Escalation is the Byword

There is something other worldly about the current sentiment in the oil space. Diverging interest rate outlooks from either side of the pond, a continued deflationary scenario in China that is in itself ignored in front of Tuesdays barrage of trade data, a roaring US Dollar, an all-time high Gold price and inflation that must keep Jerome Powell awake at night, are simply ignored. All our fraternity is interested in is the most telegraphed and spoken on Iranian reprisal for Israel’s attack on the consulate in Damascus. The what, how and effect of a revenge strike on Israel is figuratively choreographed by many talking heads and politicians which is adding more fuel to the fire of doomsday scenarios than what actually might be a contained response. The Wall Street Journal, citing inside sources, report that Israel is expecting an attack in the next two days.

However, judging by messages from Iran to Washington via an Omani intermediary that has come to light via Reuters, Iran has signalled to Washington that it will respond to Israel's attack on its Syrian embassy in a way that aims to avoid major escalation. The proof is always in the pudding and who knows how Israel might in turn respond bearing in mind the attitude it displays in Gaza at present, but the geopolitical premium is all about the rumour and not the fact. As outlined above, there are so many influences that ought see a reaction from oil prices, but while oil sits in this ghoulish state, they will be ignored.

OPEC has little reason to change tack according to the MOMR

It does not take genius thinking on how the OPEC Monthly Oil Market Report (MOMR) would be foregrounded, backgrounded and anything in between. The current state of oil prices lends not only power to the sacrifice of OPEC membership, particularly that of the de facto leader Saudi Arabia, but allows justification on how its mouth-piece publication has seemed so much more bullish than other reports. Those that have charged the MOMR with being over-confident in its recent predictions may take a seat at the back for a while.

There are no outlandish changes from the previous report, but the tone continues in optimism and while there remain doubts on the plight of the economies in Europe and China from many quarters, OPEC offer no revisions on economic growth rates apart from upwardly assessing Russia in both 2024 and 2025. The CPI and PPI numbers of China yesterday that still ring out deflation, would not have been considered in the report which takes a largely positive view of Asia. It stuck to the opinion that a more robust growth trajectory in Asian economies, predominantly India and China, has the potential to provide further impetus to global economic growth in both 2024 and 2025. World economic growth rate is seen at 2.8% and for the major trading centres of the globe; the US 2.1%, China 4.8%, Eurozone 0.5% and India 6.6%. This compares favourably and in fact conservatively with IMF data; World 3.1%, US 2.1%, China 4.6%, Eurozone 0.9%, India 6.5%, but the MOMR does warn on election risk to momentum in the US, UK, Mexico, Indonesia, South Africa and India.

The quietly optimistic tone continues when assessing the state of oil demand both nearby and in the future. The demand growth globally for 2024 is unchanged at 2.2mbpd, and although 1Q24 was revised up by 0.2 from 103.33mbpd to 103.53mbpd, there are downward revisions in 2Q and 4Q that even the sum out. However, the 4Q24 serves as a gateway to OPEC’s view on how world consumption and oil growth will continue into next year. At 105.57, and even with a downward revision of 0.12mbpd, the view of 2025 remains unchanged at a very healthy 106.31mbpd with 1.85mbpd growth. The responsibility for continued growth this year lies with strong air travel, strength in road mobility, including on-road diesel and trucking, as well as healthy industrial, construction, agricultural activities and capacity expansion to petrochemical industries in China and the Middle East.

As far as supply is concerned non-DOC, those outside the Declaration of Cooperation, is expected to grow by 1.2 mb/d in 2024, revised down from the previous month’s assessment by about 0.1 mb/d. For 2025 it is expected at 1.1 mb/d, revised down by 0.1 mb/d from the previous month’s assessment. The growth for both years is mainly driven by the US, Brazil, Canada and Norway. Total non-OPEC liquids production for 2024 is estimated at 70.44mbpd and for 2025, 71.75mbpd with small downward revisions. All well and good, but the question most want to ask is how OPEC is doing on implementation of cuts. Secondary source totals show total OPEC crude oil production at 26.382, 26.601 and 26.604 million barrels per day for Jan24, Feb24 and Mar24 respectively. However, based on direct communication, as in voluntary declaration, there are not totals due to zero data being submitted by Gabon and Iran. When the secondary sources are lined up against those countries that have adhered to direct communication they are all largely in line which must be encouraging for the OPEC compliance police. All, that is, and this will come as no shock, Iraq. Secondary sources in the month order of the three months of 2024 have 4.211, 4.217 and 4.194 million barrels per day. Direct communication shows 3.979, 3.992 and 3.903 which ‘if’ correct would keep Iraq under its quota limit.

The unsurprising Iraq issue is really the only thorn in the side of a prospectus that keeps imagining a world that is clearly not done with its thirst for oil. OPEC is looking at deficit in balance of 1.5mbpd in 1Q24 which allows for thoughts that the OPEC curbs are currently working. The feature article is a rallying cry for “countries participating in the Declaration of Cooperation will remain vigilant, proactive and prepared to act, when necessary, to the requirement of the market.” With success seemingly at hand, and an average OPEC basket price increase of $2.99/barrel in March, there does seem little reason for OPEC to move away from its current policy until the revision in June. But the observation, “robust oil demand outlook for the summer months warrants careful market monitoring, amid ongoing uncertainties, to ensure a sound and sustainable market balance”, does offer interpretation opportunities. For given a chance in time when a release of the production brake will not instil a freefall in oil prices, surely OPEC will take it.

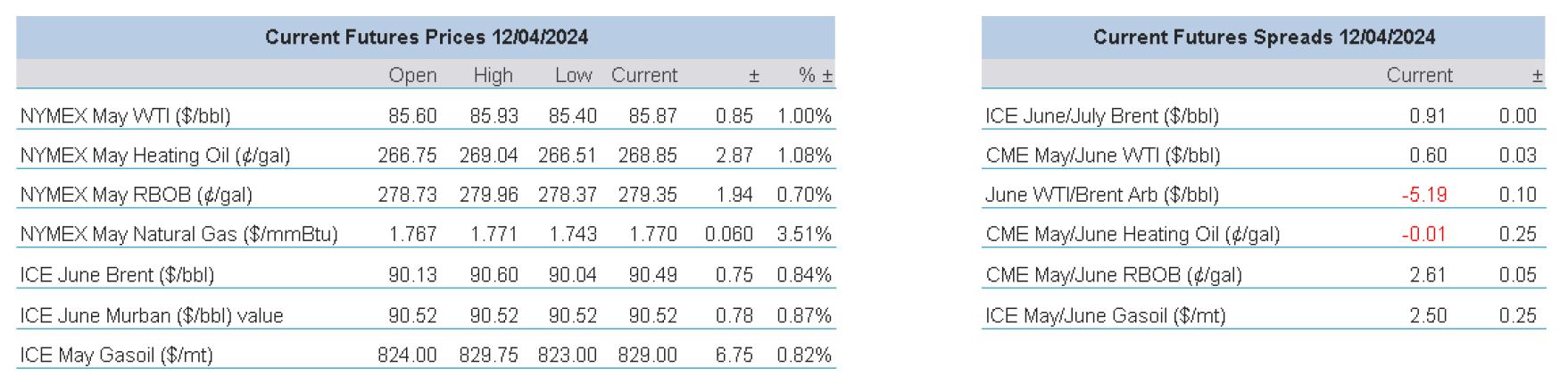

Overnight Pricing

© 2024 PVM Oil Associates Ltd

12 Apr 2024