Easing Fears

Oil can keep ascending only for so long purely based on perceptions and not actual supply disruption. Undeniably, the trifecta of money managers covering short speculative bets, the innate fear of missing out on much higher prices, and the still elevated anxiety level amongst investors of a possible and significant supply disruption helped Brent reach its highest level for over a month. The continuous advance came as Israel relentlessly bombs Lebanon, and Hezbollah and Houthi rebels target numerous cities in Israel. Although it would be irresponsible to claim that the dust has settled on Iran’s direct and ominous involvement in the conflict, but for now the threats of Israeli assaults on Iranian oil infrastructure have not materialized yet.

The geopolitical risk premium has an obscure and unforeseeable expiry date. When that point arrives and is not replaced by genuine and supportive fundamental factors, in the case of the Middle East conflict by a palpable supply shortage, the move higher will not be sustainable. And the longer it takes, the faster the price increase will slow and even reverse, something that is evidenced this morning as oil is giving up nearly half of yesterday’s gains. The focus will shift to the usual suspects, such as inventory levels, possible weather-related disruptions (no doubt, category 5 Hurricane Milton played its undisputable part in yesterday’s surge), China (the country’s stock indices fall sharply after a strong opening because of lack of clarity on stimulus during the press conference of the National Development Reform Commission) and macroeconomic considerations, inflation, interest rates et al. Yesterday, fears were still feeding perceptions and assumptions, yet it is intriguing to observe that crude oil backwardations narrowed and crack spreads struggled to make considerable headway.

One Year On – Escalate to De-escalate

One year after the monstrous Hamas attack on Israel, which claimed the lives of 1,200 people and took 250 as hostages the situation in the Near and Middle East is closer to spiralling out of control than at any point since October 7, 2023. No one contests Israel’s inherent and indisputable right to defend itself, however, some believe that the measures taken against Gaza and Lebanon, costing over 40,000 lives, are disproportionate and significantly contributes to the severely diminishing chances of a truce or ceasefire. It is a conflict where the victims are also the perpetrators on both sides suggesting, that easing the tension is anything but imminent.

The timeline is telling. Immediately after the Hamas assault on southern Israel, the Prime Minister of the Jewish state, Benjamin Netanyahu, declares war and orders airstrikes on Gaza. Later in October, the Israeli ground offensive in Gaza begins. The first truce is announced in November. It lasts for a week, during which period 105 Israeli hostages are exchanged for 240 Palestinian detainees. Fighting, however, resumes on December 1.

In January this year, the US and the UK launch airstrikes across Yemen as a retaliation to continuous Houthi attacks on commercial vessels in the Red Sea, which force tankers to re-route around the Cape of Good Hope. The same month, South Africa accuses Israel of genocide against Palestinians, and its case is heard in the International Court of Justice. By the end of February death toll in Gaza exceeds 30,000, according to the health ministry run by Hamas.

Iran’s direct involvement in the conflict gains traction in April when Israel struck its embassy in Syria. Iran launches several missiles and drones against Israel, which is met by a reciprocal response. Meanwhile, ceasefire talks in Cairo fail. On his visit to the US, the Israeli Prime Minister pledges to achieve ‘total victory against Hamas’.

Tension rises further when a top political leader of Hamas is assassinated in Iran whilst attending the inauguration ceremony of the new Iranian President. Another truce talk, this time in Qatar, fails to produce results and Israel’s focus shifts from Gaza and Hamas to Lebanon and Hezbollah. After several exchanges of fire in August, unprecedented mass explosions of pagers and radios used by Hezbollah send shockwaves throughout the world. Upping the ante, the militant group’s leader is killed in an airstrike. Israel puts boots on the ground in Lebanon, and Iran launches hundreds of missiles against Israel.

Israel, after crossing red lines after red lines set by its staunchest ally, the US, and by the international community, threatens with retaliatory strikes against the Persian Gulf nation’s nuclear and oil infrastructure. It is the highest level of tension yet over the past year. A full-blown regional war has never been more plausible. Israel, sensing a rare opportunity to obliterate its archenemy’s capabilities, which could threaten the very existence of the Jewish state and riding the wave of a conspicuous increase in Netanyahu’s domestic approval rating, feels emboldened to escalate the tension against its adversary – in order to de-escalate the long-run, its thinking goes.

Any attack on Iran’s nuclear or oil facilities will bear predictably dire consequences. At this stage, our market is visibly concerned about the real and present danger of oil supply disruption or the closure of the Strait of Hormuz traffic artery. Iran’s proxies have, in the past, attacked Saudi oil infrastructures, knocking half of the country’s output out for a few days. The Kingdom’s crude oil export is around 6 mbpd. Iran produces around 3.2 mbpd of crude oil and exports in the 1.5-1.7 mbpd range, with China being the pivotal buyer. The strait, which lies between Iran and the UAE, is responsible for carrying around 20% of the world’s oil, crude and products. It is, therefore, only comprehensible that oil prices have rallied over 15% in the past week, ever since the conflagration between Israel and Iran reached elevated levels. A partial halt in Saudi oil output would have devastating, albeit possibly short-term, consequences as it would impact a region where most of the world’s spare capacity is. A significant reduction in Iran’s export capacity will force China to look for alternatives, and the closure of the salient choke point would also be felt worldwide. Damage to Iranian oil facilities will benefit producers but drive inflation higher, hindering economic prosperity. As much as a cliché it sounds, exacerbating the animosity with a discernible impact on the region’s oil sector will ultimately do more harm than good. Yet, the nature of politics very often defies common sense; let us hope it will not be the case this time.

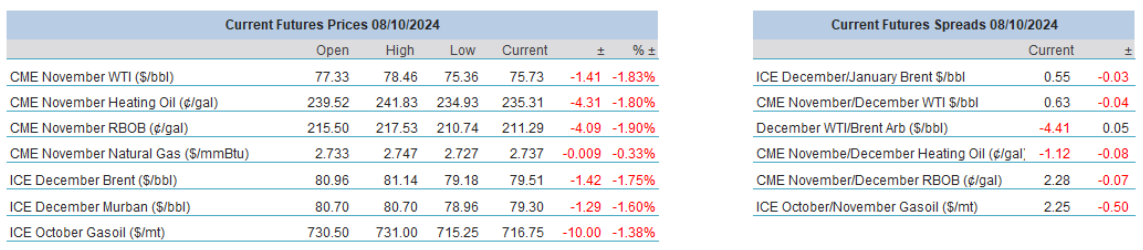

Overnight Pricing

08 Oct 2024