Escalation Instead of De-escalation

Last week was characterized by ambiguity as investors desperately tried to evaluate the likelihood and the possible timing of a direct US involvement in the Israel-Iran conflict after the Jewish state launched its first attacks on its arch-enemy on June 13. The rhetoric of the White House was not helpful and was even confusing and contradictory. Oil prices strengthened most of the week as fears of significant supply disruption rose. The negative economic impact of US strikes on Iran was mirrored in a sell-off in equities. The sentiment, however, brightened towards the end of the week when the US President set a two-week deadline for Iran to comply with its demands to strike a nuclear agreement. Hopes of a possible diplomatic resolution increased but Brent, although losing nearly $2/bbl on Friday, still ended the latest 5-day period $2.78/bbl higher.

Hopes and expectations are one thing, reality, especially with Donald Trump in office, is quite another. Not for the first and surely not for the last time, he went against the odds and decided to give the green light to an ariel attack on Iranian targets. He did so without Congressional approval (Barack Obama did the same in 2011 when he authorized air strikes on Libya) and notwithstanding his campaign pledge of being a peacemaker. It is tempting to draw parallels with the second Gulf War, the Bush Administration’s war on terror as back then the primary rationale for the invasion was the claim that Iraq possessed weapons of mass destruction. It turned out to be a fallacy and even an actual lie. Iran’s nuclear capabilities, on the other hand, undeniably pose a very real threat to Israel. Ironically, the very same president who ordered the U.S. withdrawal from the Joint Comprehensive Plan of Action (JCPOA) in 2018—an agreement that successfully curtailed Iran’s nuclear activities, and whose collapse accelerated Iranian uranium enrichment—is now Commander in Chief of the armed forces leading the military response.

The weekend’s operation, codenamed Operation Midnight Hammer, used 125 US military aircraft. It included seven stealth bombers. The targets were three nuclear facilities: Fordo, Natanz and Isfahan. The chairman of the joint chiefs of staff said that one of the B-2 stealth bombers dropped two ‘bunker buster’ bombs on Iran’s Frodo nuclear facility, whilst in total 14 of these Massive Ordnance Penetrators were utilized against two target areas. The operation was carried out with Israel's full knowledge. According to US Defense Secretary Pete Hegseth, the operation did not target Iranian troops or civilians. It did not intend to bring about a regime change, which is the ultimate Israeli objective. President Trump labelled the attack a success and said that the three nuclear sites had been ‘obliterated’. He warned Iran of further attacks, which could include the country’s oil export plummeting close to nought, unless a diplomatic solution is achieved.

The long-term consequences of the weekend’s attack are impossible to predict. What is already evident, however, is that the decision to directly involve the U.S. in another foreign war has divided the public and the political elite—even within Trump’s MAGA base. Prominent figures like Steve Bannon (Trump’s former chief strategist), conservative commentator Tucker Carlson, and Republican Congresswoman Marjorie Taylor Greene have all warned against entanglement in the conflict. Others have been more supportive, arguing that the strikes were not aimed at regime change, but at neutralizing Iran’s nuclear capabilities. Democrats, unsurprisingly, condemned the operation. Senator Bernie Sanders labelled the decision unconstitutional, while Representative Alexandria Ocasio-Cortez called for Trump’s impeachment.

In the short term, Iran’s response will be crucial and could determine whether the situation escalates further. The initial reaction from Tehran was predictably belligerent, warning of "everlasting consequences." One possible—albeit unlikely—outcome is that Iran capitulates, agrees to resume negotiations, and restricts its nuclear program to peaceful purposes, with uranium enrichment conducted abroad. This would potentially forestall further U.S. attacks. Alternatively, it could retaliate by launching renewed strikes on Israel or, in a severe escalation, attack US forces in Kuwait, Qatar, the UAE or Bahrain. Although its proxies, Hezbollah and Hamas have been seriously weakened in the last 19 months, the Yemen-based Houthi group could also re-start attacking commercial vessels impeding traffic through the Bab al-Mandab Strait and the Suez Canal. The metaphorical nuclear options are attacks on the region’s energy infrastructures and the closure of the Strait of Hormuz.

This critical maritime chokepoint sees nearly 20 million barrels of oil and refined products sail through daily. While the OPEC+ group holds spare capacity that could cushion the blow, the problem is that most of that oil also transits through this very strait. According to Energy Intelligence, OPEC+ has about 6.75 million barrels per day (mbpd) of adjusted spare capacity—output that could be brought online within 30 days and maintained for at least three months. However, 80% of that capacity is located in Middle Eastern countries, and shutting the strait would severely complicate efforts to reach global markets through alternative routes.

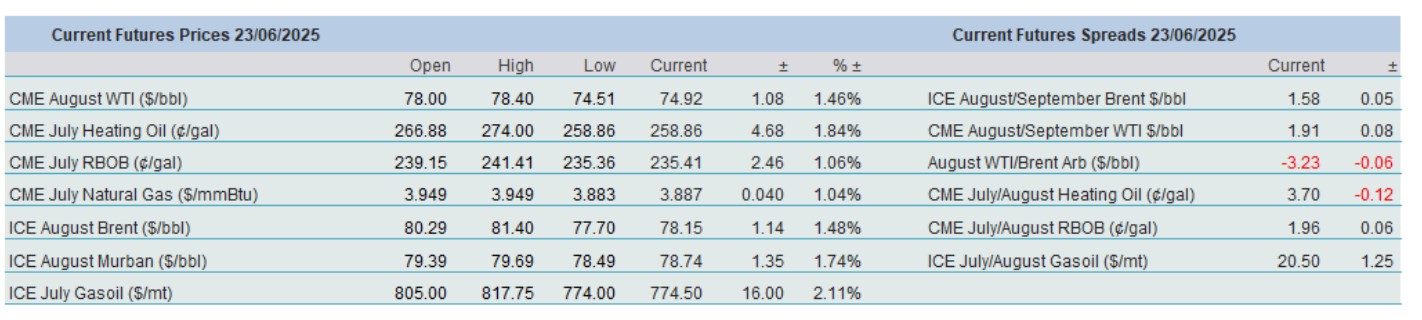

With the weekend’s strikes, Pandora’s box has been opened. U.S. involvement in the conflict is a double-edged sword: it could hasten the collapse of the Islamic Republic and pave the way for democracy, or it could create a dangerous power vacuum, leading to the rise of extremist groups—just as ISIS emerged in the aftermath of the Second Gulf War. For immediate market concerns, the key issue is whether the attack escalates into a broader conflict. Investors’ initial reaction was pragmatic, proportionate and composed. Oil prices started to weaken after a strong opening, stocks drifting lower but not plunging and the dollar is crawling higher. If the Strait of Hormuz is closed or oil facilities are damaged, however, prices could spike above $100/bbl, reigniting global inflation. If these outcomes are avoided, the current risk premium may gradually erode, potentially pushing oil prices below $70/bbl in the second half of the year—especially if a supply surplus materializes, as expected. Our view is that even if the conflict escalates any oil price strength will be transitory.

Overnight Pricing

23 Jun 2025