Drones, Ships and Early Bulls

The Houthi drone attack on shipping in the Red Sea and the upward influence on oil prices reveals that there is always a bias bull-twitch within the oil trading community, for while the attacks are worthy in the sense of adding more geopolitical intrigue in expectation of some sort of hostility spread where Iran, the sponsor of Houthi fighters, among others get dragged into more than war by proxy, the actual effect on oil flows is likely to be limited bearing in mind under 10% of global crude travels the Suez/Red Sea corridor and the attacks have not hit anything that would interfere with production. With oil prices in a relief rally, with volumes very light and a wider investor community that is set on a program of owning 'stuff', the consciousness of those that prefer trading markets that are upwardly mobile have been pricked and as likely that the hiatus in flows of oil in the Red Sea will be short-lived, those that have embarked on 'knife-catching' buying over the mini-collapse of oil prices will not be cowed.

Whether or not this is another false dawn for an oil price bottoming will be decided on how quickly counter measures are deployed to the drone attacks. Operation Prosperity Guardian was announced by US Defence Secretary, Lloyd Austin yesterday, a multinational force that will initially run escort for commercial ships at the entrance to the Red Sea using warships that are already in the region with hardware increasing over the coming week. It will be interesting to see how quickly, or even if, the Combined Maritime Forces coalition is able to thwart the Houthi attacks and whether those that have sought to jump the gun of a turn in oil price fortunes get to run their race all the way to the finish line or are pulled back because of a false start.

The US Dollar and 2024

Last week the Bank of England left interest rates at 5.25% for the third time in a row having been preceded by 14 consecutive rises leaving rates at the highest for 15 years. It does appear from the travails of the UK’s economy that the Monetary Policy Committee (MPC), the decision-making body within the BoE, hardly had much of a choice. Even though inflation has fallen from a lofty 10% in January of this year by well over half to 4.6% as of October, it still remains stubbornly in excess to the central bank’s target of 2%. The conundrum faced by those that set rates at the MPC is the constant juggle of not bridling an economy that has little growth with punitive borrowing finances, while trying to reduce inflation and spiralling employment costs. The answer comes in a warning from BoE Governor Andrew Bailey that there was still some way to go, while the MPC implied that it still followed the ‘higher for longer’ mantra and even gave a nod to higher rates if it became necessary.

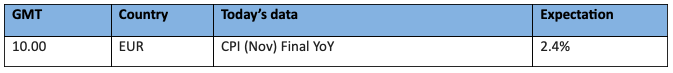

Such issues faced by the BoE are somewhat magnified in Europe as the European Central Bank grapples with more than just one economy when trying to set a fiscal path. A protracted individual look into the major economies that make up the bloc is not necessary for the averaging out of progress is plain to see as observed in last week’s HCOB Manufacturing PMI of 44.2, Services PMI of 48.1 and Composite PMI of 47 that not only showed all in contraction but were actually lower than their forecasted measures. Inflation has fallen from 8.6% in January to the current level of 2.4% which is the lowest rate since July 2021 and on the way to the targeted 2.0%. Admittedly, the PMI data came after the ECB’s decision to hold its key interest rate at 4.5%, but the language deployed does not appear to signal a change of policy in the near future and been pre-judged even with abject economic markers, for the ECB President, Christine Lagarde, said rate-setters did not discuss rate cuts at all. Hawks prevail, and in an interview with the Financial Times, Pierre Wunsch, Belgian Bank Governor and member of the ECB’s governing council said, and referring to a possible cut in March, investors are ‘too optimistic […] we still need to see good news on wages’, referring to how wage growth in the third quarter was the highest for 10 years, embedding his view by adding restrictive rates would be kept as long as necessary.

The ’hold’ that has permeated around the global central banks is also true of Japan, which seems unlikely to change very soon judging by this morning’s decision. Asia’s second-largest economy faces a wholly different prospect than that of its global peers because its accommodative monetary policy has actively sought inflation after the miserable decades of deflation and stagnation. Negative interest rates alongside fiscal stimulus measures have seen success in many areas and an overhaul of job creation in a work force that up until recently was considered old and burdensome and much of any decision will rely on sustained wage growth born from industrial/service growth rather than that of easy money. Being the Governor of the Bank of Japan is often referred to as the hardest of all gigs in the central bankers’ world and for Kazuo Ueda negotiating the next half year is going to be as arguably tricky as the last. An early rate rise would spike the Yen and immediately make Japanese exports too expensive particularly if the FED does indeed start on its programme of cutting interest rates. For years, Japan has never been altered in attitude concerning its GDP to Debt Ratio which now stands at a whopping 255% and the mind boggles as to how an economy can be weaned off such loose money. However, 80% of economists polled by Reuters recently expect the BoJ to end its negative rate policy next year with April the likely candidate in which month it will happen.

The BoE and the ECB’s continuing in high interest rate policy and a chance that the BoJ will be forced into taking some tightening action is starting to bring more thoughts of a swooning US Dollar in 2024. For the first time since September, hedge funds and other large speculators switched to a net short position against the dollar as of December 12, according to Commodity Futures Trading Commission via Bloomberg. The CME FedWatch Tool is now pricing a cut by the US Federal Reserve in March at nearly 70% and interestingly already pricing a cut to 4% by next December at 38%. If the ‘higher for longer’ mantra persists around all the other central banks of the world that make up the G10 currencies; Australia, Canada, European Union, New Zealand, Norway, UK, Sweden, Switzerland and if Japan sees a future scenario of tightening, commodity prices and particularly oil are about to be handed a bull-saving prop that could very well be leaned upon for the whole of calendar 2024.

Overnight Pricing

19 Dec 2023