The EIA Giveth and the EIA Taketh Away

The difference between voluntary and mandatory data submission can sometimes be as much as 2 million bbls. The latest downturn in oil prices was triggered last Wednesday when the EIA registered an unexpected build of 7.3 million bbls in crude oil inventories. It made amends yesterday when it reported a draw of 1.4 million bbls against a build of 509,000 bbls seen by the API. Bottom pickers emerged even before the release of the weekly statistics as technical supports had come under brief pressure, but the stock figures further brightened the mood. The drawdown in crude oil stockpiles was plausibly the result of increased refinery runs and a 550,000 bpd jump in gross crude oil exports. Although gasoline and distillate inventories grew a tad, this increase was much less than the API figures and a 2.2 million bbls drawdown in commercial oil inventories ensued, whilst product supplied, the indicator for proxy demand, stayed resolutely over the 20 mbpd mark.

Was this report the harbinger of a trend reversal and has oil found its short-term bottom? Ostensibly. The impressive recovery was also helped by increasingly slim hopes of an Israel-Hamas ceasefire, as the former intensifies its assault on Rafah, the latter said it would not compromise further and the US has halted weapon shipments to Israel. Overnight Chinese data, which saw a 1.5% increase in April exports and a rise of 8.4% in imports provides additional help, especially that year-on-year crude oil imports are 5.5% up. On the other hand, the precariousness of rate cuts keeps the dollar at elevated levels against major currencies and this acts as a brake on a meaningful rally. More significantly, despite the bounce off the bottom and the impressive re-widening of crude oil backwardation crack spreads, the ultimate barometer of refinery and therefore consumer demand, have not recovered and unless they show tenacious signs of revival a prolonged march higher remains ambivalent.

GMT | Country | Today’s data | Expectation |

12.00 | UK | BoE Interest Rate Decision | 5.25% |

13.30 | US | Initial Jobless Claims (May/04) | 210,000 |

Loosening of the Oil Balance

The latest downturn in prices started last Wednesday, after the EIA released its findings on the weekly levels of US oil inventories and recorded a surprise increase in crude oil stockpiles. Of course, there have been other factors under consideration. These are the usual suspects of geopolitics and interest rates, nonetheless, it appears that developments around Israel and the Red Sea should not have a meaningful impact on oil supply, neither pro nor contra. The sentiment towards the potential change in the cost of borrowing fluctuates with almost every word central bankers murmur and it has also become obvious during the past week that oil behaves in a rather idiosyncratic way as it has visibly de-coupled from equities. At the same time the structure of the two crude oil futures contracts narrowed up until yesterday, Brent CFDs also cheapened and so did refining margins, insinuating a weak physical backdrop. This backdrop is supported up by the Short-Term Energy Outlook released by the statistical arm of the US Department of Energy on Tuesday afternoon.

The first data set that catches the eye is global oil consumption. It has been amended downwards by 320,000 for the incumbent quarter, by 40,000 bpd in 3Q and revised up by 10,000 bpd towards the end of the year. Moving on to the supply side of the oil equation, from producers outside the OPEC+ alliance it is now seen up by 120,000 bpd in 2Q and 3Q and 170,000 bpd higher in the last quarter of the year. Since OPEC’s other liquids were left unchanged the downgrade in OPEC call is rather substantial: for the next three quarters they are 440,000 bpd, 160,000 bpd and 160,000 bpd with an average annual cut of 160,000 bpd. These changes have inevitably led to higher projected OECD stocks. For the current quarter they are seen at 2.743 billion bbls, up 18 million bbls from April. They are expected to bid farewell to 2024 at 2.737 billion bbls compared to 2.712 billion bbls reported a month ago. The rather comfortable inventory levels foresee limited price upside, which is also mirrored, in the view of the EIA, in OPEC’s surplus capacity. It is estimated to stand just above 4 mbpd, more than 1 mbpd above the 2014-2023 average implying abundant readily available volume in case of supply emergencies.

As the US contributes more than 40% to total OECD oil inventories the same tendency is observed on the other side of the Atlantic. Consumption in the second quarter has been revised downwards from 20.65 mbpd to 20.32 mbpd month-on-month and by 80,000 bpd to 20.37 for the whole of 2024. Commercial inventories, consequently, have been rewritten slightly upwards. This altered oil balance then naturally entails a more pessimistic view on oil prices. Brent should now average $88/bbl and $85/bbl in 2024 and 2025 respectively, a decline of $1/bbl and $2/bbl from the preceding month. Whilst such adjustments are anything but surprising in the light of the updated findings it is imperative to point out that the current curve is significantly lower than the latest price forecast.

The EIA figures must be taken with a pinch or even a tablespoon of salt. Diverging inflation expectations coupled with widely varying perspectives on energy transition have led to significantly deviating views on global and regional supply, demand, and oil balance estimates. There is a painful lack of consensus between the three major forecasters, the EIA, OPEC, and the IEA. (The latter two will publish their own findings next Tuesday and Wednesday.) Notwithstanding these chasms, there is some kind of agreement on annual changes on global oil demand and supply, however. The current outlook generally envisages reliable growth in both fronts. The extent of them determines whether stocks would deplete or grow year-on-year. The EIA finds that OECD inventories will exit 2024 lower than 2023. It indicates a higher average price than last year, which was $82.17/bbl basis Brent, right whereabout the year-to-date average price is suggesting limited downside. Whether Tuesday’s revision from the EIA falls in line with the others remains to be seen but rest assured that the upcoming sets of data will be equally scrutinized next week in our attempts to find common ground in the seemingly dissonant prognoses.

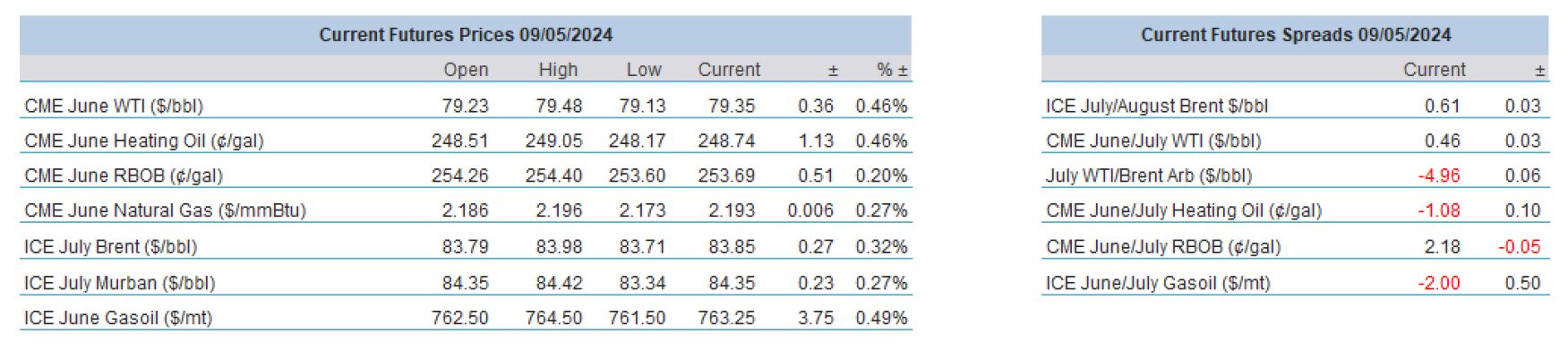

Overnight Pricing

© 2024 PVM Oil Associates Ltd

09 May 2024