Competing Drivers and Uncertainty Keeps Enthusiasm Contained

Having clawed their way back into something akin to a recovery after last week's shellacking, well at least for the moment, oil prices are yet again showing signs of captured behaviour with bulls and bears struggling to make a great case out of the mishmash of news that might be considered price drivers. It comes to something when the most pertinent of news available is the API inventory, which in normal circumstances have a few hours of relevance before the EIA/DOE numbers come in and trump them half a day later. The American Petroleum Institute's data offer little surprises given the thaw of US crude infrastructure, the BP Whiting outage and a general sense that distillate is finding a bid after the Ukrainian instilled damage to Russian Black Sea production.

Crude built by 0.7mb against a 1.9mb build call, Distillate drew by 3.7mb versus a -1.0mb call, Gasoline +3.7mb versus a +0.1mb call and Cushing +0.5mb versus a TankWatch call of +0.73mb. The smaller than expected Crude build and the greater Distillate draw is enough to keep bulls interested, but arguably the biggest kicker came from the EIA, which yesterday cut its outlook for US 2024 oil output growth by 120kbpd. While the figure itself does not inspire a collective gasp, the fact last year's output growth was a call of increase to the tune of 1.02mbpd, the idea of ever-increasing US production has suddenly felt a tug on the reins.

Meanwhile, there is no news from Anthony Blinken, the US Secretary of State, on the state of a ceasefire plan in his fourth visit to the Middle East since the attacks of 7 October. Allied with Qatar and Egypt, the US continues to broker a way through intransigent and emotional issues and all the while oil market participants continue to count missile trading in the Red Sea and weigh them up against what will happen to price if a ceasefire is found to stick. This is all comes at time during the 'roll period' in which financial funds that follow mechanism such as, and amongst others, the S&P GSCI or BCOM (not always) move positions forward adding to odd price movements and giving more reasons for would-be oil speculators to stay away.

Oil’s future to enjoy an Indian summer

It is fair to say that the bright spark tag of the global economy has solely been the remit of the United States. Its resilience has been recently highlighted by the expectation-busting increased employment, as seen in the non-farm payrolls, and a yet again increase in Institute for Supply Management (ISM) services PMI. Yet, for all these indicators of growth and a rampant stock market, fuelled by interest rate expectation and AI, it does not follow that any increase in oil demand will not be comfortably dealt with by the record 13mbpd crude production, although seasonal product tightness can never be ruled out. The economic travails of China have been much discussed with a likely crimping of requirement from the world’s second largest economy and biggest importer of oil, leaving the question to be begged as to where will the next cycle of large demand come from?

In its recent 2024 outlooks, the International Monetary Fund (IMF), records that the population of India at 1.441 billion officially outstrips that of China’s 1.410 billion and that the sub-continent’s projected Real GDP will beat its Asia economic rival by 6.5% versus 4.6%, while also observing that India is poised to be one of the fastest growing economies in coming years. This is taken up by Deloitte, forecasting GDP in 2024 to be at or around 7% and comments on the robustness of the industry sector and qualifies their positive outlook by offering a belief in that momentum will be strong as the world recovers in 2024 with India seeing much broader economic growth.

India faces an election in 2024, which must be held no later than May, but unlike the uncertainty around votes in other large trading countries, the process should be a stable affair with Narendra Modi’s ruling Bharatiya Janata Party (BJP) full of confidence as the National Democratic Alliance looks to win over 400 of 543 possible seats with the incumbent Prime Minster already referring to his third term. Last week, in the interim budget, Finance Minister Nirmala Sitharaman echoed such confidence in a ‘time of nectar’ announcing investment in travel infrastructure such as railways, airports and reforms that will enable long-term growth and, according to Reuters, claiming to have simplified tax laws, poured money into new ports and roads eventually announcing an 11% increase to spending of $134 billion.

The Bombay Stock Exchange Sensex index is trading at 72,000 up 100% in 5 years and up 20% from last year, and quoting the Financial Times, the surging stock market is fuelling a rush of initial public offerings (IPO) with strong demand from foreign investors, citing Dealogic data showing 21 IPOs raising $678 million in January compared with only $17 million a year ago. With government modernisation plans such as digitisation very much underway, India has opened itself up for business and is becoming very attractive to investors in search of stable but unfulfilled growth.

According to the Ministry of Petroleum & Natural Gas, in the financial year April-March 2021/2022, India consumed 201mmt of refined products, in 2022-2023, 223mmt and April-December 2023, 172mmt and with 3-months still to register that consumption looks set to be at the least steady with crude imports also stable at 4.65mbpd in 2023, and according to Reuters, up 2% from the previous year. Prime Minister Modi, while speaking at India Energy Week, announced a 5-year investment plan of $67 billion into the energy sector with particular focus on bringing a rise in natural gas consumption that currently only makes up 6% of the energy mix, increasing it to 15% according to the Economic Times. What should have all our oily ears pricked and be a salve for all that is thrown at fossil fuel thinking from the green agenda, is Modi’s highlighting that India’s oil demand will double by 2045.

On Monday, while addressing Parliament, he (Modi) said "I say with confidence that in our third term, India will become the third largest economy in the world. This is Modi's guarantee”, which is some promise bearing in mind India’s current fifth position, but it does allude to the growing positivity that seems to emanate from India where in January domestic consumer confidence improved to a score of 66.5 which is the highest of 29 countries that measure using Ipsos PSCI (Primary Consumer Sentiment Index), with only 12 other nations achieving a positive sentiment score above 50. India at current levels is not a panacea for all that is wrong with global oil demand, indeed, the latest IEA monthly report says that China will still contribute 57% to the global oil growth demand in 2024 whilst India’s share will be 14%, although the former is probably over, and the latter underestimated.

But given the underlying will to grow the economy, the modernisation to achieve it and a democratic, stable government that is actively investing and investor-friendly that also includes energy/oil, maybe, just maybe India will match all of this promise and bring cheer to those of us who do not think the global oil story is anywhere near over.

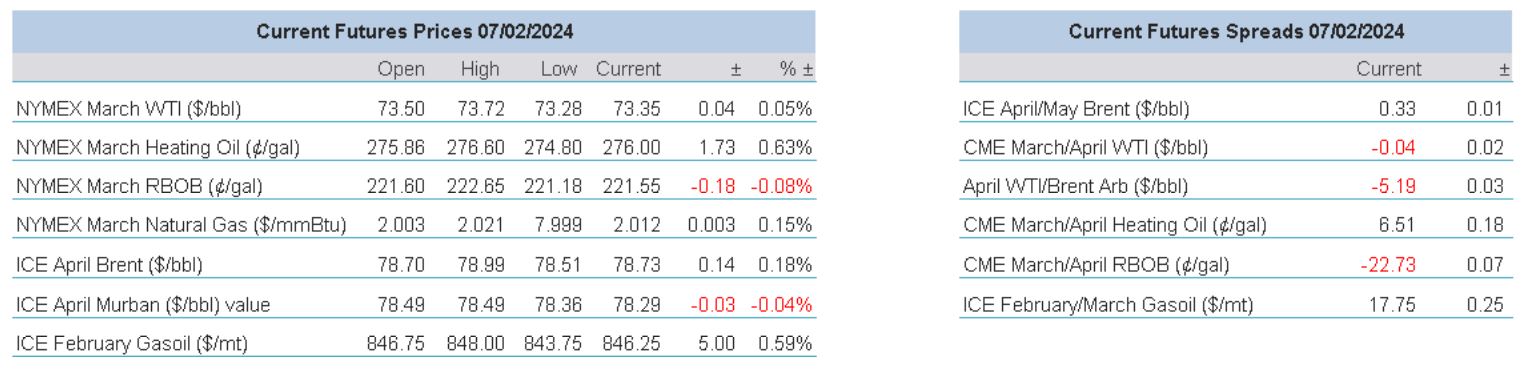

Overnight Pricing

© 2024 PVM Oil Associates Ltd

07 Feb 2024