Equities Continue to be More Palatable than Oil

Oil prices, its drivers and participants remain in uncommitted form as the world and its investor populace look elsewhere to place their risk capital. Clearly, the government data this afternoon is where the real story is, but the precursor of US oil stocks in the API data does not exactly show much of an effect of Hurricane Beryl and the shutting down of some the infrastructure that stood in its path. Admittedly, Crude with a draw of 4.4 million barrels is counter to an expected build, but with Distillate building by 4.9 million and more importantly a small Gasoline build against an expected draw, serves initial notice that not much has changed. Attitudes to the horrors of Gaza and possible conflict in Lebanon cool and not much is made of the successful Houthi shipping attacks reported on Monday. The current ear of the oil market appears to be open to more negative influence as shown in the poor data from China (which is now shackled with a threat from candidate Trump of 60-100% tariffs and another bout of US semiconductor scrutiny) and a US Dollar spurred on by yesterday's Retail Sales.

Markets are sometimes duplicitous. How Americans spend money would be a 'tell' for a September FED cut in interest rates if Retail Sales came in lower, as was forecast. Yet, in a switch to good news is actually good news, the sales data came in unchanged on a month-on-month basis in June and increased by 2.3% from a year earlier. The reaction from the wider macro suite with commentary to follow was of an economic and consumer resilience sending not only the S&P and DOW to fresh highs but adding buoyancy to the Dollar without a thought to interest rates. Markets are so convinced in a September Rate cut in the US, as shown in FEDwatch pricing, that instead of being a thorn in the side of fizzing bulls, the decent Retail Sales adds another rung to the ladder. Such returns, such certainty, will keep the gaze of investors, and oil in comparison will continue to be a Cinderella before the ball waiting for its fairy Godmother.

The Houthis and the Donald

It is hard not to keep approaching current affairs through the prism of the United States election. Wherever there may be conflict in the world or tricky diplomatic situations, one cannot be sure of how the US will continue to address points of geopolitical and geoeconomic inflections. In particular, and what will be very much of interest for those of us controlled by oil market thinking, are the consequence of any change in behaviour to Iran. Without trawling over Donald Trump’s history and antipathy towards the current regime and its reputation of Middle East troublemaking, presumably the current status quo of acceptance could very well change next year. Indeed, with the most powerful nation in the world’s eyes inward looking, there does seem to be a US-shaped hole in the world’s ability to deal with the ongoing threat from Houthi attacks. Not in terms of the commitment to hardware deployed, but politically. The WSJ reports that the US Navy is as busy as it was in times of World War II, firing over one hundred missiles to counter attacks, but there is alignment from sources that are critical of the Biden administration’s lack of wider pressure on Iran’s continued support to its (Iran’s) satellite provocateurs.

The United Kingdom Maritime Trade Organisation (UKMTO) is keeping count of reported incidents involving those attributed to the Yemen’s rebels and it amounts to a rather surprisingly large number of 101 encounters in 2024 so far. Yet that rate of attack is unlikely to see any downturn soon as the rebels become emboldened and their attacks more technologically advanced. This refers to a type of ‘drone boat’ that are remotely driven into the sides of merchant vessels. Obviously lacking a submarine fleet, the Houthis are relying on a lower point of impact to hole ships at or under the water line and in doing so cause much more damage and even sinkings. Monday saw reports of these types of attacks on two merchantmen in the Red Sea. So what? Might be a fair question from an oil fraternity that has developed immunity to such attacks due to the world largely working out the longer delivery dates associated with navigating around Africa. However, and the stories are sketchy and unconfirmed, Houthis have claimed an attack on a vessel actually in the Mediterranean Sea. If the attack is confirmed, the geography of the attack might just show it emanated from Houthi allies in Iraq such as ‘Islamic Resistance’ and ‘Hezbollah Brigades’ and a growing concerted network funded by Iran. The idea of a network that is tracking and hitting floating targets with something close to impunity was a report back in March and picked up by many publications of a vessel prowling in and around the Gulf of Aden and the entrance to the Red Sea. It has been speculated that the Iranian owned ‘Behshad’ was a floating observation post for Houthi and even Iranian military personnel from which viable shipping targets are chosen. It was the subject of a US cyber-attack and after being named in the press, in April it sailed for home. The accuracy of recent Houthi attacks and information suggests that there might be another source of strategic signposting. Incidentally, it is worth noting that despite Iran’s new President, Masoud Pezeshkian, being billed as more moderate, in a recent message to Hezbollah he expressed continued support for Iran’s proxy allies, resistance to an illegitimate Zionist regime and any of its allies in the region.

The White House incumbent may have very good reasons to supress either a direct fight with Houthis or take Iran to diplomatic task over its big brother role in the maritime attacks. The negotiations with Israel and Gaza including Hamas are very delicate, a hardening of US attitude to Iran might make the situation worse, leading to more provocative action from Israel. One can only speculate on Joe Biden’s stately attitude to not only the attacks, but the cost and commitment of US forces involved in Operation Prosperity Guardian that is supposed to ensure freedom of navigation in the Red Sea area. What looks like dithering is political manna from heaven for the Donald. His tougher stance to Iran is a vote winner, and if the attack in the Mediterranean turns out to be true, the presidential challenger can adopt as much alarmism as his fancy takes, with warnings that if Houthi action cannot be contained in its current theatre, where next will Iran’s influence see breakouts from proxies? Oddly, if Houthis want the Donald to arrive in his full glory back to the White House all they have to do is keep on hitting seaborne targets. Where shall we next look for what the US election might mean for the world?

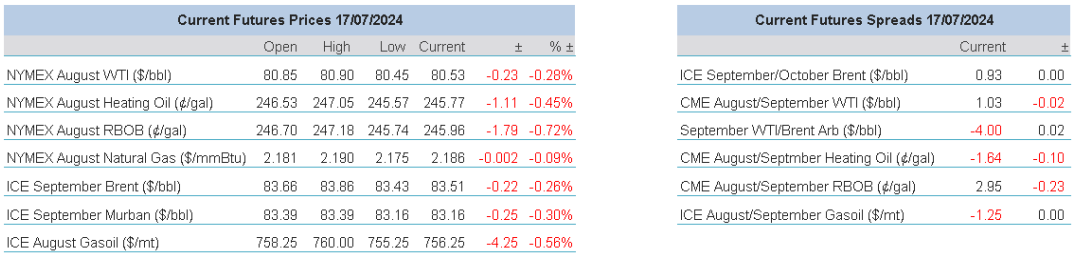

Overnight Pricing

© 2024 PVM Oil Associates Ltd

17 Jul 2024