Elevated Anxiety Level

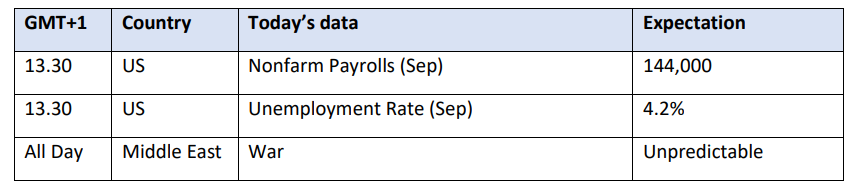

Apart from those in the know, no one has the crystal ball. Still, presently everyone is worried about a potentially gruesome outcome of the animosity between Israel and Iran and its proxies. The major driving forces in the very recent past are being ignored. It is impossible to overlook what is happening around the Persian Gulf but if one could, she would find oil significantly lower, equities higher and the dollar index possibly under the 100 mark. Libya has lifted the force majeure on its crude oil production and exports, US oil stocks built, the labour market is solid as the marginal rise in jobless claims last week was down to hurricane-related issues and the service sector is nicely humming.

Yet, anything deemed a risk asset, bar oil, has fallen out of favour as the economic impact of a full-blown war in the Middle East is urgently assessed. One can only suspect the desperate negotiations behind the scenes to reach an at least temporary truce. The Israeli UN ambassador's comments about ‘lots of options’ to deal with Iran do nothing to soothe frazzled nerves. The outcome is unpredictable and therefore inventors are on the defensive. Contradictory remarks from the US President on the possibility of attacks on Iranian oil infrastructures lies behind yesterday’s $4/bbl rally. The move higher was possibly amplified by the massive amount of speculative money sitting on the sidelines waiting for an ostensibly reasonable excuse to get back into oil. This excuse is deemed to be the fast-approaching boiling point in the hostilities between Iran and Israel. Hence the relentless jump but it must be kept in mind that this money, if winds change, can leave the sector quicker than you can say ayatollah.

A Conflict Like No Other

The intensifying war around Israel has its idiosyncratic aspects for more than one reason. Firstly, its longevity. It began well over 2,000 years ago and it is unlikely to be settled in a mutually acceptable manner any time soon. Secondly, it is being fought in a strategically important geographical area, which covers three pivotal maritime traffic choke points: the Suez Canal, the Strait of Hormuz and the Bab al-Mandab Strait. Thirdly, it is near critical oil-producing regions. Accurately reading the consequences of events as they unfold, therefore, bears massive political and economic significance, which reverberates throughout financial and oil markets.

Reaction to conflicts or flare-ups of geopolitical/geoeconomic tension usually follows a well-established pattern, which probably has three stages. The initial step is to adjust portfolios as keeping counterintuitive positions is deemed unnecessarily risky. In our market, it means covering short positions. After the Iranian missile strike on Israel the volume traded in Brent, for example, averaged over 2.3 billion bbls, an increase of 100% from the previous trading session. To a lesser extent, this jump was also the product of adding to long exposures as the risk premium received a considerable boost. The second phase is what one might call consolidation. It is when the actual impact of the latest development is evaluated. Lastly, positions are readjusted according to the updated outlook. If the chances of long-term supply disruption, perceived or actual, are rising then the uptrend will prevail. On the other hand, if there is a consensus that the likelihood of attacks on oil installations will not go beyond belligerent rhetoric, prices will fall back to where they came from and, as is frequently the case, even lower.

In Phase II, it appears, the market concluded that betting on de-escalation is plausibly premature and irresponsible. President Biden’s pledge that Israel’s staunchest ally would not support any strike on Iranian nuclear sites, simply does not seem credible in the current climate – and understandably so. It is fresh in memory that the US has set several red lines over the past year (no more civilian casualties in Gaza, no ground offensive in Lebanon) only for these warnings to be causally or even cynically ignored by Israel’s Prime Minister, which then were met by inert reaction and indeed even by further support from the US. It is worth remembering that Israel sees Iran as an existential threat and eradicating its nuclear capabilities is deemed the ultimate goal to ensure the Jewish state’s security with no possible regards to short-term repercussions.

Available supply cushion, currently amounting to anywhere between 4 and 6 mbpd, will also mitigate the impact of unexpected supply disruptions, the thinking goes. The only problem is that this spare capacity is found precisely in the region, which is susceptible to a full-blown war. Besides potentially disabling Saudi oil production, the closure of the crucial Strait of Hormuz, which 20 mbpd of oil, condensate, and petroleum products and about one-third of all seaborne trade pass through, would entail a tangible oil shortage.

The proverbial barrel filled with gunpowder, the Middle East, has just made a huge stride toward igniting the spark that would engulf the region in flames and send oil prices considerably higher. It is anything but clear whether further escalation of the conflict is a realistic prospect, or whether the warring parties will opt for restraint and avoid an increase in geopolitical temperature. Hopefully and for the sake of standing any remote chance of rapprochement, Iran’s direct involvement and Israel’s scorched-earth military approach is close to reaching their limits.

The fierce march higher in prices carries ominous signs. Yet, it must be noted that the reaction to the latest petrifying chapter of the Middle East history has been rather benign compared to the market response to Russia’s invasion of Ukraine. The understandable rise in the front-month Brent structure is dwarfed by the $4/bbl backwardation recorded in February 2022 and does not suggest an immediate and unmanageable shortage. Should the worst happen, refiners would scramble to secure supply of their feedstocks, crude oil, and would not be able to satisfy consumer and industrial demand for products. This would lead to scarcity in refined oil sending crack spreads to elevated levels. For now, and notwithstanding the present ferocious rally, the doomsday scenario is not an alternative and the longer attacks on oil infrastructures and trading routes are avoided the more likely the anxiety will moderate. But again, who knows?

Overnight Pricing

04 Oct 2024