Dissention and Double Standards

Concurrent, competing and cancelling-out events are compelling investors to slowly holster their investment guns as the end of the year approaches. There is little shock in how the Federal Open Market Committee shaved a quarter of a point from interest rates in the United States and as predicted it was not a wholly unanimous outcome. There were three dissents in the end, two for holding rates and one for a ‘double’ cut. Where differences were more quietly aired came in the form of the Fed’s quarterly projections. As seen in the Wall Street Journal, nineteen Fed officials wrote down where they believe interest rates should be at the end of the year; twelve agreed with the setting, one believed it should be lower, but tellingly, six members thought it should be higher. Dissention is growing within the Fed and if President Trump believes it will be a simple case of gerrymandering whosoever he wishes onto the board as Chair to achieve his goal of an American economy enjoying cheap money, he has not reckoned with nearly a third of his economy keepers opting for a more reserved approach. There is also expectation of only one 25-basis point cut for 2026 even though the Fed sees a strong economic outlook which even with the departure of Jerome Powell, the White House frustration with its central bank will not abate.

As for the oil market it is acting out a slow death in price action. The boarding of a Venezuelan vessel by the US Coastguard and members of its law-enforcement agencies ought to have caused more than an overnight spike in prices. But one vindictive action brought on by the spite shown toward Caraccas by Washington under the guise of sanction enforcement, is not enough to quell the narrative of a market that just has too much oil on the water. Something of which might be portrayed in the IEA and OPEC monthly reports due today. Equity opinion seems untroubled by the Fed decision, it will always find a bull case, but the disappointing earnings at Oracle which saw its stock melt by over 10 percent after hours causing a risk-off wave across the investment suite, is not entitled to bring down oil prices unless the market believes that any Venezuelan crude is easily substituted. A cynical move by this Administration calls for a cynical question from our market. If sanctions are being enforced, when will the boarding of Russian ships begin? That would not see a rally petering out after just twelve hours.

The National Security Strategy writing is on the wall

The plight of peace talks, if that is what they can be called, to end the meat grinder in Ukraine is about to give a severe dose of double jeopardy. The fate of Ukraine may well be the kicker instilling an Uncle Sam walk-away from not just Europe’s Easterly flank, but from the Old Continent itself. The current US President has rarely shown much affection toward Europe but his frustration and almost enmity has reached palpable proportions and with his new sense of emboldenment, born out of never being really challenged, his vitriol toward Brussels and Strasbourg has reached bilious levels. While Keir Starmer, Friedrich Merz and Emmanuel Marcon the respective government heads of the UK, France and Germany clapped their collective arms around the beleaguered Ukrainian President, Volodymyr Zelenskyy, in an act of visual solidarity, even the most politically ignorant would beg the question on where a certain Donald J. Trump was in this barely passable ‘Insta’ moment.

The Donald was far too busy lambasting Europe and the Ukraine which came hotfoot on the release of the Trump Administration’s National Security Strategy. It is not the remit of an oil missive to pull apart such an official putdown of an entire continent but look beyond the warnings on a “stark prospect of civilisational erasure”, into a policy that must contain, at minimum, an insight into the current state of geo-negotiations and what that might mean for oil supply. One snippet of the strategy document resounds with many of us charged with conducting business between the land masses bordered by the Atlantic and the Bosphorus. Etymology is always curiously fought over, but ‘red tape’ is thought to have originated in 16th century Spain when official documents were bound with red ribbon to indicate importance and priority. Excessively used it caused bureaucratic pile-up hence its current idiomatic form. Getting anything achieved in the European bloc blob must be accomplished through a sea of ribbons from the red, white, blue, black, gold, green, orange colours of all the member countries and the battalions of lawyers who stalk the halls of the European parliaments getting rich on mounding legislation. The Wall Street Journal picks out “failed focus on regulatory suffocation,” and Europe’s declining share of global economic output stemming in part from “national and transnational regulations that undermine creativity and industriousness,” seen in the report.

Where this must echo, and relevant for our market, is if business decisions are hampered by custodians of process and parochial considerations, then how on earth will anything as mightily important as a military aid package or support for Ukraine against Russia be uniformly agreed? Zelenskyy is feeling immense pressure all round, from the US, from Russia and from a fallout of political corruption domestically. He is rightly reaching for any port in a storm, but by doing so with Europe, Ukraine risks running the gauntlet of institutional flummery and process with a risible outcome and elevating the ire of the United States, which wants no interference coming in via a European back door. No matter that the current peace plan is a bitter pill for Ukraine, the US leader has already expressed dismay at Ukraine’s intransigence this week in not accepting. He accused Zelenskyy of having failed to read the latest peace plan while Russia’s President Vladimir Putin was “fine with it.”

This hunt for allies has now become a living nightmare for Ukraine, with its leader, and against constitutional law, considering a wartime election to counter White House accusations of the country not living by democracy. Whatever peace plan the Europeans ever manage to compose, it might very well be a misstep for Ukraine to use it as leverage while negotiating with the United States. The transactional nature of this White House is a results-based business and ending the war is way more important than any perceived fairness. Given US antipathy toward not only Europe, but also NATO, and how the current Administration considers its own backyard in Venezuela and China’s potential expansion much more worthy of attention, it is more than feasible for a piqued Donald Trump to walk away from the US historical guarantor role for Europe.

Not only would such a disaster accelerate the demise of Ukraine, but any sort of cohesion from examples such as Hungary agreeing to using funds derived from frozen Russian assets to Belgium doing the same from Euroclear will be sacrificed on the altar of self-interest in not poking the Russian bear. The worst-case scenario is a withdrawal from United States as the security supervisor for this part of the world. It is the only nation capable of it and the price will be Ukraine’s acceptance of a very unfair peace deal. Under that deal, Russian oil will flow and by the state of current oil prices, our market might just be getting used to the idea.

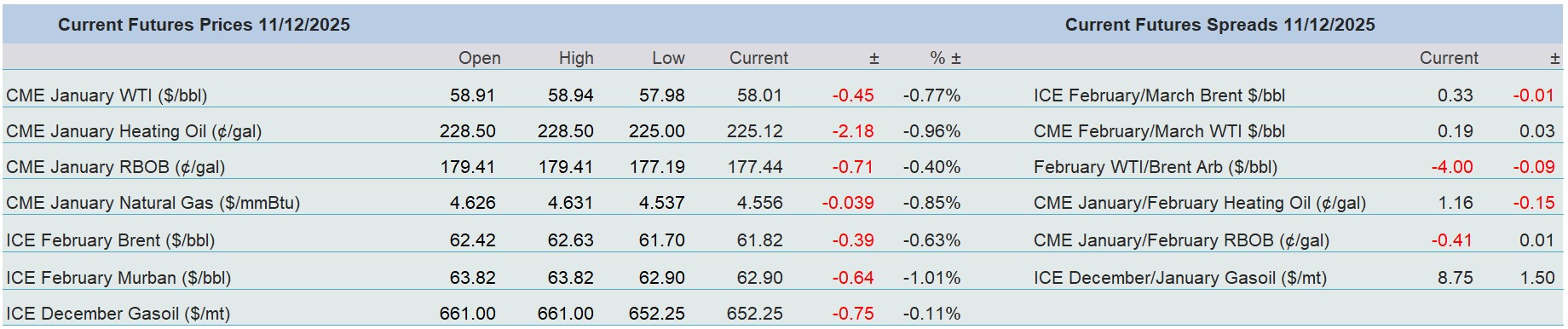

Overnight Pricing

11 Dec 2025