Data, Politics and War

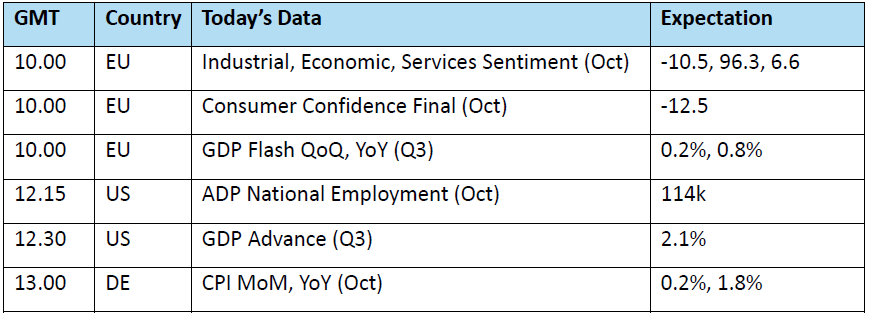

We endeavour to take a look at the mooted stimulus from China below, but whether or not the event actually finds fruition may have just been given another pressure. The EU has increased tariffs on Chinese EVs, taking effect from today and lasting five years. The injurious subsidisation, so said, by the China's government for manufacturers, and after a long investigation led by Ursula von der Leyen, the EU has taken stiff measures and China's bourses are once again fading after the recent rally due to various forms of fiscal intervention. Trade wars can only ever be bearish; therefore, it is convenient that the performance of Alphabet/Google taking the Nasdaq to a new record high, dulls what might have been more of a global fallout. Markets await the results of Microsoft and Meta today and many commentators warn that unless something akin to Google's performance are revealed there might just be a bout of profit taking. Indeed, markets today are overridden with data. With French, German, EU and US GDPs, German CPI, EU sentiment markers and US ADP employment, there is little wonder when also faced with the US election next week, haven is sought in Gold which once again makes a new all-time high.

Oil prices have a found a little favour from the API data overnight. Crude stocks drew by 0.6mb against an expectation of a 2.2mb build. The paradox of the Middle East continues. Yesterday, there seemed an endeavour in which Hezbollah was seeking a truce with Israel, but a wave of missiles was sent into Israel overnight. With such macro drivers as listed above, the US election, duplicitous behaviour as always in the Middle East, oil market participants have every right to be edgy.

When will China stimulate the oil sector?

China dangled the carrot of stimulus in front of market sentiment yesterday and although there have been a few nibbles at the bait, the reaction by-in-large is underwhelming. Which distinctly matches China’s piecemeal efforts to trigger any sort of financial movement within its borders. Yet it is a massive number, and one that might indeed be a cake-topping cherry to all the recent efforts of fiscal loosening. Reuters sources have revealed the Standing Committee of the National People’s Congress is considering issuing sovereign and local government bonds to the value of CNY10 trillion ($1.2 trillion) over the next two years, greatly increasing the debt to GDP ratio. There are warnings that such a capital injection has not been finalised yet, and that the decision will not be forthcoming until the early part of November. With such vagueness of when the monies might be announced, the reticence from markets is rightly understandable. The decision on when and whether to allow largesse of this magnitude must be influenced by the outcome of the US election. If the anti-China rhetoric often deployed by Donald Trump manifests into reality, China it seems is endeavouring to Donald-proof its future. Political considerations aside, the oil industry of China is in dire need of a kicker and although a Trump administration will be unfavourable, demand domestically must be ignited somehow and stop the daily rolling news of oil industry doom.

PetroChina and its ambassador role of the fortune in how China’s oil industry fares, took something of a knock yesterday in unfortunate coincidence with the stimulus leak. Third quarter profits at just under CNY44 billion is lower when compared with the same period of last year at CNY46.4 billion. Decarbonisation, domestic inertia and a so far derisory influence from stimulus have provided tough trading conditions particularly from the refining sector. The results come hot foot following the news on Monday that the state-owned oil company is to close the massive Dalian Petrochemical plant in Dalian, North China. With push-through at 410kbpd and representing 3% of China’s total output, eyebrows should be raised. While the decision had already been made to move the refinery away from the general populace of the city, the sudden decision to shutter it next year can only be inspired by how oil processing now and in the future is regarded. This is outlined by PetroChina’s stalling of investing in the 200kbpd replacement for the Dalian plant on the island of Changxing, according to Reuters.

PetroChina’s refining fate is hardly surprising considering the poor data associated with China’s refinery output of late. September’s crude runs of 14.29mbpd were 5.4% lower than that of September 2023, with January to September of this year being 1.6% down on the same period of last year. Oilchem, the Chinese consultancy, paints an even bleaker picture for smaller independent plants. It calculated in late September that the minor processors of Shandong were operating at just 53.5% of capacity. This is dramatically proven by Diesel exports in September being half of those of August and, indeed, 71% below that of September 2023. The pattern is set to continue. Secondary sources using Oilchem data reveal that China will cut refined fuel exports by over 12% in November. Unsurprisingly, Bloomberg calculates apparent oil demand (crude processed plus refined oil imports) fell in September by 6.98% year-on-year. Trump-proofing China’s economy might well be the main reason for the supposed stimulus outlined above. However, if it is yet again a disposable promissory note, only valid for the time it wanders across the financial wires, it is difficult to see where the imprisoned fate of China’s massive refinery sector will find an escape or other inspiration.

Overnight Pricing

30 Oct 2024