The Fall from the Summit Could be Painful

If you think the investment environment is bewildering, you are correct. The now-infamous nonfarm payroll data from two weeks ago and the subsequent sacking of the head of the Bureau of Labor Statistics raised many eyebrows, prompting questions about data accuracy. Consumer inflation data was mixed, with the headline reading better than expected but the more significant core figure proving a tad disappointing. Although initial jobless claims fell in the latest week, hiring slowed, perhaps an unmistakable sign of faltering aggregate demand. The unexpected rise in producer prices has thrown a spanner in the works for a September rate cut. Equities, despite yesterday’s PPI-induced lackadaisical performance, are holding up reasonably well, but bond yields are not reflecting an unambiguous show of confidence in the US economy. Cast your eyes to the opposite corner of the world, and you will learn that the state of the Chinese economy is anything but sanguine, with both factory output and retail sales growth disenchanting.

The oil market is sending equally confusing signals. Distillate support seems to be evaporating, US crude oil stocks registered an unforeseen increase, and the oil balance for the remainder of the year is expected to turn loose — or very tight, depending on which forecasters one believes. The geopolitical risk premium is still tangible, and in the case of implausible secondary sanctions on Russian oil dealings, a brisk rally cannot be ruled out.

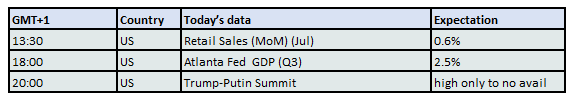

It is worth remembering that, aside from yesterday’s technical bounce, oil prices have trended lower recently. Given today’s pivotal summit between Donald Trump and Vladimir Putin, which is expected to shed some light on Ukraine’s future and will begin at 1900 GMT/1500 EDT, further short-covering would not come as an utter shock. The mind games have begun, mandatory optimism is being disseminated from both sides, but a mutually acceptable outcome is as dubious as Israel recognising an independent Palestinian state by the end of next week. So, what to expect come Monday? Well, today is what Monday’s report will be all about.

Differences Remain, Inventories Ought to Rise

There was no major surprise after the updated monthly supply–demand prognoses were released earlier this week. What is noteworthy is that the EIA reduced its estimate for the 2H 2025 DoC call by 340,000 bpd, predominantly because it revised upwards its non-DoC supply estimate by a hefty 460,000 bpd. OPEC went in the opposite direction and, although it left its 3Q projection unchanged, it raised the 4Q DoC call figure by 200,000 bpd due to a cut in the supply projection from producers outside the alliance by the same margin. The IEA lowered its call forecast for 2H by 50,000 bpd – no change for 3Q, but a downward revision of 100,000 bpd for 4Q. It is also notable that the energy watchdog of developed economies, acknowledging the faster-than-anticipated rise in DoC production, raised its global supply growth estimates by 370,000 bpd for 2025 and by 620,000 bpd for 2026.

The diverging views, therefore, remain intact. OPEC is still buoyant on 2H prospects, whilst the other two agencies paint a comparatively grim picture. These tangible gaps are echoed in global and OECD stock changes for the latter part of the year. Both the EIA and the IEA anticipate considerable swelling in inventories, in contrast to OPEC, which expects counter-seasonal drawdowns. To put numbers on it, the gap is as large as 2.7 mbpd: the statistical arm of the US Department of Energy foresees a rise of 1.86 mbpd in global stockpiles versus a plunge of 850,000 bpd in OPEC’s view. The difference in predicted end-year OECD stock levels has stretched to an almost unprecedented 201 million bbls.

As mentioned above, OPEC’s stance runs counter to empirical evidence, which shows rising stocks in the second half of the year compared with the first six months. Even after accounting for seasonality, the disagreement remains clear. OPEC is the only forecaster that predicts a small depletion of 2H 2025 industrial inventories in the developed world from the corresponding period of 2024, from 2.781 billion bbls to 2.747 billion bbls, assuming a 2H 2025 DoC output of 42.55 mbpd. Conversely, the other two agencies envisage substantial year-on-year increases in OECD stockpiles for July–December: 88 million bbls (EIA) and 90 million bbls (IEA). To approach the discrepancy from the price perspective, OPEC appears to anticipate, at least according to the numbers, that the 2H 2024 average Brent price of $76.38/bbl will be exceeded in 2H 2025, much to the disapproval of the EIA and the IEA.

The current forward curve disagrees, sitting well below last year’s average price. The protagonist of OPEC’s view, however, would argue that the backwardated structure of the two major crude oil contracts implies genuine strength, also confirmed by strong Brent CFDs. She would also take comfort from robust crack spreads, particularly for distillates. The antagonist would point to the tentative recovery in distillate inventories and argue that although various spreads, time as well as crack, are indeed uncharacteristically and seasonally strong, the retreat has already begun.

Those siding with the EIA and the IEA would also emphasise the almost religious seasonality observed in weekly EIA stock data. It shows, year after year, that stocks in the so-called “other products” category, which includes any oil with a boiling range equal to or greater than 401°F, tend to increase meaningfully in the second and third quarters. This will, almost by definition, help US commercial stockpiles continue the ascent seen over the past three months or so until October. Given that US industrial stocks make up around 44% of OECD oil inventories, this should translate into an overall increase in stocks in the developed world.

This synopsis does not attempt to suggest protracted weakness in oil prices. After all, the 2H 2025 curve is nowhere near the average 2024 price; rather, it reflects an equilibrium price based on the latest oil balance forecasts. It also merely establishes that any rally towards the upper end of the current trading range, seen in the $59–$74 band, potentially precipitated by the US hurricane season, a cold snap in the northern hemisphere or a transient disruption to Russian energy exports, would, in all likelihood, be viewed as an irresistible selling opportunity.

Overnight Pricing

15 Aug 2025