Escalate, De-escalate, Repeat

Currently, there is no escaping the Middle East. One might even argue that Monday’s massive price fall was somewhat overdone and perplexing, as it was evidently based on the US President’s assumption that Iran was “seriously talking”. The content of these talks was never revealed. Since the US military reportedly shot down an Iranian drone yesterday as it approached one of its aircraft carriers—just hours after gunboats of the Iranian Revolutionary Guard Corps threatened to seize a US-flagged tanker in the Strait of Hormuz—one might cynically assume that the talks were belligerent. Common sense, empathy and self-interest would dictate that, just ahead of any peace talk, it is in no one’s interest to re-ignite tensions, but, as also seen with Russia shamelessly bombing Ukraine during ongoing negotiations, common sense and empathy do not feature highly on the geopolitical agenda these days.

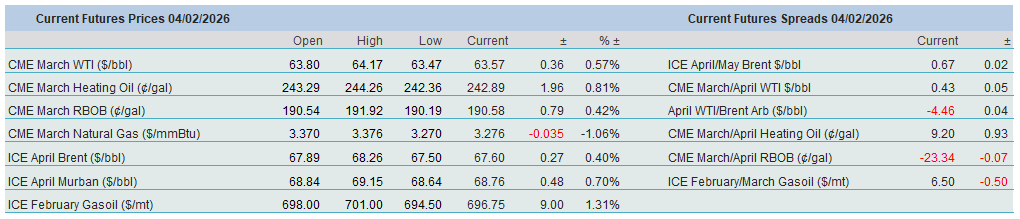

Until the Iranian nuclear talks, scheduled for Friday in Oman, the market did what it had to do under the circumstances and reversed the morning’s losses by reacting to headlines. The two crude oil futures contracts settled around $1/bbl higher. No doubt, given the sell-off in equities, dragged lower by software stocks, the considerable fall in bitcoin and the impressive flow of funds back into gold, oil would be lower without Middle Eastern sabre-rattling. Post-settlement API figures, faithfully echoing the impact of the cold spell in the US, provide additional support this morning, as crude oil stocks dropped 11 million bbls. These are extraordinary days, weeks and months, in which perceived oversupply has been overwhelmingly overlooked, yet it is still able to set a price ceiling when perceived supply disruptions are in the crosshairs of investors.

The Nature of Risk Premium

The latest turbulence in the oil market, precipitated by another flare-up in tensions between the US and Iran, has had such an outsized impact on prices that it is worth taking a deeper look at how geopolitical or geoeconomic events affect our market. To start from the genesis, and, if allowed by the reader, to be somewhat philosophical, humans are not exactly interested in the truth or facts. They prefer stories and fiction. Most things surrounding us and shaping everyday life are myths, and they only work because enough people believe in them. Sports clubs exist because of their supporters. The presence of a company is not eternal; once it loses investors’ and consumers’ trust, it will cease to exist. The same is true for any country; just look at what happened to the Soviet Union, Yugoslavia, or Czechoslovakia. Not to mention any political system, be it an autocracy or a democracy. Globalisation is not a God-ordained right either, as has been laid bare so vividly over the past 15 years or so. Once belief in it evaporates, the structure starts trembling.

So, what does this obscure ranting have to do with the geopolitical risk premium? Well, it only exists, too, because enough people, in our case, market players and investors, believe in it. Of course, their motivation is quite different from that of supporters of democracy or Manchester United. They react to perceived or actual developments, and their actions are also driven by herd mentality, or what is known as the Fear of Missing Out. This herd mentality then pushes the price of the asset higher (sometimes quite significantly), even when the actual event might not materialise.

Put simply, the geopolitical risk premium is the extra return that investors demand for holding an asset exposed to uncertainty, whether political or military. By nature, it is not constant; it surfaces suddenly and unexpectedly, and it tends to peak not at the event itself but during the escalation of risk. When belief in the actual event occurring is withdrawn, it disappears as quickly as it emerged, if not faster. In essence, it is a premium created by uncertainty.

The oil market has never been short of unpredictability, and therefore of price spikes caused by the sudden emergence of risk. Looking back over the past 25 years, there appears to be a pattern in how the geopolitical risk premium emerges and decays. The first observation is that it is always the supply-side risk that creates it. This is possibly because such risks are easier to quantify than, say, an unexpected surge in demand (which hardly ever happens anyway). When the US is on the verge of attacking Iran, it is obvious that as much as 20 mbpd of oil supply could be jeopardised.

Second, and admittedly, this is an arbitrary approach, the size of the risk premium depends on several factors. Historical examples suggest that oil prices tend to jump more sharply when the prevailing trend is down than when fears of supply disruption emerge in a bull market. Furthermore, given 2,000 years of tension in the Middle East, we believe, again, subjectively, that there is always a minimal risk premium embedded in prices because of the “what if” factor, even when tensions between Israel and the Palestinians are dormant. This baseline premium is different from the one created by events in major oil-producing regions or along key transportation routes, which can push prices $10–$20/bbl higher, if not more. Just think of the outbreak of the Russia–Ukraine war.

Lastly, because of the nature of the geopolitical risk premium, it is always concentrated at the front end of the curve, meaning that backwardation, both prompt and longer dated, widens significantly. In the latest episode of tension, the M1/M7 Brent spread moved from $1.65/bbl to $3.87/bbl within the space of a week. And when anxiety subsides, either because of workarounds or ostensible agreements between the parties, both outright prices and spreads revert to the underlying trend.

The key takeaway, if there is one, is that unless fears of supply disruptions turn into an actual and convincingly protracted physical oil shortage that cannot be neutralised by spare capacity or increased output elsewhere, the geopolitical risk premium does not persist. This was the case in 2022, when after a painful spike to $140/bbl, prices began to retreat to where they had come from. And it is only fitting to conclude this contemplation by noting that, despite suddenly becoming ‘experts’ on the topic, we still naturally find it impossible to predict when the next price spike will occur or how high prices will advance. What we can foretell with relatively high confidence is that, judging by events over the past year, any fear of a prolonged supply shock is likely to prove transitory, but the Trump administration’s foreign policy agenda will continue to offer irresistible opportunities to make quick bucks whenever rhetoric with oil producers heats up, and the proverbial hatchet is dug up.

Overnight Pricing

04 Feb 2026