Fragile Confidence in Growing Supply Surplus

It is almost impossible to comprehend the true motivation behind the flurry of activity by the US political elite in recent days, which has included the extraction of the Venezuelan president, only to replace him with his deputy, redirecting the country’s oil fortunes from China to the USGC, threatening to annex Greenland, seizing a Russian-flagged tanker in the North Atlantic, and detaining a ‘dark fleet’ vessel closer to home in the Caribbean. It is possibly a combination of transactional foreign policy, the use, or even abuse, of military and economic dominance for leverage, and an attempt to deflect attention from domestic troubles, be they the affordability crisis or the Epstein files, a list to which now the fatal shooting of a woman by an ICE agent in Minneapolis can be added.

In these truly gobsmacking times, investors are unable to look further than a day ahead and can only cook with presently available, rather bitter, ingredients. Therefore, when the US administration claims it will promptly receive millions of barrels of Venezuelan oil and asserts its authority over the country’s oil sales indefinitely, including its national oil company, the WSJ reported, conditional reflexes inevitably kick in, suggesting a growing availability of crude oil. The meal that has been served has been a conspicuous downward pressure on oil prices over the past two trading sessions

The weekly EIA data on US stocks failed to brighten the mood, notwithstanding the 3.8 million barrels drawdown in crude oil inventories. This was more than offset by a combined swelling of 13.3 million barrels in gasoline and distillate stocks, bloating commercial inventories by more than 8 million barrels, a foretaste of stock changes in OECD and global oil inventories in the first quarter of the new year, and possibly beyond. Sentiment is bearish, but the flexibility to swiftly change one’s mind remains a prerequisite for sound trading decisions, as this ominous and disturbing chapter of 21st-century history still has many pages left to be read and digested.

Products Outperform Crude Oil

Commodity index providers calculate the weights of components based on each commodity’s global production, weighted by market value and liquidity as the most salient factors, and adjust them annually. In most indices, energy—and within that, oil—plays the most significant role. It is noticeable that crude oil far outweighs refined products within this sub-sector. When examining the five major oil futures contracts traded on the CME and ICE, one finds that WTI typically carries around five times the weight of Heating Oil or RBOB, while Brent’s weight is roughly four times that of Gasoil.

There is a strong case to conclude that the predominant role of crude oil within the oil segment is somewhat unjustified or at least overzealous, possibly for two reasons. First, focusing on the three major CME oil futures contracts, refining one barrel (42 gallons) of physical West Texas Intermediate yields 19–20 gallons, or about 45%, of motor gasoline and 11–12 gallons, or roughly 26%, of distillates. Refinery yields would therefore imply a weighting of around 58% crude oil, 26% gasoline, and 16% distillates. Similarly, approximately three barrels of Brent yield one barrel of middle distillate; accordingly, in the ICE Brent/Gasoil relationship, a split of 65%–35% appears more reasonable than the 80%–20% ratio reflected in the weighting of commodity indices. Second, historical data show that the long-term returns of refined products have been significantly more attractive than those of crude oil.

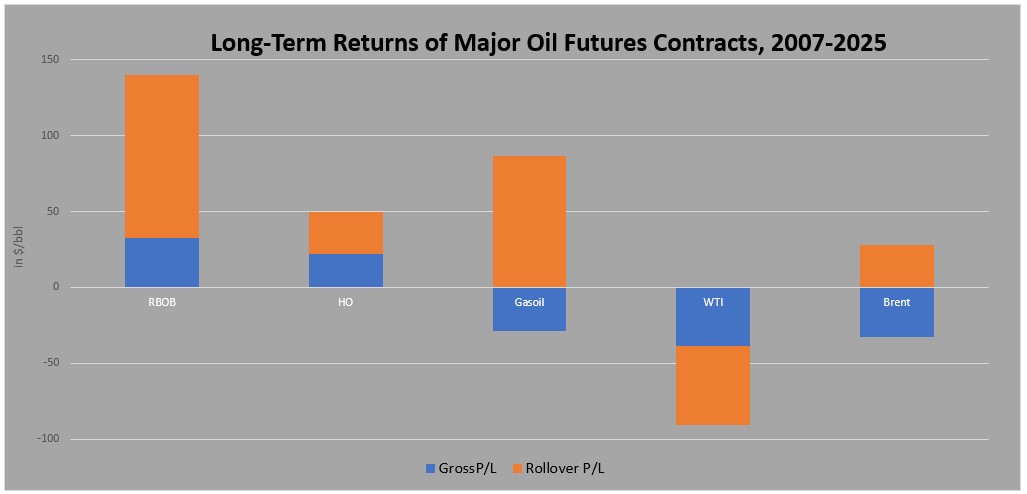

This is aptly illustrated in the chart below, which shows the combined returns of the individual contracts from 2007 (the year RBOB replaced the Unleaded Gasoline contract) through December 2025, expressed in dollars per barrel. Rolling positions from one month to the next were arbitrarily assumed to occur on the first trading day of each calendar month. The graph speaks for itself, demonstrating beyond doubt that refined products are the ultimate measure of oil demand growth and economic prosperity, as they have consistently outperformed crude oil over the past 19 years. After all, they are the final goods, whilst crude oil is ‘merely’ an input. During this period, WTI was the best performer on only three occasions, with Brent faring somewhat better, as Gasoil returned more or lost less than the European crude oil benchmark on 11 occasions. It should be noted, without any perplexity, that the lion’s share of positive returns originates from roll yields. Product contracts have exhibited backwardation more frequently than crude oil—again, possibly a sign that global and regional economic growth, and seasonal factors, such as the summer driving season or the winter heating period, exert a more pronounced influence on them than on crude oil.

When market conditions are unpredictable and confusing, the role crude oil plays in futures trading becomes more significant, as it provides unparalleled depth and liquidity. However, when the oil market is driven by genuine fundamental considerations, placing greater weight on refined products in commodity indices offers the prospect of markedly improved performance—or at least, that is what history suggests.

Overnight Pricing

08 Jan 2026