The Feel-Good Factor Spreads

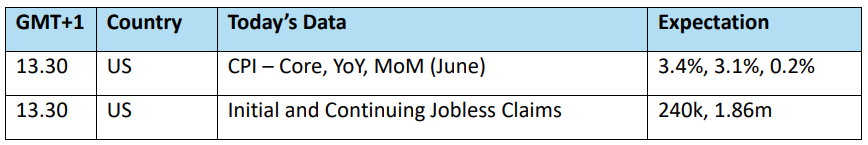

It remains difficult to not approach each morning by first looking at the state of equities. When the Nikkei, S&P and Nasdaq continue to make record highs on a daily basis, it is always worthy to see if the infectious bullish behaviour in stock markets is about to jump species and influence commodities such as oil. Looking for demand and that which drives it is always responsible, however, demand can accumulate from sentiment and bourses are dripping with positive vibes. The hunt for interest rate cuts is experiencing a global groundswell and after New Zealand's RBNZ indicated a tolerance for at least consideration of lower lending costs, the Bank of Korea, while similarly keeping rates at unchanged, indicated that it too was gearing up for cuts. Meanwhile, in his second of speeches to US lawmakers, Jerome Powell played with a straight bat again, but conceded that if data continued in its current good reading the case would build for the FED to act. Core inflation is expected to fall, one of the key pieces of data comes today in the form of the US CPI, which analysts expect to have improved annually to 3.1% in June from 3.3% in May. This is reflected in how the CME FEDwatch pricing tool indicates a 75% likelihood of a cut in September. As an interesting aside, Mr. Powell took great umbrage during a post-speech press conference when asked if the forthcoming US election might influence a September decision.

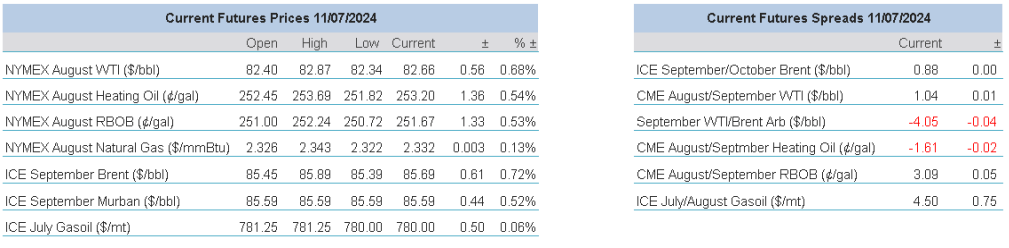

Proving migrating confidence into oil is tricky, but with US Dollar taking a backward step due in part to interest rate reduction chat, there is some tangibility. Admittedly, the greenback was nudged lower by a Bank of England talking head pushing back against a UK rate cut and urging Sterling on, but oil as always performs better when the Dollar gives. Still, the surrounding events within the oil news of yesterday at last brought something of brake to the current downward correction. Unsurprisingly, in its monthly report OPEC continued to predict growth of 2.2 million barrels per day in 2024 and also held its call for 2025 at 1.8mbpd. An aid to prices came from the EIA Weekly Inventory Report. Crude stocks fell by 3.4 million barrels against a reduction call of 1.3mb, stocks at the Oklahoma hub of Cushing fell by 702k barrels in line with a TankWatch call of -900kb and Gasoline diminished by 2mb against -0.6 expectation. Such opinion and inventory data, coupled with investor expectation and fear of Israel's intent at the border with Lebanon is more than enough to bring support to what has been a tough week for bulls. We await the IEA monthly and how markets kick about the eventual US CPI reading.

Ukraine should never be ignored

We live in an ephemeral world in terms of news. Our attention is screamed at by the headlines of the day’s banners, “look at me, look at me!”. Successions of bad news stories and the misery of the world outdo each other, and we are always told that we are a nano-second away from global annihilation be it from environmental disaster or as some would make us believe an inevitable nuclear weapons exchange. Dulled by such noise it is understandable how the swipe, click and scroll has demoted the goings-on in the Ukraine from the front page of consideration to the also-rans of stories next to ‘who wore what’ and ‘how can he play on the right wing when he only has a left foot?’ Maybe attentiveness will revert to Eurasia after the gathering of NATO leaders for their 75th anniversary summit in Washington.

For us of an oily disposition, it is probably fair to say that we might just be as guilty of nonchalance if it were not for massive influence that anything to do with Russia has on the oil flow of the world. Which is why what ‘the great and the good’ (dripped in sarcasm, with no apology) of the political world say concerning the conflict, is likely to exert seen and unforeseen influence in the bloody impasse of war on both the European and NATO border and subsequently oil prices. If Russia was hoping for an agenda place a little way down the list on what was to be discussed, it scored an own goal and elevated itself to the premier issue by its latest barrage of missiles sent into Kyiv. Straining the point made above, the targeting of civilians is nothing new and there has been a corporate state of immunity developed by the rest of the world but targeting a children’s hospital powers up social attention; targeting a children’s hospital for the sick, dials up scrutiny to the maximum which will force pressure on an assembled NATO.

Whatever disharmony might have been bubbling within the alliance, the Ohmatdyt Children’s Hospital is serving as a unification point for world leaders to rally around. Fortuitous in fact for US President Joe Biden who managed to get his cognitive teeth into some meaty prose, “Russia will not prevail,” he said, “Ukraine will prevail” being part of the keynote address concerning the war. There ensued an outlining of increased air-to-air defensive systems that would see international contributors. Five strategic systems were outlined including the US, Germany and Romania sending additional batteries of Patriot missiles, Italy the SAMP/T air defence system and Patriot components from the Netherlands. Whatever reluctance there has been for NATO members in showing too much commitment has now well and truly been quashed. However, where reluctance will prevail is allowing Ukraine to become part of the North Atlantic Treaty Organisation. Supplying weapons as a self-defence medium is one thing, allowing the joining of a new member already at war is another. Being a member of NATO ensures support in conflict from existing members and there is little stomach, even from the US, for direct military engagement with Russia.

One wonders how any increased support for Ukraine will hold out if the USA rolls the dice and takes the Donald Trump fork in its political road in November. Whether or not any arms agreement can be ‘Donald-proofed’ remains to be seen. Mister Trump is no lover of NATO judging by his former rants and has very much criticised the extent to which the US has committed aid to Ukraine. The political intrigue is about to be increased again, and with it market anxiety in a war that at present sees no end despite the braggadocio of Trump who claimed last year that he could end the war in one day. A briefing on election security by US Intelligence said, “we have not observed a shift in Russia’s preferences for the presidential race from past elections”, and while Trump was not named the inference is obvious. Political anxiety aside, the UK’s new Prime Minister said that aid supplied by Britain was “for defensive purposes” but Kyiv can “decide how to deploy it for those defensive purposes”, he told reporters en-route to the NATO summit in Washington, according to The Telegraph. Such language is arbitrary, and because the quote was based around conversation involving the UK’s Storm Shadow, a form of cruise missile, if similar systems and accompanying, ambiguous diplo-speak is used from other nations then Ukraine might be given a greater ability to strike into Russia. NATO in unity is one thing, a strategically strengthened Ukraine is another. However, all these scenarios lead to flow charts of anxiety at the least, and greater conflict at the worst. The world’s population, news services and markets ought to pay much more attention, for in the future and in today’s interconnected world, if another bombing of a children’s hospital in Eastern Europe occurs we should not be surprised to see a gasoline price rally in the US.

Overnight Pricing

© 2024 PVM Oil Associates Ltd

11 Jul 2024