The Floundering Greenback Aids Bulls in All Asset Classes

If there was any doubt on what course the White House was plotting for the US Dollar, it came in a certain glib, throw-away comment from the US President yesterday. With the notion of de-dollarization rife in market chatter, when Donald Trump was asked whether he was concerned on the state of the US Dollar and its value he replied that it was “doing great.” Given the Conference Board’s Consumer Confidence Index fell to 84.5 in January, the lowest in over a decade, it was a perfect sail-filling zephyr for the flotilla of eager dollar bears to run rampage with. The US Dollar Index and the Dollar’s pairing with the Euro slumped to levels not seen since 2021.

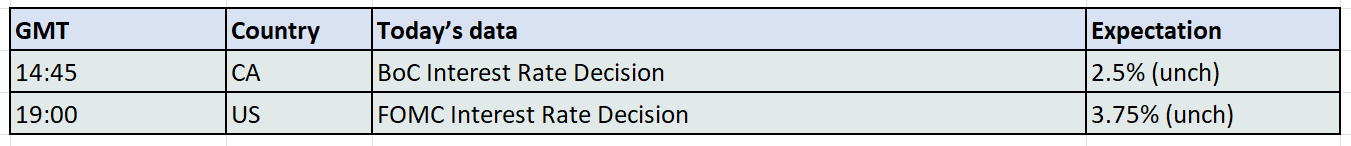

Today’s US Federal Reserve decision on interest rates will not be affected by a collapsing home currency, but their conservative eyes must be drawn toward how a lower US Dollar incentivises all assets higher and thereby fuels inflation. Stock markets are chased forward anyway by expectancy from the results of the Magnificent 7, starting with Microsoft, Tesla and Meta today. But with higher ‘bookings’ in the fourth quarter from ASML and reports from Reuters on how China is about to allow the first batch of Nvidia's H200 artificial intelligence chips for import, S&P500 futures is surpassing the dizzying heights of 7000 this morning.

The cheapening USD is not lost on oil prices either. Aligning with equities in how the Dollar is an enabler, the recent rally is still garnished with a hangover of production issues caused by winter’s grip in the US and the slow revival of production and delivery from Tengiz and the recently repaired CPC mooring delivering oil into the Black Sea. Much of the effect is on sweet grades of crude oil, which is why there is such a strong showing from the Brent contract and its structure as it nears the expiry on Friday.

Invisible but Real Risks

The Siamese twins that used to be joined at the hip, equity and oil prices, that is, have been separated of late and, more often than not, now move in opposite directions. This decoupling, nonetheless, does not alter the economic axiom. Stock markets are still a somewhat faithful reflection of underlying economic health, which, in turn, has a profound impact on oil consumption. Yet a bull market in equities does not contradict sluggish performance in oil, as rising production can always lead to excess supply. Without an auspicious economic backdrop, the oil balance would be even looser.

It is, therefore, imperative to understand what the major drivers behind equities are, whether investors’ mood regarding the global and regional economies will remain sanguine in the foreseeable future, or whether there is a risk of a downturn, which would then result in an even more pronounced oversupply.

Stock market performance over the past year, since President Trump occupied the White House for the second time, has confounded expectations and perplexed investors and analysts, including the writer of this piece. After all, the incumbent US administration’s most lethal trade weapon is import tariffs, which are deemed to be a tax on US consumers and, in the case of reciprocal measures, on trading partners as well. Although the Liberation Day tariff rates were scaled back considerably, the average effective US tariff rate on all imports is still estimated to be around 15%, the highest in almost 100 years and a tenfold increase from the 2022 weighted average. Yet what we see is that the MSCI All-Country Index has rallied 44% since the post–Liberation Day bloodbath, while the Nasdaq Composite Index, thumbing its nose at stubborn inflationary pressure, has returned 60% over the same period. Has the global economy been inoculated against excise duties and trade tensions, and has President Trump been vindicated?

The relentless march higher in equities has seemingly proved the naysayers spectacularly wrong. The reality, however, is far more nuanced. There are probably three reasons behind the economic and stock market resilience. The first is the support emanating from the emergence of artificial intelligence, which, through data centres, is also a pivotal source of energy demand growth. AI spending not only provides a boost to US tech companies but also to the economies of Taiwan and South Korea, exporters of AI-related goods. The second is expansionary fiscal policy, together with interest-rate cuts by several central banks last year, including those of the US, the EU, the UK, Australia, New Zealand, Canada, Sweden and Norway. Lastly, the reluctance of US firms to pass tariffs on to consumers also played its not insignificant part.

These three factors have greatly contributed to the auspicious economic backdrop reflected in upbeat growth estimates. The Atlanta Fed, for one, expects the US economy to have expanded by 5.4% in 4Q 2025, the most robust growth rate in 10 years, apart from the post-COVID recovery. The IMF revised its 2026 global GDP growth forecast from 3.1% in October to 3.3% this month, with inflation expectations also moderating year on year.

This buoyant economic environment suggests protracted optimism for the rest of the year. Yet most forecasters, despite their confidence, warn of possible downside risks. These include the admission that the recovery currently underway is uneven, or K-shaped, with some sectors thriving while others suffer, widening the inequality gap and rendering the expansion unsustainable. Estimates suggest that tariffs in the US added 0.7% to inflation and made the average US household $600 poorer. Their impact will become more visible in 2026 as front-loading gradually diminishes. The AI sector could also disappoint. Owing to fierce competition for dominance, tech companies have increased spending by tapping the debt market. If the chasm between valuations and returns widens, the AI bubble could burst with a deafening bang. Another risk lies in the growing share of investment flowing into unregulated sectors, such as cryptocurrencies. The waning ability to manage the ever-growing mountain of public debt could also prove a gnarly challenge, although a weak dollar might provide some relief. China’s export-oriented economy is another source of tension. Reigniting trade wars remains more than a distant possibility. Should all hell break loose and US adversaries, long $27.6 trillion in US assets on a net basis, decide to sell, the repercussions would be beyond imagination.

Of course, all of the above are merely assumptions. This inventory, without claiming to be exhaustive, has simply attempted to outline the potential risks and dangers that could derail or slow the economic recovery. If or when the present optimism fades and sentiment sours, oil demand estimates will inevitably be recalibrated, further inflating already swelling oil stockpiles.

Overnight Pricing

28 Jan 2026