Fixating on $100

In hindsight, yesterday’s and this morning’s price action is reasonable and sensible. The impressive run up in crude oil prices had to come to a temporary halt and today’s Fed decision on interest rates provides the perfect excuse to bank some money, especially that the expiring WTI hit its target, the 50% correction point of the June 2022-May 2023 downtrend at 93.74, which coincides with last November’s peak. In other words, it is a salient technical hurdle and in case the November contract clears it bulls will justifiably feel emboldened to start firing again from all cylinders. Heating Oil and Gasoil underwent a heartening revival and, as laid out below, could provide further support. Azerbaijan’s muscle-flexing over Karabakh adds to the geopolitical risk premium and last night’s API data, showing a significant decline in crude oil and a small fall in distillate stocks, is also deemed constructive.

The auspicious fundamental backdrop, however, is being confined to the back of investors’ minds for the nonce as attention today shifts to the Fed and its approach of controlling inflation. High energy costs are unquestionably hindering the cheapening of consumer prices as it was demonstrated in last week’s US August CPI data and yesterday’s euro zone inflation reading. Although the flash estimate of 5.3% was revised down to 5.2% in the common currency area for last month, it is still well above the 2% target raising fears that the ECB might keep rate high for the foreseeable future. (Running counter, UK inflation unexpectedly moderated in August.) As for the Fed, pausing rate hikes is the widely expected outcome of today’s FOMC meeting, nonetheless, persistently strong US economic data could also force the US central bank not to encourage cuts and even up borrowing costs one more time this year. That said and barring any unpleasant surprise, attention will likely return to the perceived supply deficit once interest rate decisions are out of the way and reaching the $100/bbl milestone remains a not-so-distant possibility.

|

GMT +1 |

Country |

Today’s data |

Expectation |

|

19.00 |

US |

Fed Interest Rate Decision |

5.5% |

Historically Low Distillate Inventories

For a few months now we have been of the view that distillates and diesel will provide an invaluable support for the oil complex come the last quarter of the year for three major reasons. Firstly, refinery turnaround in the US is expected to create shortage in the product. Secondly, Europe will not be able to satisfy its needs during the winter months therefore will be forced to compete for significantly diminished volume. Thirdly, Russian exports, partly due to the G7 export ban, will be seriously constrained.

The picture is not as unambiguous as was expected few weeks ago. Sure enough, the oil complex, in general, is in an undeniable uptrend but the move higher has been led by crude oil in the recent past. Heating Oil and Gasoil, whilst occasionally outperform WTI or Brent, are generally lagging. It is manifested in retreating crack spreads. The Heat/WTI price differential, for example, lost more than $10/bbl between last Thursday and Monday. The front-month Gasoil crack on ICE declined $6/bbl in the same time frame. The structures of the contracts also weakened considerably in a few days. The October/November Heating Oil spread on the CME narrowed 3 cents/gallon in the last couple of days and its European peer lost $7/tonne. Admittedly, amends were made yesterday underlining the volatile nature of distillates.

One of the reasons for the unexpectedly tepid performance, as pointed out in yesterday’s note, is rising Chinese exports. Diesel exports jumped to 1.26 million metric tons last month, an increase of more than 50% on July. During the first eight months of the year Chinese diesel shipments have doubled from the comparable period of 2022, customs data suggests. Secondly, Russian sales were holding up well, too. Seaborne diesel and gasoil exports were up 2% last month to 3.85 million metric tons despite the embargo and the price being over the cap, LSEG data shows. As the re-alignment of oil flows continues Russia sent shipments as far as Africa and Brazil, with the latter directly competing with US exports.

No doubt, the signs have occasionally been unfavourable, nonetheless it is too early to conclude that it was misguided to foresee tight global distillate market. The curious thing is that despite the recent correction in crack spread values and structures the market is still seemingly strong by historic standards. Let us remember that the Heat crack at $50/bbl is still unbelievably attractive and compares with $20/bbl in September 2021. (Last year’s swelling above $70/bbl was plausibly a knee-jerk reaction to the uncertain consequences of the invasion.) ICE Gasoil/Brent spread, despite the recent weakness, is also strong by the 2021 standard. At $36/bbl it is thrice as expensive as during the autumn of 2021.

Going forward, it is simply impossible to know whether China will maintain elevated exports levels and, of course, published data must be taken with a shovel of salt. (Consider this - Bloomberg spotted that China’s imports of Malaysian crude oil last November was twice the country’s actual production.) As a fund manager put it, it is a bold and risky endeavour to trade off Chinese data. Russian exports could also be on the descent as it plans to reduce diesel exports by 25% in September from its Baltic and Black Sea ports. Energy Intelligence notes that the country’s energy ministry is preparing to issue quotas for domestic sales and exports as it is prioritizing the easing of supply deficit in the domestic market over shipments abroad and an export duty of $250/metric ton is also under consideration.

Finally, and perhaps most importantly, global middle distillate inventories are depleted by seasonal norms. US distillate stocks, as reported by the EIA, are 11% under the 5-year average. In the ARA centre in Europe the deficit is 17%, PJK International finds, whilst in Singapore current middle distillate inventories are also 17% under the long-term average, according to Enterprise Singapore. Combined stocks in these three hubs are at 146 million bbls, 20 million bbls or 12% shorter than the 5-year average whilst 13 million bbls or 9% under the corresponding week of 2021. Although the erratic behaviour of Heating Oil and Gasoil is understandably discomforting for those with bullish propensity, refinery maintenance, the perceived cut in Russian exports and low inventories going into the winter foretell limited price downside and renewed strength from the middle of the barrel despite Middle East exports, to a small extent, mitigating the impact of missing Russian barrels.

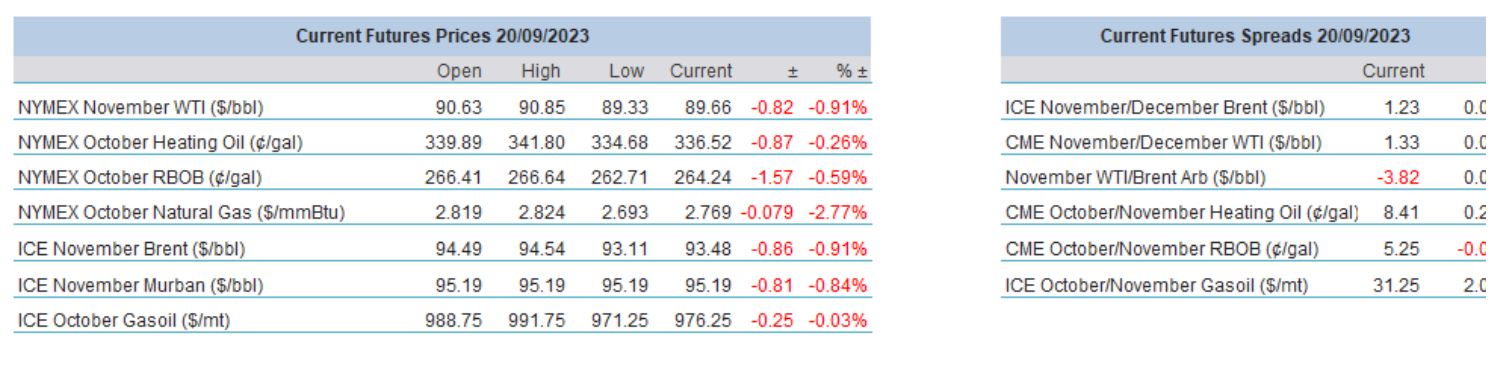

Overnight Pricing

20 Sep 2023