Fading Peace Prospects, Falling US Oil Inventories

A combination of factors pushed oil prices higher, more than offsetting Tuesday’s losses. Following the recent diplomatic pinballing, it is once again suspected that Russia will not accept the role of the loser. Talks of a Russia–Ukraine meeting remain just that - talks - and US security guarantees for Ukraine would only be acceptable if Russia were included. You got that? Washington and Europe could only provide defence against Russian aggression if the aggressor held a veto. Simply put, the possibility of tighter sanctions on Russia, however implausible, has resurfaced, tempting trigger-happy bulls to start firing, and they did. President Trump’s current strategy of not antagonising Vladimir Putin, however, could turn on a dime, experience suggests.

Further momentum came from the EIA’s weekly inventory report. A steeper-than-expected crude oil draw was driven by net imports falling 1.2 mbpd as gross exports surged. Gasoline stocks also plunged, while distillate inventories rose modestly. Commercial stocks nonetheless fell by more than 4 million bbls as proxy demand stood above 21 mbpd last week. Although the Whiting refinery has restarted, full operations are not expected until next week, according to IIR, hence the sustained strength in distillates.

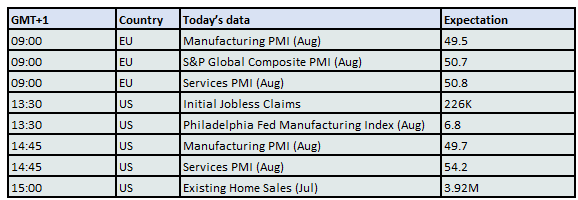

The duration of this optimism is uncertain for three reasons. First, markets remain headline-driven, and an ostensibly bearish one could lead to the souring of the sentiment again. Second, the wobble in tech stocks might unnerve investors and risk spilling over into other asset classes. Third, the news flow will be heavy in the coming days: today brings PMI releases in Europe and the US (Japanese manufacturing contracted in August, but the Indian economy appears on steroids as the composite PMI covering the private manufacturing and service sectors rose from 61.1 to 65.2 this month). Tomorrow, the Fed chair delivers his closely watched speech. There is further upside potential in oil, but its longevity is anyone’s guess – the very definition of unpredictability.

Tragedy of the Commons

Calling the upcoming annual Jackson Hole symposium pivotal is somewhat of a cliché, as the event is traditionally expected to illuminate the monetary path central banks around the world are taking. Terms such as crucial, critical, or make-or-break surface every year, and 2025 is no exception. The most eagerly anticipated address is that of the Federal Reserve chair, given that the US is the world’s largest economy. If it sneezes, the world catches a cold, or even pneumonia. If it is in good health, the benefits are also felt globally. Against the backdrop of looming trade wars and rising import tariffs, Jerome Powell’s speech tomorrow will undoubtedly carry extra weight, and every single word will be closely parsed by analysts and investors.

The central point of contention is whether a cut in borrowing costs is imminent. The acrimony between the data-driven Fed and the coercive US administration is well publicised, thanks largely to the President’s almost daily interventions. The Jackson Hole conclusion will re-emerge in Tuesday’s note; for now, however, it is worth examining the spectacular performance of equity markets despite the Fed’s reluctance to cut rates. This resilience, notwithstanding the tech sell-off of the last two days, echoes not just a generic response to uncertainty, but specifically, there are notable parallels to how markets handled the Ukraine invasion and the current trade conflict. While comparing geopolitical and trade disruptions might initially seem forced, both create global economic uncertainty and trigger anxiety about growth, yet both also reveal markets' capacity for adjustment.

Russia’s invasion of Ukraine is a military conflict with sweeping economic consequences. The US attempt to re-shore manufacturing and shield its domestic market from foreign competition has sparked trade wars of its own. In March 2022, a month after the Russian invasion, Brent crude spiked to nearly $140/bbl amid fears of a major disruption in oil supplies, given Russia’s role as a leading producer and exporter. In April 2025, shortly after the Rose Garden announcement of steep tariffs on US imports, equity markets tumbled as concerns about inflation and recession intensified.

Yet in both cases, what followed was a reassuring consolidation. Oil prices quickly retreated once it became clear that the feared collapse in energy supply was instead a realignment of flows. The most striking example is Europe and India: as European imports of Russian oil and gas plunged under sanctions, driven by the stated goal of eliminating energy dependence from its former supplier, India (along with China, Turkey, and several Latin American countries) eagerly and happily absorbed the discounted barrels.

A similar pattern may emerge with goods blocked from the US by tariffs, particularly from China. Trade flows are already being redirected. Exports to the US may decline, but shipments to Europe, South Asia, and Latin America could rise. While the political debate increasingly invokes “national security” concerns, manufacturers and exporters, not exclusively Chinese, are nevertheless finding new markets for their products, much as Russian oil found its way to India, China, et al.

The odds of a global recession have therefore receded significantly, as reflected in the extraordinary stock market rally, just as the feared oil shortages of 2022 never materialised. Oil flows were redirected then; export flows are likely to undergo a comparable transition in 2025–2026. Still, it is important to acknowledge the distortions such disruptions create. Europe now pays higher energy prices, while Russia loses vital oil revenues. Similarly, in the trade war, exporters must offer discounts, while US consumers will bear the brunt of higher tariffs.

In both scenarios, catastrophic economic shocks have been avoided, but the negative consequences are undeniable. To rethink the economic concept of the Tragedy of the Commons: individual actions, Russia’s invasion of Ukraine and the US attempt to rewrite the global trade order generate harmful repercussions for all. And while Russia bears heavier costs than most by suffering from the self-inflicted economic wound, the US is also undermining itself by rejecting the very benefits global trade was designed to deliver.

Overnight Pricing

21 Aug 2025