Everything the Bullish Heart Desires

The names and words such as Iran, Israel, Hamas, assassination, and dead in the same headline usually stimulates the conditional reflexes of any trader worth his or her salt leading to short-covering or even allocating some money to oil as a hedge against escalation and retaliation, which might adversely affect oil production from the region. It is the killing of a Hamas leader on Iranian soil that led to the jump in oil prices yesterday morning. The gut reaction was understandable, but the market behavior is such that in case nerves calm in coming days and output is not threatened this rise in tension will cease to provide perennial support to our market.

This is of course not to say that other factors will not take over. If the strike on the Hamas politician precipitated yesterday’s price rally the EIA report amplified its impact. Dismal Chinese manufacturing data was long forgotten when the inventory stats were released. It showed forecast-beating drawdowns in crude and gasoline stocks. Although distillate stockpiles unexpectedly rose, total commercial inventories declined. Products supplied by refiners stayed at healthy levels, but it was demand from overseas measured as net combined crude oil and products exports that appeared really constructive reaching 2.3 mbpd, a weekly jump of 544,000 bpd.

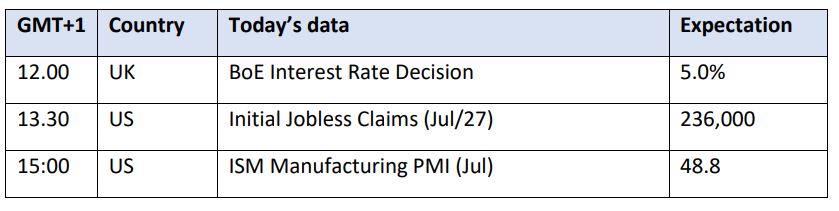

Interest rate developments were also deemed price supportive echoed in the brightening mood in the equity markets. Euro zone inflation edged higher in July, however, the price pressure in the critical service sector eased keeping the ECB on track for another rate cut shortly. The Federal Reserve, as widely anticipated, kept borrowing costs unchanged but its chairman sent out an unmistakably strong signal of the impending cut come September unless implausibly disheartening economic data in the next month or so upends expectations. The stars were perfectly aligned for a significant rise in risk appetite yesterday. It appears that the most dominant of these bullish factors were the EIA data, which strongly insinuates OECD inventories depleting at a healthy clip setting oil on the path of challenging recent highs in coming weeks and months.

After Upbeat 1H, a Dismal July. What’s Next?

There was a general belief in the first half of the year that the Ukrainian war and the and the Israel-Hamas conflict would keep the geopolitical/geoeconomic temperature at elevated level in the foreseeable future. This view proved accurate. Investors also anticipated the global economy perform reasonably well and central banks being on the cusp of lowering borrowing costs. It was a justified expectation and could come to fruition in coming months. Yet, conspicuous Chinese economic headwinds and emerging anxiety about the sustainability of the rally in the tech sector sent global equities lower throughout July after a gain of 10% in 1H, albeit amends were made impressively on the last trading day of the month. The global oil balance was predicted to tighten considerably as the summer driving and holiday season got under way on the northern hemisphere. These hopes have proven to be misplaced. WTI and Brent, after returning 12% in the first half of the year, have lost 4.5% and 6.6% respectively with a convincing backwardation on the front-month Brent in June turning into contango by last night’s expiry.

Risk assets performed underwhelmingly and disappointingly last month. The factors that impacted equity and oil prices last month will plausibly play a salient role in shaping investors’ thinking going forward. Whether it means a protracted move south or the massive dip seen in July will turn out to be an irresistible buying opportunity is open for debate and below we would like to join this discussion.

Geopolitics: July was a busy month even by recent standards. Just think of the mind-boggling events that took place in the US: the assassination attempt on Donald Trump and Joe Biden’s decision to remove himself from the top of the ticket. With Democrats likely endorse Kamala Harris, the presidential race has been thrown wide open. Its immediate impact in oil is negligible but it is worth keeping in mind that the Democratic nominee is an ardent opponent of fossil fuel unlike her Republican challenger.

Events in the Near and Middle East and in South America, on the other hand, could have a profound impact on the oil balance. The increase in tension between Israel and Hamas was seasoned with the Iranian presidential election run-off at the beginning of the month and was won by a moderate. The swearing-in ceremony was accompanied by ‘Death to America, death to Israel’ chants. It is this background against which Israel launched an attack in Beirut killing a senior Hezbollah commander in retaliation of the Golan Heights assault, shortly followed by the deadly strike on a top Hamas leader. The assassination took place on Iranian soil and the market’s instinctive reaction was a meaningful rally as the odds of an actual supply disruption grew, the thinking went. We have long argued that such a development is anything but a foregone conclusion, nonetheless the gunpowder barrel called the Middle East will keep providing a few dollars of geopolitical risk premium and so would sporadic Ukrainian drone strikes on Russian oil infrastructures.

The manipulated result of the Venezuelan presidential election was somewhat expected, the ensuing protests were probably not. Its impact, therefore, is unclear. Should the incumbent crush the attempts of removing him the sanction screw will be tightened but in case Maduro is removed the Latin American country will gradually be re-integrated in the global oil export market.

Economy: with a little bit of goodwill and optimism one might conclude that economic prospects remain sanguine. The IMF, in its updated World Economic Outlook saw global growth at 3.2% for 2024 but warned of persistent service inflation and a slow progress of disinflation in developed economies. Yet, the consensus is that inflation is being reined in and central banks could cut interest rates soon. Such a move has a political dimension in the US as a September rate cut by the Fed could undermine Trump’s chances of winning the election. The world’s biggest economy expanded faster-than-expected in 2Q, consumer confidence grew. Although the US economy added more jobs than thought in June, unemployment ticked up to 4.1%. Eventual rate cuts will be an undeniable confidence booster.

Although US equities were under intense pressure for most of July due to a retreat from historic highs in the tech sector the economies of the developed world are on a moderately sound footing. There is, however, big trouble in big China as the country’s leadership is reluctant to stimulate its economy and fight against deflation. Consumers still prioritize savings; retail sales grew by a disappointing 2% in June and the country’s manufacturing sector reached its lowest point in five month as new orders are on the descent. Trade tensions with the EU and the US have also had an adverse impact on growth prospects. The collective direct result is falling Chinese crude oil imports and refinery closures due to unattractive margins. Admittedly, the Chinese economic malaise is the most significant spanner in the works that has kept oil prices under pressure. Any willingness to provide economic catalyst will almost unreservedly aid oil to reverse course.

Oil balance: ailing Chinese economy and discouraging equity markets forced the IEA to cut its 2H call on DoC demand by 200,000 bpd in July whilst OPEC downgraded it by 50,000 bpd. Yet, both forecasters still pencil in some drawdown in global oil inventories for the second half of the year although the gap is yawning: 250,000 bpd, according to the IEA and 2.05 mbpd, OPEC reckons. The curious development over the course of July was that despite the considerable fall in outright prices crack spreads held up reasonably well. There was a slight pressure on distillate-crude oil price differential but the CME RBOB/WTI and the 3-2-1 crack remained confidently stable. Add to that the 15.5 million bbls drawdown in US crude and the 8 million bbls plunge in gasoline inventories last month (distillate stocks built 7 million bbls) and there is a case to make that the long-awaited improvement in consumption is finally on its way. It is probably reasonable to wrap up this note by concluding that, pending Chinese economic fortunes, the move lower in risk assets in July will prove to be a healthy, albeit somewhat vicious retracement when one looks back at the monthly performances at the end of the year.

Overnight Pricing

© 2024 PVM Oil Associates Ltd

31 Jul 2024