Cometh the Moment, Cometh the Man

Well, here we are. The man of the hour, Jerome Powell, Federal Reserve Bank Chair, will climb the dais of monetary power later today at the Jackson Hole Symposium with the weight of the world's economic fortune on his shoulders. There probably has not been a more anticipated speech in the recent annals of central banking. One wonders whether his usual conservatism and stoicism, be it in policy or public image, will be enough to quieten the disgruntled swelling of opinion that the Fed has missed important employment signals (alluded to below). Such a revision in the now press-blazoned payroll data is at the forefront of analysts' minds and whether the US is about to see a change of fortune. There are always doomsayers, and time will tell whether the FED is late in reaction, ultimately having to scramble to save a soft-landing as the alternative is a sharp decline into a mini recession. Hence the importance of the words chosen today. Alluding to a quarter point cut in September is something already priced in and will receive a lukewarm reaction. But a double-decker half point percentage cut goes against how the FED wishes to manage a controlled move away from tightening. Mr Powell's task today is an unenviable one.

Elsewhere and continuing in the hard decisions of central bankers, BoJ's Governor Kazuo Ueda has publicly wrestled on how and when it might be appropriate to raise interest rates. Bearing in mind the perceived effect of higher Japanese interest rates had on markets at the start of the month, the outward show of controlled intent is understandable. This all leaves oil prices bemused. The reprieve of yesterday feels akin to relief rather than any great sentiment or fundamental shift. However, the state of manufacturing as seen in Europe and the United States is still one of contraction and once again, it is to the services sectors that growth is found. Oil has many micro influences including whether or not OPEC+ can bring more oil back into such unhealthy prices, how and if ceasefire talks will stay the hand of an Iran attack into Israel and whether refiners can expect anything of demand from distillates as the seasons change. But none can outstrip what might be said in Wyoming and our market along with every other port of investment will hang onto the macro-importance of what intention the US Central Bank will pursue.

Employment storms its way back into things that matter

The Current Employment Statistics (CES) is a program within the US Bureau of Labor Statistics (BLS) detailing the nonfarm employment, hours and salaries of workers on payrolls. The data is gathered from the 50 states, the District of Columbia, Puerto Rico, the Virgin Islands and about 450 metropolitan areas and divisions, according to the Bureau’s website. The data is compiled using a sampling of 629,000 workplaces of 119,000 business and government departments/organisations. Any survey is a basically a prediction and needs to be brought back into line with hard data. When this occurs with the CES data, this is known as the Payroll Benchmark. Annually, when updated information from tax returns, unemployment insurance, current population surveys and labour force statistics are added then the revision is announced. Collating such data is a huge task bearing in mind the US civilian labour force totals just under 170 million according to the BLS, therefore, when the Benchmark Revision is finally produced in August it is awaited with much interest.

This is particularly true of current times, when the sensitivity of employment is one of the mainstays of how the Federal Reserve judges the current plight of the US economy and any dangers to inflation because of upward payroll pressure. There has been an inherent belief in the strength of US employment and that such worry that there may be, has been focused on the strength in the workspace. Such an attitude was displayed in July when the unemployment rate was posted. Having understandably been put in the in-box of things not to worry about as post-pandemic readings have been mainly posting decently under 4%, when May 2024 touched 4% and June 2024, 4.1% they were largely ignored. Indeed, the July reading of 4.3% (not seen since October 2021) was dismissed as a temporary anomaly due to Hurricane Beryl barrelling through Houston and the surrounding area disrupting temporary unemployment and data. But it was hard to dismiss the Non-Farm Payrolls July number of an increase of 114,000 positions against a 175,000 forecast which in many ways was the catalyst of the following Monday Madness and the meltdown in the Nikkei that went global.

The revision estimates that came before the actual publication on Wednesday topped out at a negative 500,000 payroll losses, therefore the actual reading of 818,000 less jobs in the economy than estimated is a dent to the state of the US economy. The downward reading of the net job gains is the lowest since 2009 and will bring increased worry that the job space is weakening too quickly, which is backed up by the above outlined rise in unemployment. Blame may be levelled at the BLS for erroneous surveys but there can be little doubt that the FED has overestimated the strength in the labour market and may now be faced with a decision of being more aggressive in easing than it might have wanted. There is also the issue that once unemployment begins a trend, either way, it normally holds onto it for quite some time.

The wider macroeconomic suite is now growing in expectation of a FED cut that could very well run to 50-basis points. Equities, bonds and their like will find willing buyers in expectation, despite what Jerome Powell at the Jackson Hole Symposium might say today in a speech that the global investment community will hang on to, even those that must stay up late. The FED Chair is unlikely to move away from how the FOMC minutes of July that signpost a cut to rates in September, but whether not he dares express an accelerated one is debatable. The US remains the expansionist economy, its progress is singularly the most important driver in the world. Yet, there is a question now, and because of the unemployment Benchmark, that a broader cut is no longer defensive against inflation but is progressive for jobs. The weak payrolls in July, the rise of unemployment, shorter working hours and wages point to such a consideration. The cut in interest rates will keep the US Dollar cowed and ought to be a riser for dollar-based commodities. However, as much as a currency shift is welcomed, a softer employment scenario in the United States will prove hard to align with a situation of increasing oil demand.

Overnight Pricing

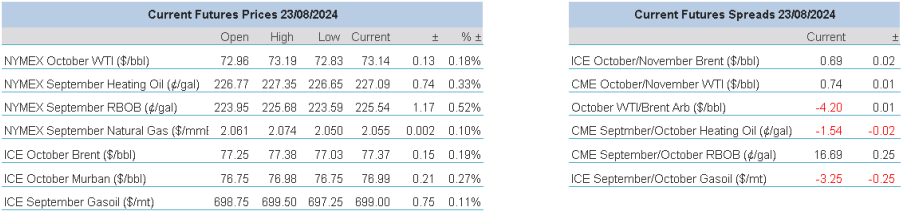

23 Aug 2024