Drone Damage Might Have to Wait; Here Comes the FED

Oil prices are once again dominated by the Ukraine war. We touch on the struggles of the European Union’s application of tariffs and sanctions below, but instead of the hollow words of the protagonists who assure us that Russia’s oil supply will be dealt a blow financially, Ukraine has decided it would mete out a supply problem for its enemy, fundamentally. The continued pot shot use of drones on Russia’s refiners and now Crude export facilities is starting to bear fruit. A sourced headline from Reuters yesterday had that Transneft is telling domestic producers their production may have to be slowed because the damage done to outlets in Primorsk and the Baltic are hindering export capabilities. Some banks and commentators are assessing there is a possible loss of some 200kbpd. Given the approach of winter, and the worry over relatively low Distillate stock globally, Heating Oil, Gasoil and their like took a leap because despite sanctions, Russia remains a key supplier of products from the middle of the barrel.

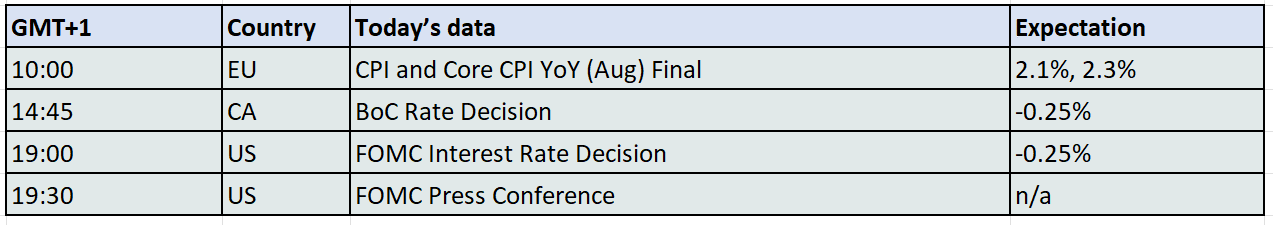

Oil, having taken little notice of the US Dollar for most of the last week or so, decided the world’s marker currency’s demise ought to be important, and of course it is now latterly added to reasons to be bullish. Which is why, and barring any more headlines of failing Russian infrastructure, oil and every other market’s eyes will be on the FOMC decision on US interest rates later. A 25-point basis cut is more than ‘baked in’, it could be argued that the state of the US Dollar at present has at least another four cuts already factored. It will be to the infamous ‘dot plot’ and extent of dovish language from Jerome Powell which will determine the fate of today’s market moves, everywhere.

Sanctions must be easy, right?

It has in the past been easy to be over-critical of landlocked countries such as Hungary, the Czech Republic and Slovakia. But they should have been offered some mitigation due their geographies which is well described by being ‘landlocked’. Not for them the luxury of floating all the gamut of energy stuffs into a handy port for national distribution. This is why they were granted exemptions to carry on with imports of Russian energy, and in the case of Hungary and Slovakia, it is very hard to give up on the Druzhba pipeline that has serviced oil needs for decades. And as with all political intrigue, there is breathtaking hypocrisy on how the rest of Europe did not exactly turn the spigots to ‘closed’ on oil deliveries from Russia when the commodity was weaponised after the illegal invasion of Ukraine. If sympathy can be found for the likes of Germany in how it serviced its national interest by taking its time in securing energy before joining in with punitive action on Russia’s energy industry, the same must be afforded to economically smaller Eastern European countries. The cost of abandoning Russian oil would have done incredible harm to their economies.

However, such excuses are wearing thin, and for many commentators the exemptions are being abused. Initially granted for the three countries mentioned above in June 2022, the derogation was supposed to only last until December 2024. In this time refineries would be adapted to alternative Crudes other than the heavier Russian examples, and extensions from alternative pipelines such as Transalpine should be emplaced in order to transport different Crude grades from the port of Trieste in Italy. Yet there seems to be no end in sight of what was supposed to be temporary alleviation while alternative paths of energy imports were sought.

The Centre of Research on Energy and Clean Air pulls no punches and declared in a recent publication, “Hungary and Slovakia have in fact exploited the exemption, offering weak justifications for continuing Russian crude imports, which in 2024 remained above pre-invasion levels — violating the intent of EU legislation.” This scathing assessment does not stop there, it almost throws accusations of profiteering, rounding up with, “both Hungary and Slovakia have exploited the exemption to the EU ban on Russian crude oil and have increased their imports through the Druzhba pipeline by 2% in 2024 compared to levels pre-full-scale invasion of Ukraine.”

Such behaviour is threatening the very fabric of the European Union, which is under increasing pressure from the United States to fully remove itself as a destination for Russian energy. How Ursula von der Leyen negotiates a way around vetoes available for members when all 27 must offer a united vote when such magnitude of policy is changed, remains to be seen. Hungary and Slovakia have not been shy in threatening vote blockers where Russia is concerned. But the seriousness of the situation is reported by Politico, citing a European diplomat there will be no new 19th sanctions package due today, and goes on to note the delay is linked to the EU shifting its focus from imposing new measures against Russia to pressuring Slovakia and Hungary to "cut their reliance on Russian oil."

The EU has little alternative in trying to get its own house in order if it is to receive the backing of the US in pursuit of cutting financing for Moscow’s war machine. With the elongation of Hungary and Slovakia’s oil relationship with Russia, there must have been billions of Euros paid. As much as Donald Trump has sometimes acted as an apologist for Vladimir Putin, and that the US oil industry could very well be beneficiary to the alternative needs of Europe, tackling its two errant Eastern members may just be the easiest of the tasks set by the US President for the EU to achieve. Placing 100 percent tariffs on China and India, is another discussion, and can be tackled at later date on a more level playing field. But that levelling involves Budapest and Bratislava falling into line, which is why the tariff and sanction farrago around Russia will run and run.

Overnight Pricing

17 Sep 2025