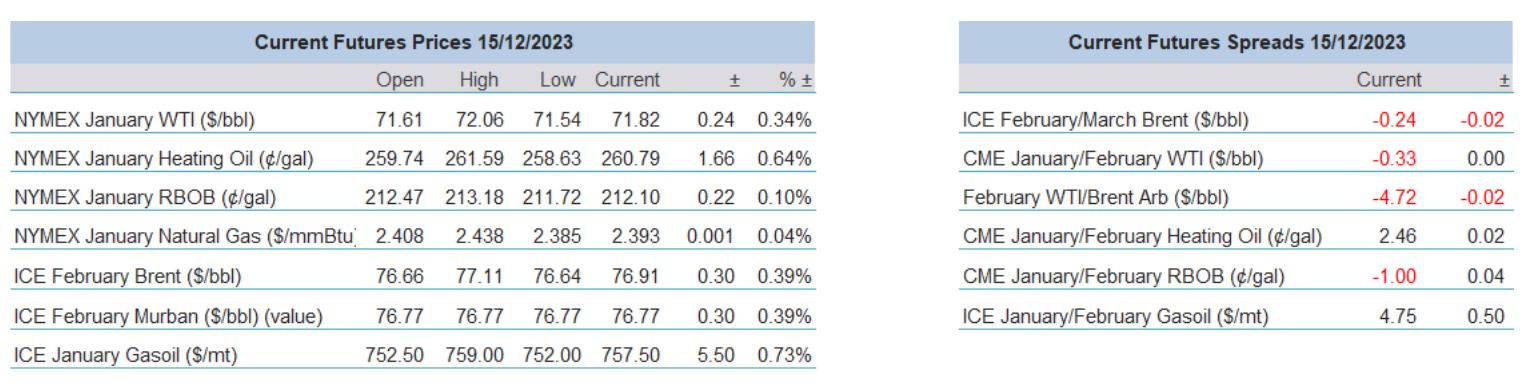

Overnight Pricing

15 Dec 2023