Everything the Bullish Heart Desires

The latest week kicked off where the previous one left off. Relentless drone strikes on Russian oil infrastructures and auspicious Chinese factory and retail sales data set the tone for the day. Further support arrived from the supply side as Iraq announced a reduction of 130,000 bpd in crude oil exports for the next few months whilst the updated JODI data showed Saudi discipline and determination in balancing the market as the Kingdom’s crude oil shipments abroad declined for the second successive month in January. On the demand front, the Aramco CEO sees no letup in consumption and has called for sufficient investment in exploration and production during the CERA week. Additional boost arrived from the US Energy Secretary, Jennifer Granholm, who, at the same industry event, said that US SPR will match, if not exceed the level that preceded the 180 million bbls sale by the year end. It is a big number, but the devil is in the detail, around 140 million bbls that would have been released between 2024 and 2027 will be left in the SPR because of the cancellation of sales mandated by Congress, whilst 40 million bbls, around 145, 000 bpd, will be replenished in the next 9 months.

Equities were also kind to oil yesterday. The protracted rally in tech stocks sent US indices higher ahead of a series of central banks’ meetings this week. The Australian central bank was the first one and it left rates unchanged. The BoJ, in a vote of confidence of beating deflation, unwound its ultra-loose monetary policy, and lifted rates out of the negative territory. The sentiment has unconditionally turned positive in the last week. It is usually risky to go against the flow and far it be from us to hint at any imminent reversal, the skeptic in us, nonetheless, will intensely watch any development in Russia and China, the major drivers, as supply disruptions have been unplanned in the former and positive economic data could easily turn out to be the product of the Chinese New Year, thus prove temporary. For now, however, the tauri are in control.

The Mixing of Politics with Economy

Last week’s slight increase in both US consumer and producer prices has led to a re-evaluation of the lowering of US borrowing costs. One can be forgiven for thinking that rate cuts are akin to peak oil demand: the latter is always 30 years away and the former has been consistently expected to take place roughly in three months’ time. Last year’s forecast of 6 rate cuts in 2024 is now a distant memory as it has been reduced to three or maybe even two. Those who were betting on a March action have been forced to push their expectations out to June. The updated CME FedWatch Tool now implies a 99% probability of unchanged rates in tomorrow’s Fed meeting, which will retreat to 97% in May. The odds of lowering borrowing costs in June are nearly 60% and there is a 75% probability that benchmark rates will be lower than the current 5.25%-5.5% range by July. Will the current snapshot prove accurate and if it is, how will oil prices be affected?

The Fed has always emphasized that the decision of making the move will be data driven. The Fed’s chair, Jerome Powell, believes that the bank is ‘not far’ from having the confidence to reduce borrowing costs but wants to see inflation moving sustainably towards the 2% target. Given how wrong the Fed got the inflation forecasts 2-3 years ago this pragmatism is understandable. The trigger point will ostensibly be economic data; however, it is possible that politics will also play their part in the decision and if this, in fact, proves to be the case then cutting rates is entirely feasible during the summer.

Election results are greatly influenced by the state of the US economy; that much is suggested by statistical evidence. The reigning governing party usually stands a much greater chance of getting re-elected if the economy is growing and unemployment is falling prior to the elections as voters’ memory tends to span only over a few months. The administration’s economic achievements are something that is currently not acknowledged in US polls, nonetheless there are still a few months to go until November to present a reassuring 4 years to voters. So, the temptation is high to manipulate macroeconomic policy. It is already tangible on the fiscal side as Joe Biden revealed a $7.3 trillion budget plan for 2025, which would push the US debt above 100% of the GDP and which would be mitigated by targeting the wealthy with a minimum tax of 25% and levy corporate America with a minimum of 21% tax.

On the monetary front, the most obvious, and possibly more effective tool than fiscal measures, is the lowering of interest rates. After all tax rises or government spending only affects a narrow segment of society but cheapening borrowing costs have a profound impact on the electorate in the form of lower mortgages or affordable loans. Whilst the central bank, currently run by a Republican, is independent from the incumbent administration of Democrats, it has always been, the Republican presidential candidate, Donald Trump, has made it abundantly clear that he would not re-appoint Jerome Powell in 2025 should he win in November. A rate cut prior to the elections would, consequently, do no favour to Trump just like an implausible rate increase would unlikely save Powell’s job. The political business cycle might just permeate monetary policy resulting in a rate cut in the near future provided that economic conditions will not deteriorate unexpectedly and intolerably.

Common sense dictates that lowering borrowing costs should be supportive for stocks and oil. It would generally incentivize economic activity, create additional demand because of the weaker dollar and at the same time lower the cost of trading. Considerably higher equity and oil prices based on falling interest rates, however, are far from a foregone conclusion. The current equity market strength in the US is chiefly the function of the unsatiable appetite for technological stocks. Oil demand has been continuously advancing post-pandemic, it is at an all-time high and is unlikely to be revised further up. Geopolitics/economics and the supply side of the oil equation currently seem to be the more dominant driving forces. An eventual rate cut is likely to keep investors’ sentiment buoyant, set a floor under risk assets and even trigger a brief rally but its medium to long-term positive impact will be contentious.

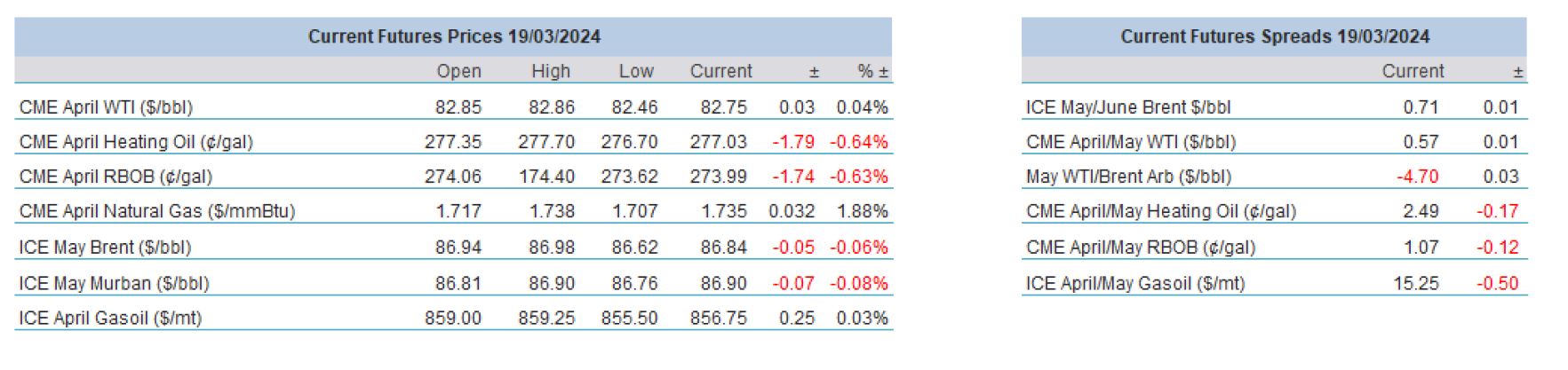

Overnight Pricing

© 2024 PVM Oil Associates Ltd

19 Mar 2024