Do Not Blink, You Will Miss it

Yesterday, the oil market performed more pirouettes than might be seen at the forthcoming season in the Nutcracker ballet. Bulls were armed with Israel's chat on possible targeting of Iran's oil infrastructure and possible damage from Hurricane Milton while bears with the lack of specific stimulus from China and Hezbollah jawboning a possible truce with Israel. All the while headline reading algos triggered and accelerated the heaves and haws, with the rest of the battalions of machines giving no time for thought or reasoning as they joined in with anything but Artificial Intelligence to magnify bewildering multi-dollar moves in Crude prices. The CBOE Oil Volatility Index (OVIX) is at the highest level for 2 years. It is a price prediction and trading nightmare for the oil fraternity and one that might see reduced exposure or even abandonment of position taking from traditional quarters until this headline melee abates.

Eyes this morning are drawn away from the Middle East toward the United States. Barrelling along toward Florida with some quite scary predictions of damage, Hurricane Milton, while likely to miss the US Gulf's major oil operations, is closing ports and oil deliveries into Florida that relies on shipping for its needs. Coinciding with the Hurricane is the API data showing an extraordinary build in Crude stocks of 10.9mb, which is way higher than the expected 2mb increase. The API data comes on the heels of the US EIA revision lower of oil demand growth next year for the US by 100kbd to 20.5mbpd which is adding to growing expectation of a poor year in 2025 for demand. This is made much starker by the larger global downsizing of the EIAs global demand growth by 300kbpd in 2025 and 20kbd for this year. Such a backdrop belies the war premium in oil prices at present, but it would be a brave soul indeed to dismiss what will happen to oil prices if Israel does the unthinkable and targets Iran's oil sector.

If you are looking for stimulus, do not look to China

After the miserable economic times that followed the unprecedented state of social wellbeing and household uncertainty, the US introduced the Coronavirus Aid, Relief and Economic Security Acts or CARES, which under the tutelage of Donald Trump in 2020 released $2.2 trillion in various forms into the US economic system. Since then, further payments have been extended and spread into the Presidency of Joe Biden with the total amount contested, but likely to be toward $5 trillion. It has been the single biggest state splash of cash in the US’s history and unlike the bailout of the banking crisis that never really reached humans, but swallowed up by unapologetic banks, fresh bundles of greenback hit the streets of American communities. From corner shops or mama and papa stores as the Americans coin them, to direct payment into individual bank accounts or credit cards. This extraordinary amount of stimulus is the singular cause for the incredible rally away from the economic ravages of COVID-19 and the reason the US stands on such solid financial ground. Naysayers will point to the difficulties faced by the US Federal Reserve in bringing inflation back into control and what the payback might be in years to come, but they are drowned by the roars of encouragement as the US equity markets march to ever new highs. The fact is, the US backed itself and it has paid off.

Here in Britain, we view our antipodal nation as Australia, in the US they view theirs as China. It is a convenient metaphor for the difference between how the two nations have handled the aftermath of the pandemic. China stands as not only the geographical opposite of the US but also in attitude towards pumping money into its own economy. Its initial recalcitrant policy of zero-COVID kept its economy indoors for a year longer than almost anywhere else and while the economy emerged with great gusto in 1Q23, there has been a succession of data ever since signposting low financial growth that has been unrecognisable when compared with recent prolific history. There is no point in trawling over the property crash, decreases in industrial output, overcapacity, investor confidence, reliance on exports, too much money in savings and international monetary flight; they are all well documented. Each bout of negative data over the recent months and years has been met with placatory words promising state assistance. When such words are put into practice, the packages offered have been piecemeal and seem largely to play to the crowd. Take last year’s much lauded CNY1 trillion additional sovereign debt that would be released in two tranches of CNY500 billion at the end of 2023 and the balance in 2024. Seemingly a fine amount of money, but in keeping with China’s obsession with security, the monetary release would be issued to local governments with emphasis on disaster relief. The amount also pales when considered against the government funds released in the banking crisis of 2008. Analysts observe that the CNY4 trillion issued then and representing at the time 13% of GDP, far outweighs last year’s paltry representation of 1% of GDP. There have been other scatter gun attempts changing sentiment, but they have never been joined up and have always lacked substantive monies. Therefore, in July’s Third Plenum, expectations from markets were limited and the Communist Party did not disappoint. An 18,000-word document that blustered on about security, open economies and long-term growth there was no addressing of the housing issues, consumer confidence and what promised aid might look like. Still, at the end of last month when the PBoC cut interest rates, reduced banking reserve requirement, eased stock market restrictions and reduced deposits on second mortgages, markets by-in-large bought into it particularly as opinions became convinced that this was the start of real stimulus, the value of which would soon follow. Such was the welcome that Brent managed to squeeze over a $1/barrel of rally out of it.

Hope is never a good trading strategy, and if any existed in China stimulus action, they yet again fell in the same manner as a property in one of the vast numbers of unoccupied new builds. The National Development and Reform Commission (NDRC) met yesterday and while its leader, Zheng Shanjie bloviated "we are fully confident in achieving the goals of economic and societal development for the year”, which alludes to and argues against most forecasters believing China will miss its 5% GDP target, nothing new was announced. The only mention of any economic aid is there would be a continuance in issuing ultra-long-term government bonds next year. The disappointment is written all over the faces of falling markets from the Hang Seng that had gorged on stimulus hopes to oil prices that thought maybe, just maybe China might just stop being a weight on demand.

Behaviour it seems is ingrained in China’s dealings with anything that is stimulus. ‘Incremental as she goes’, cries the helmsman of this economic ship. China is too important within global economics, it can never be ignored. Which is why these bouts of stimulus expectancies will serve to build and shatter hopes on a regular basis until the cynicism that the Communist Party bestows on the world is returned in kind. China is indeed running as an opposite to the United States, it refuses to back itself and that can only be bad news for consumption commodities such as oil.

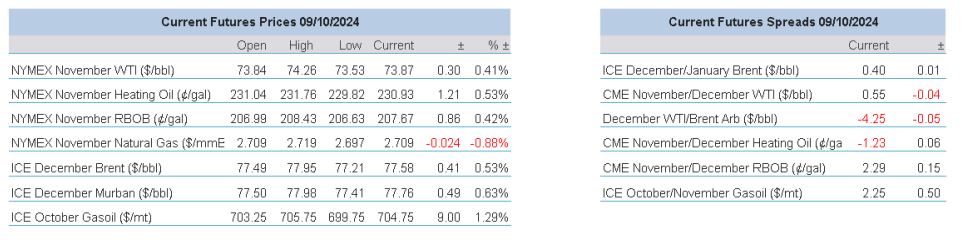

Overnight Pricing

09 Oct 2024